Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we dissect what rippled through global markets this weekend. Silver surged, then snapped violently lower, sparking whispers of leverage breaking behind the scenes. While metals traders scrambled, Bitcoin quietly moved the other way, hinting that this wasn’t just volatility, but a shift in liquidity.

Crypto News of the Day: Silver Chaos, Bank Rumors, and a Bitcoin Bid — Here’s What Matters

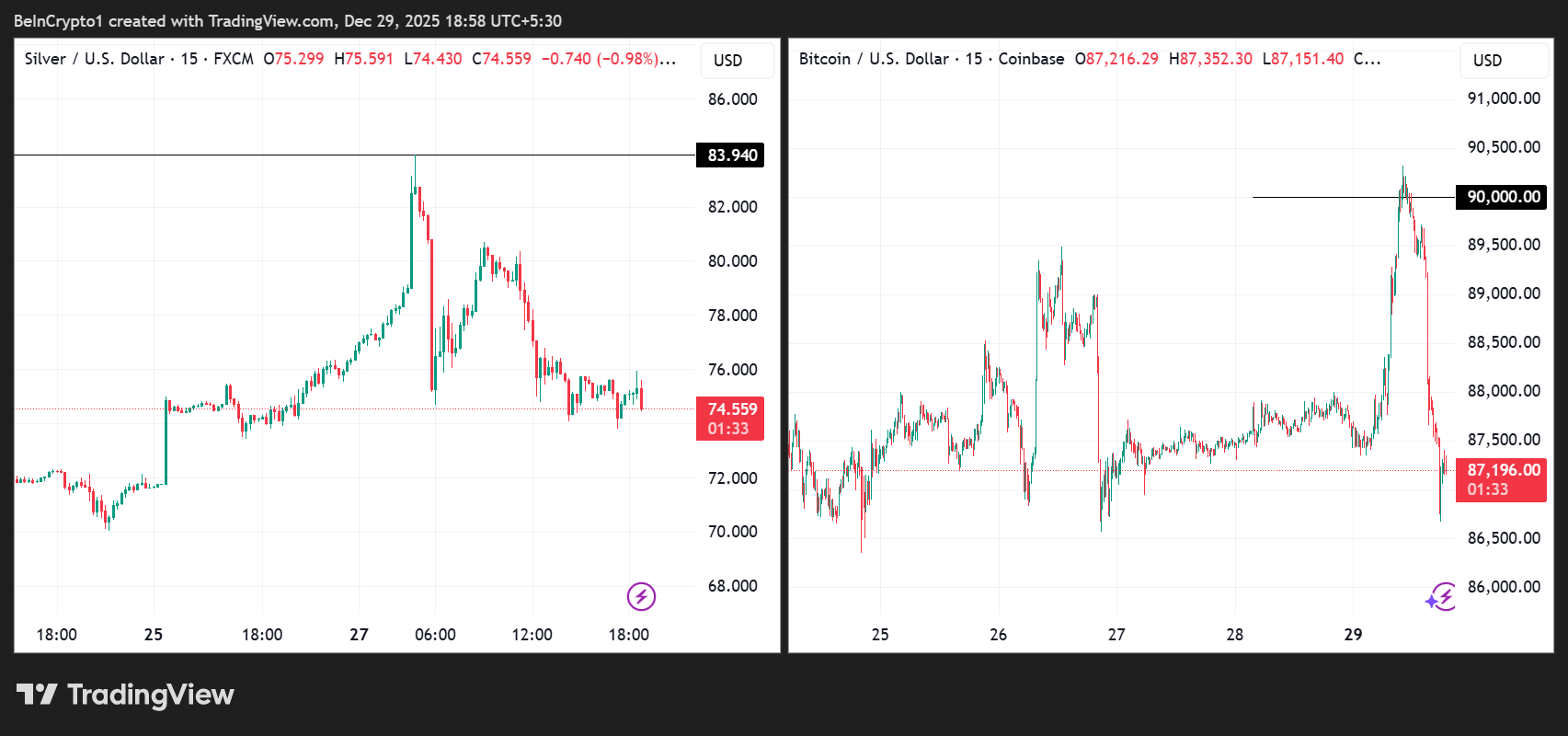

Silver markets descended into chaos over the weekend, and Bitcoin traders were watching closely. In a violent move that exposed deep leverage in the commodities market, silver surged to record highs near $84 before collapsing by more than 10% in just over an hour.

The speed and scale of the reversal rattled futures markets, triggered margin hikes, and reignited systemic risk fears, while Bitcoin quietly caught a bid.

At the center of the turbulence were unverified reports circulating on social media claiming that a systemically important bank failed to meet a massive silver margin call and was forcibly liquidated by a futures exchange in the early hours of December 28.

The claims alleged losses tied to hundreds of millions of ounces of short silver exposure and emergency liquidity demands exceeding $2 billion. As of December 29, no major news outlet or regulator has confirmed any bank collapse.

Still, the market reaction was undeniable.

Silver’s price action was extreme even by commodities standards. The silver price jumped to a record $83.75 shortly after futures opened, only to plunge to $75.15 within 70 minutes.

“… watching “$4 billion in silver longs get vaporized in just over an hour…one of the fastest wipeouts I have ever seen. Liquidity appeared to vanish entirely during the drop, with prices teleporting lower as bids disappeared,” wrote analyst Shanaka Anslem.

As volatility exploded, the CME Risk Management Team announced significant margin maintenance increases across nearly all precious metals products.

The move signaled that exchanges were moving quickly to rein in leverage after the violent swings. This pattern is familiar, often seen during past stress events in commodities and crypto alike.

Bitcoin Catches the Flow as Metals Leverage Breaks

While metals traders were being forced out, Bitcoin began moving in the opposite direction. Crypto Rover noted that silver dropped roughly 11% as crypto prices began to surge, suggesting a rotation rather than fresh capital entering the markets.

Indeed, the Bitcoin price caught a bid right as silver started rolling over, with this pioneer crypto testing the $90,000 psychological level briefly. The parallels were striking:

- Highly leveraged positions were squeezed,

- Margin requirements rose,

- Forced liquidations accelerated, and

- Capital sought refuge elsewhere.

Whether the rumored bank failure proves true or not, the sequence of events aligns with the pattern that stress in traditional leveraged markets often precedes a flow into Bitcoin.

Some analysts urged traders to look past the most sensational claims. Shanaka later highlighted a verifiable data point that drew less attention than the collapse rumors: JPMorgan disclosed nearly $4.9 billion in unrealized silver losses and flipped from a massive short position to owning roughly 750 million ounces of physical silver.

“The collapse story might be fiction,” he wrote, “but the position flip is filed with the SEC.”

That distinction matters for crypto traders. The key signal was not a headline. Rather, it was how fast liquidity moved once leverage cracked.

As silver’s paper market seized up, Bitcoin behaved less like a speculative asset and more like a pressure valve.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- The XRP price appears to be broken—but investors are quietly doing the opposite.

- China’s digital Yuan to become interest-bearing under new 2026 framework.

- Ethereum staking entry queue surpasses exit queue after three months — What’s next for ETH?

- Three Gold market signals that suggest Bitcoin’s price may be near a bottom.

- Is America about to finally solve crypto chaos? Lummis’ bill could change everything.

- Hyperliquid drops hint on HYPE Unlocks—What’s coming January 6?

Crypto Equities Pre-Market Overview

| Company | Close As of December 26 | Pre-Market Overview |

| Strategy (MSTR) | $158.81 | $156.85 (-1.23%) |

| Coinbase (COIN) | $236.90 | $234.78 (-0.89%) |

| Galaxy Digital Holdings (GLXY) | $23.40 | $23.20 (-0.85%) |

| MARA Holdings (MARA) | $9.59 | $9.48 (-1.15%) |

| Riot Platforms (RIOT) | $13.44 | $13.22 (-1.64%) |

| Core Scientific (CORZ) | $15.29 | $15.07 (-1.44%) |

The post Bitcoin Attracts Capital Flight As Silver Futures Margin Call Crisis Triggers Liquidity Shock | US Crypto News appeared first on BeInCrypto.