Bitcoin (BTC) remains stuck in a tight range, with options data and on-chain activity showing a shift in how the market is positioned.

Holiday conditions have thinned liquidity, and recent data points to cautious trading in derivatives while long-term holders continue to add.

Options Data Shows Shift in Market Positioning

CME options data shows that Bitcoin call option open interest peaked in December 2024, close to recent price highs above $90,000. Since then, call interest has declined steadily and is now near cycle lows. This pattern follows historical behavior, where call interest often falls after strong price rallies fade. Crypto analyst CW said,

“$BTC CME options open interest indicates a bottom in buying pressure.”

Lower call positioning shows that traders are no longer pricing in a near-term move higher. Meanwhile, put option open interest has risen, pointing to increased demand for downside cover rather than fresh upside exposure.

Moreover, growing put option activity often appears during periods of uncertainty. While it can reflect downside risk, similar conditions have also formed during price stabilization phases. CW noted that “an increase in put options can also signal a potential market reversal,” especially when positioning becomes crowded on one side.

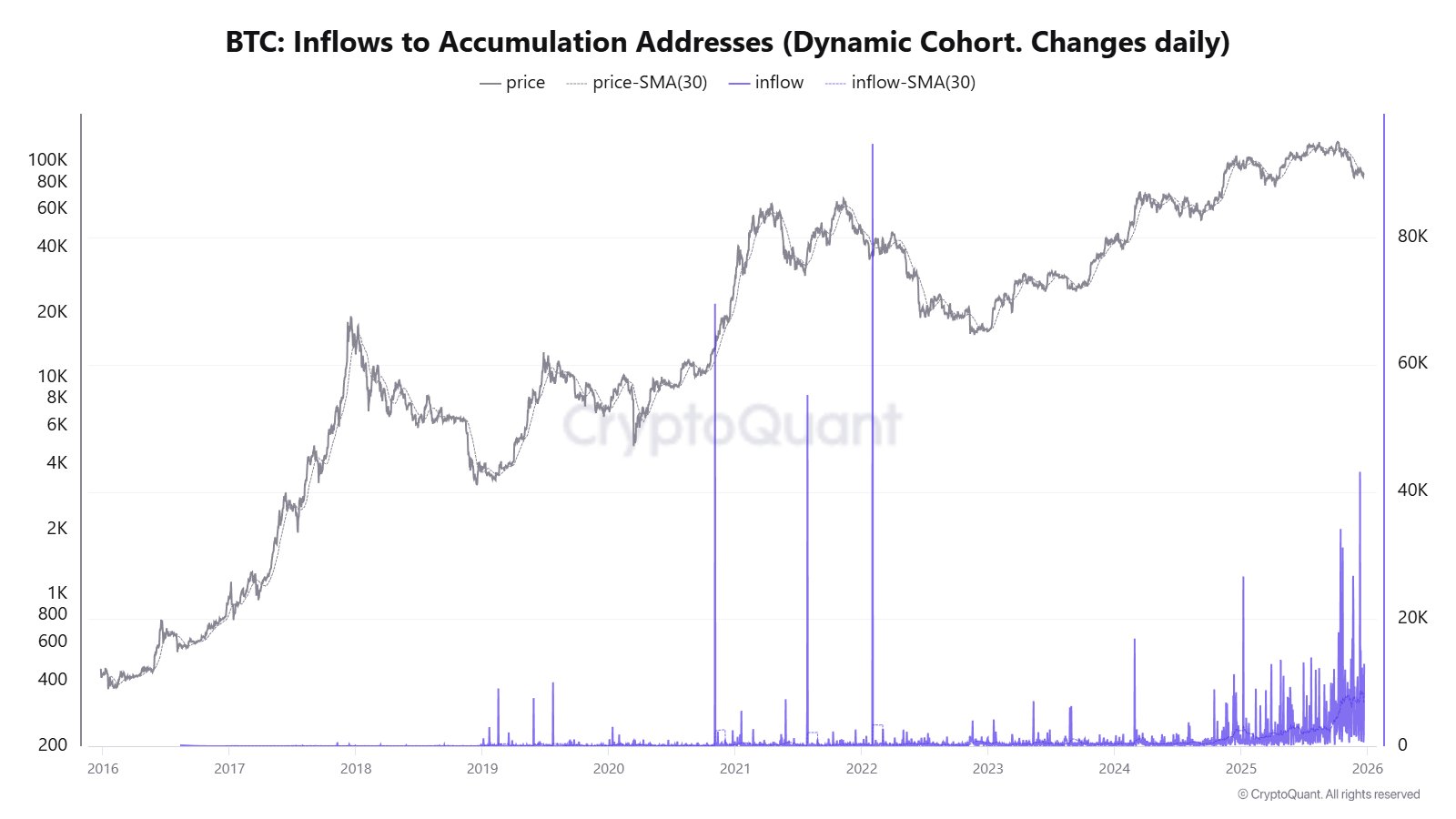

On-chain data shows a different trend. Bitcoin inflows to accumulation addresses have increased, with several large spikes recorded while the price trades below recent highs. These wallets tend to hold for long periods and rarely move funds, which points to large holders increasing positions rather than selling.

Bitcoin Price Trades Between Key Support and Resistance

Bitcoin trades near $87,000 at press time, down just under 1% over the past day and slightly higher on the week. Earlier in the week, the asset dropped from above $90,000 to below $86,500 before buyers stepped in and lifted it back up. Activity slowed over the weekend, followed by another failed push near $90,400.

On the 4-hour chart, BTC continues to move sideways with little follow-through. The $86,500 area has held as support after several tests, while selling pressure near $88,000 has kept price contained. Michaël van de Poppe said that “there’s just some chop taking place on the markets,” adding that a break above $88,000 would improve short-term structure.

Elsewhere, liquidity data shows heavy sell interest between $90,000 and $95,000, with strong buy interest sitting between $83,000 and $85,000. Merlijn The Trader stated that “massive sell walls” remain above current price, while buyers continue to step in on dips.

The post Is Bitcoin’s Cycle Top Already In? Key Metric Hits Alarming Low appeared first on CryptoPotato.