Ethereum continues to show signs of weakness, failing to build any significant recovery despite holding above local support. Market participants are showing hesitation, likely due to broader uncertainty and the lack of bullish momentum from Bitcoin. While ETH hasn’t broken down yet, it also hasn’t managed to flip any major resistances, which keeps it in a vulnerable, range-bound state.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH is currently trading below the key $3,300–$3,700 supply zone, where the 200-day (orange) and 100-day (blue) moving averages are acting as major dynamic resistance. This zone has consistently rejected the price over the past month, confirming it as a key battleground between buyers and sellers.

The RSI on the daily timeframe is also stuck below the 50 level, showing weak momentum and continued bearish pressure. If ETH cannot break above the mentioned confluence area soon, the probability of a deeper pullback toward the $2,700 support zone increases. A rejection here would also confirm a lower high on the macro structure, which is not a good look heading into 2026.

The 4-Hour Chart

On the 4-hour chart, the structure has turned fragile again after ETH failed to hold the lower channel trendline and broke back below the ascending channel. The uptrend attempt near $3,100, followed by a lower high, signals a clear loss of bullish strength.

Currently, the asset is hovering just above the $2,800 support level, which is acting as a short-term support. But there is no follow-through or aggressive buying. The RSI has also started to curl back down, indicating fading momentum on intraday timeframes. If the $2,800 support zone breaks, a quick flush toward the $2,600 area would be likely.

Sentiment Analysis

Open Interest

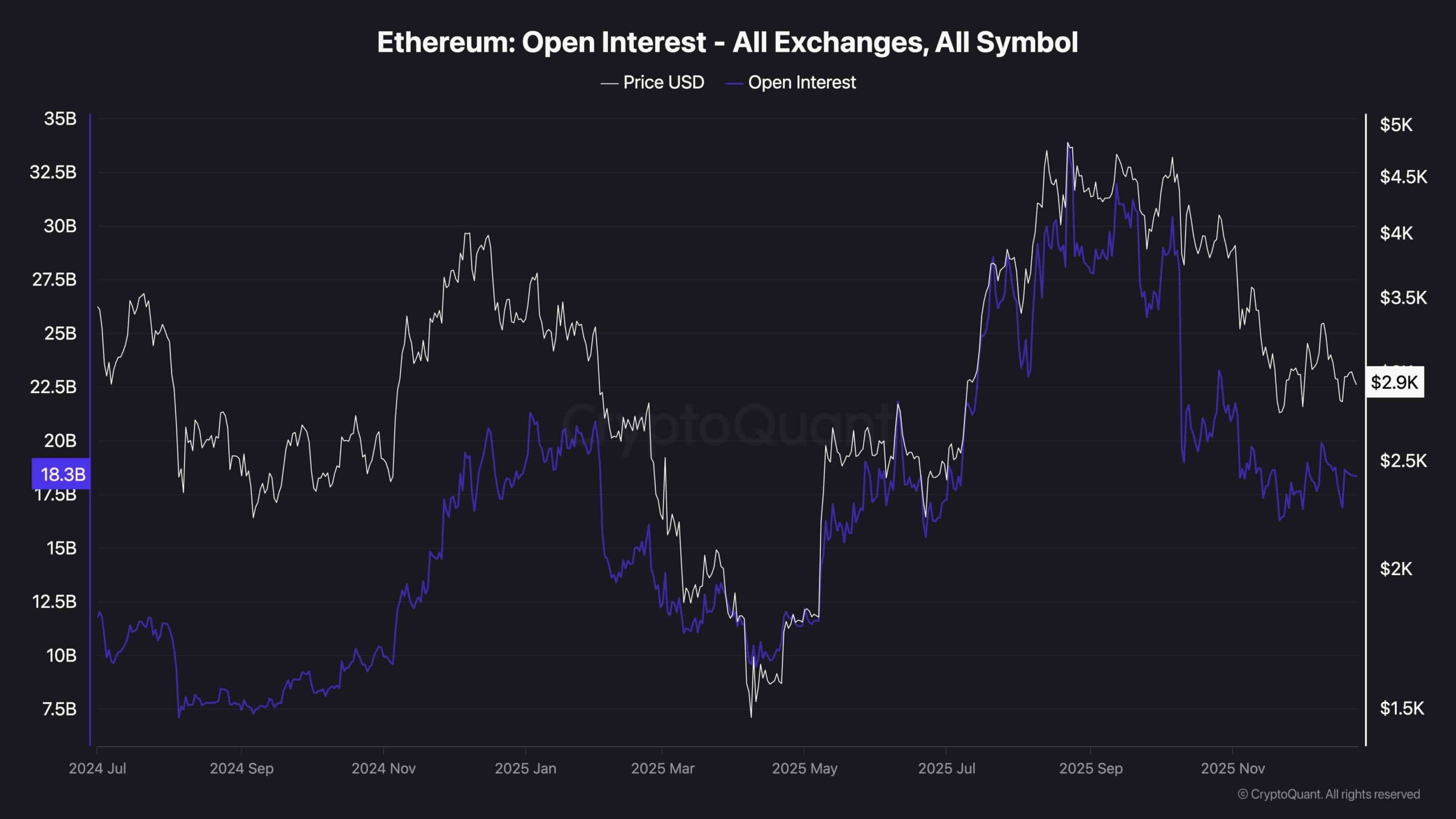

Ethereum’s open interest remains quite high at around $18B across all exchanges, even as the price struggles to push higher. This disconnect between stable open interest and flat-to-downward price action often signals a build-up of speculative leverage, particularly from longs. Without a breakout or strong demand to back it, this kind of OI behavior becomes a risk factor, especially if funding rates start to show highly positive readings.

If ETH fails to hold key supports, this situation opens the door for a long squeeze, where overly optimistic positions get forcefully liquidated, accelerating the drop. Therefore, for buyers, it is critical that open interest starts dropping with the price, or that a breakout confirms the build-up was justified.

The post Ethereum Price Analysis: ETH Hasn’t Turned Compeletely Bearish, but It’s Close appeared first on CryptoPotato.