Justin Sun-owned HTX has an unusual set of reserves that raises worrying implications about how Sun uses them, and about its internal controls.

While HTX has been cagey about its ownership, about Sun’s role, and that of the HTX DAO, it’s more forthright than many other exchanges about the current contents of its reserves.

Indeed, it distributes a tool that allows us to gain a much greater insight into its reserves than most other exchanges.

This tool is owned on GitHub by an account called “huobiapi.” We can verify that this is an official tool because it’s linked on HTX’s website.

The tool distributes a set of addresses that belong to HTX, as well as their balances of various assets, therefore providing a tremendous deal of insight into the company’s reserves.

We can even use this tool to help verify its own reality as, once compiled, it can be used to check a series of messages and signatures that are included, helping show ownership of these addresses by HTX.

Some things to keep in mind if you want to verify yourself:

- This code can be sensitive to NPM version; we were able to successfully compile using NPM 11.

- The readme suggests that it will create an executable called “VerifyAddress,” but in our experience it actually made several executables, and you will need to choose the correct one for your platform.

- The readme additionally suggests that the executables will be in the “cmd” folder, but they will actually be in the root of the repository.

- The readme claims that the proof-of-reserves snapshot file needs to be in the same directory as the executable. This isn’t true; you just need to supply the executable with the correct path.

Having completed the download and compilation of this product, you’ll be able to use it to verify the most recent snapshot. The command we used to accomplish that was:

./bun-darwin-arm64 --por_csv_filename /snapshot/huobi_por.csvThis code will use the provided message and signature, as well as the address for these various locations, to verify ownership.

In some cases, especially for recently added addresses, the tool will not include messages and signatures, but the majority of addresses do have this verification provided.

Read more: Binance, OKX, HTX, Bybit, Kraken cited in ICIJ scam probe

By using the repository’s history, we were able to download a variety of snapshots from HTX, dating back to March 2023. Several 2023 files from August, October, and November weren’t included in the repository.

There are data problems with the Ethereum data provided in these proof-of-reserve files; specifically, there are some assets attributed to ETH-Optimism in 2024 that are actually meant to be attributed to USDT-Optimism.

This can be confirmed by looking at the metadata at the top of the files and by using Etherscan’s Optimism block explorer and its ability to determine historic balances.

In places where we refer to dollar value, we retrieved historical prices from CoinGecko.

Making those corrections, we had monthly snapshots of HTX reserves for a variety of assets going back over two years, and it reveals strangeness in almost every single one of those assets.

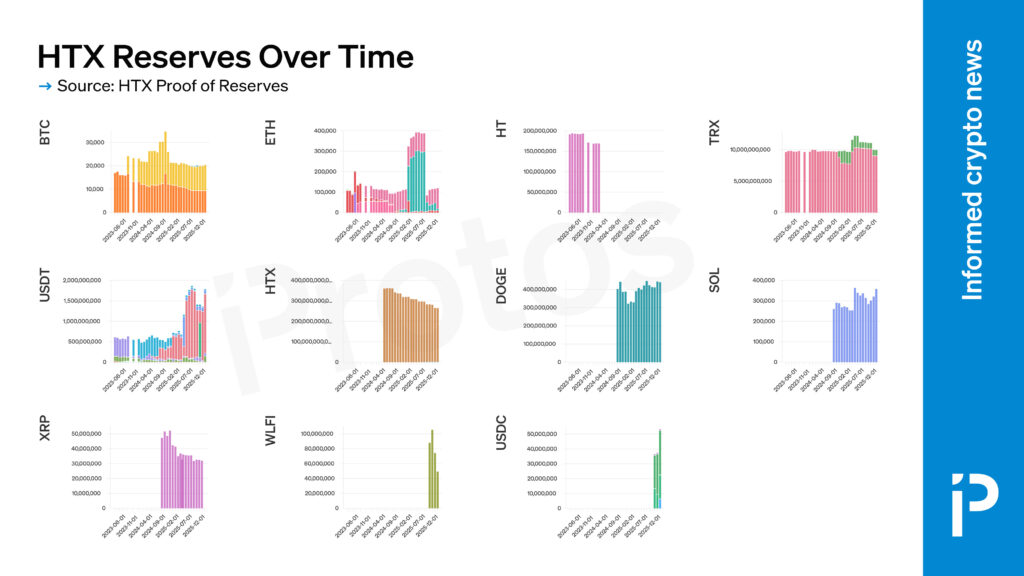

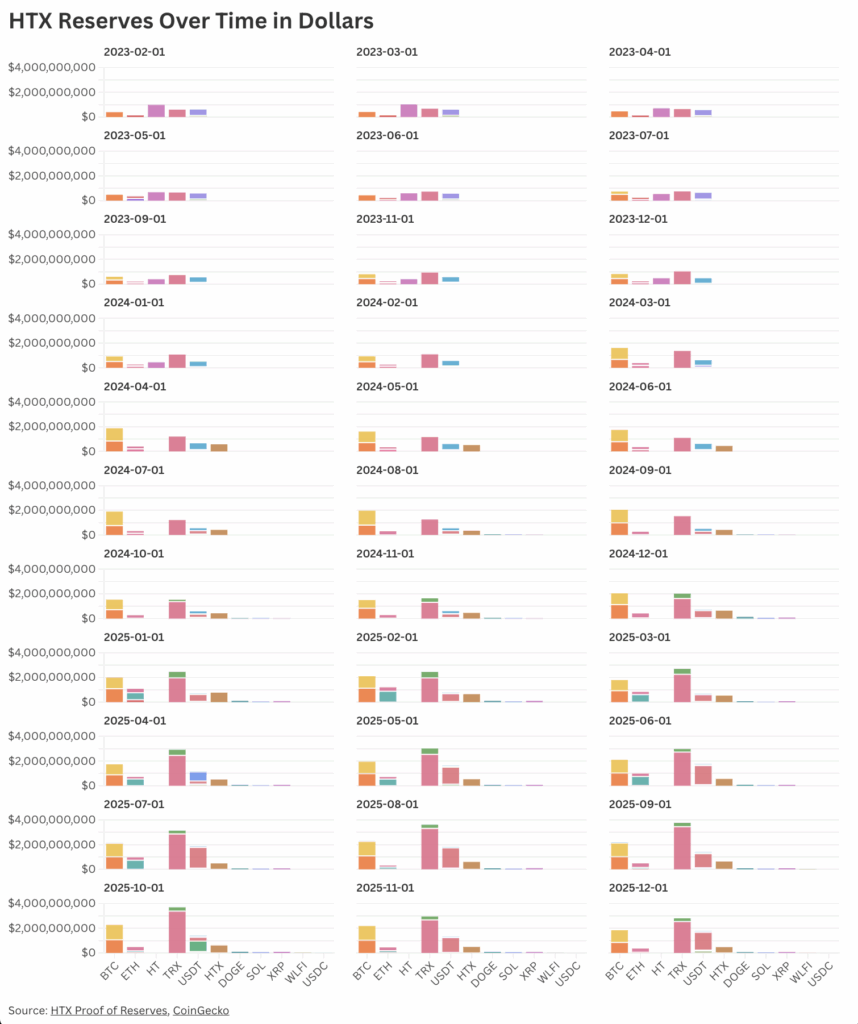

BTC

At times, bitcoin (BTC) has been the largest single asset by value in dollars reported on the proof-of-reserves file.

The most striking change to this asset occurs in July of 2023 when a new version of BTC, BTC-TRC20, is added.

This asset, at many points, is the majority of all BTC held at HTX.

You may be aware of Sun’s involvement with Wrapped Bitcoin, know that Wrapped Bitcoin had a TRON variant, and assume that’s what this token is. However, it’s not.

That Wrapped Bitcoin product never had much more than 100 BTC in it, and there are times that we’ve 18,000 BTC represented by this tokenized representation.

Instead, this product traces back to another Sun-owned exchange, Poloniex.

Read more: CHART: Almost every new Poloniex listing is a memecoin

Poloniex doesn’t disclose where the BTC that’s meant to be backing this product is.

Additionally, Sun previously promised that Poloniex would complete a proof-of-reserves process.

Poloniex has yet to complete a proof-of-reserves.

Sun has since claimed that “all exchanges in the industry have already implemented proof of reserves,” despite his own exchange failing to do so, and he continued that “there is only one explanation for why” an exchange would fail to do so, namely that “they are unable to meet the requirements.”

Thus, Sun has claimed Poloniex, an exchange he owns, an exchange that provides the tokenized BTC product making up such a massive portion of HTX’s reserves, has such substantial issues that it cannot get a proof of reserves.

Protos previously reached out to Poloniex to request additional information on the custody of the BTC for the tokenized product, information it wasn’t willing to share.

ETH

There is very little native ether (ETH) held at HTX.

There are many months where the majority of the ETH held at HTX is lent on Aave and other months where the majority of the ETH is in the form of staked ETH.

For December of 2025, only 10,421 ETH of the 118,675 total ETH included in this proof of reserves snapshot are native, a mere 8.8%.

At its peak in May of 2025, HTX reported a total of 392,273 ETH.

This means the current amount has fallen approximately 70% since May.

Read more: Justin Sun’s Poloniex and HTX withdraw huge amounts from AAVE

TRX

TRX, the gas token for Sun-founded TRON, has also had months where it is the largest asset in dollar terms held in the HTX reserves.

Unlike ETH, the majority of TRX held at HTX is held as native TRX.

The remainder is held in a small quantity of other tokenized versions of this asset, as well as “jsTRX,” which is TRX lent on Sun-founded JustLend.

The TRX balance on-exchange has remained much more level than ETH, though it has still declined 28.5% from its peak in May 2025.

Bloomberg recently reported that Sun owns the majority of all TRX.

USDT

Tether’s stablecoin, USDT, is the most important stablecoin in the HTX reserves.

Again we see some very interesting patterns in how these reserves are used.

There are many months, especially over the last year, where the vast majority of what HTX counts as “USDT” in its reserves is lent out.

For December 2025, there was a total of about $1.78 billion worth of USDT in HTX’s reserves, and $1.44 billion worth was lent on Aave, as well as an additional $96 million lent on JustLend.

Additionally, a further $18 million is placed in Sun-founded “stUSDT,” which previously focused on delivering “yield” in real world assets (RWA) but has since pivoted to also lending through Aave.

Of all the so-called “USDT” on HTX, merely 12% is native USDT.

Read more: Justin Sun-advised Huobi controls 85% of ‘decentralized’ stUSDT

This pattern of having the vast majority of on-exchange USDT deployed for other purposes began in earnest over two years ago with the September 2023 report; this was the first report where non-native USDT, stUSDT in this case, made up the majority of “USDT” in the report.

The pattern of USDT use in HTX wallets raises additional questions about the USDT’s source and about how these reserves are managed.

HTX wallets will frequently move massive amounts of USDT, sometimes as much as $1 billion, out of and then quickly back into Aave wallets, in some cases apparently affecting the rates on the platform.

Read more: Nobody knows why HTX is juggling $1B USDT on Aave

There are also strange patterns that suggest one person or entity is directing much of this activity.

Consider October of this year, where compared to previous months and subsequent months, a large portion of the USDT that was lent on Aave was instead placed into “XPL” or Plasma, the Tether- and Bitfinex-backed stablecoin blockchain.

The subsequent month these funds appeared to be removed from XPL and returned to Aave.

Read more: Tether Papers: This is exactly who acquired 70% of all USDT ever issued

Sun has a long history with USDT; when Protos completed the Tether Papers investigation in 2021, he had acquired more USDT from Tether than any other individual.

In total, he’d received more than $200 million, and it was acquired directly by Sun, not by other entities related to him.

Of note, Sun was the first Tether client to ever receive USDT-on-TRON.

HT/HTX

Huobi Token (HT) was Huobi’s exchange token that was also used as the gas token for the Huobi Eco Chain (HECO).

This chain is now defunct, and the token is effectively abandoned.

But for a while it was a portion of HTX’s reserves, as makes sense for the exchange that was once Huobi, with several months in 2023 when it was the largest asset in dollar terms held at HTX.

HTX Token (which uses the ticker HTX) is HTX’s exchange token and governs the HTX Decentralized Autonomous Organization (DAO).

HTX has claimed that HTX DAO “is not controlled by the HTX exchange.”

However, HTX did immediately partner with the HTX DAO, promising that “HTX will contribute 50% of its platform revenue to support the liquidity of the HTX DAO ecosystem.”

HT tokenholders were not left entirely out in the cold; instead, HTX offered an opportunity for HT tokenholders to convert their tokens to HTX tokens.

However, this wasn’t a 1:1 conversion; instead, it relied on a mysterious conversion formula wherein “earlier conversion will reward you with a more favorable conversion rate.”

Moreover, less than 19% of the total supply of HTX tokens was reserved for HT tokenholders who were converting, effectively diluting them in the conversion.

For HT tokenholders who wanted to maintain their benefits on HTX, namely reduced fees, they had to accept this dilution into this ‘new’ ecosystem of value.

Additionally, HTX DAO claims in its white paper that “HTX DAO’s governance system” would include three phases:

- “Platform Co-building Period: Starting with token listing governance and trading incentives.”

- “Ecosystem Governance Period: Leading asset incentives, budget allocation, etc.”

- “Financial Governance Period: The $HTX will be used to govern products and services across the decentralized crypto financial hub.”

The most recent vote held in this DAO was in July.

HTX’s DAO governance forum currently displays a banner that claims, “This site is in read-only mode because there are overdue hosting payments.”

SOL

Solana (SOL) is a relatively small and stable portion of HTX’s reserves.

The total balance of SOL is currently very close to the peak it reached in April.

The December snapshot valued the total amount of SOL in the reserves at approximately $48 million.

At the time of writing, HTX reports a 24-hour volume of $25.8 million on the exchange, more than half the total reserves.

XRP

Sun’s entry into the world of cryptocurrency was as an adviser to Ripple Labs.

This early gig gave him the experience and connections to eventually launch his many and varied products.

However, despite his personal familiarity with XRP, it makes up a relatively small portion of HTX’s reserves.

At the December snapshot, the total amount of XRP on the exchange was valued at approximately $71 million.

Since the peak was reached in November of last year, the exchange has generally seen a decline in the amount of XRP.

The total amount of XRP has declined by approximately 37% since then.

DOGE

Dogecoin (DOGE) is another small portion of the total HTX reserves that has been relatively stable over time.

In the December snapshot, the total value represented by DOGE was approximately $65 million.

Interestingly, at the time of writing, HTX reported a total of approximately $74 million in 24-hour volume for DOGE, approximately 114% of the total amount in the reserves.

When Elon Musk formed the poorly named Department of Governmental Efficiency, or “DOGE,” that was used to illegally gut the United States government, Sun took to X to proclaim that “as someone who witnessed DOGEcoin’s early activity in the community, seeing a US government department ultimately named after it today truly makes me feel like we’re living in a giant simulation.”

WLFI

Sun is the largest investor in the World Liberty Financial token, WLFI, and is an advisor to the project.

World Liberty, for its part, has also invested in Sun-related projects, including TRX and Wrapped Bitcoin.

This project, founded by Donald Trump and his sons, was intended to launch an Aave instance that received approval over a year ago; however, despite Sun’s best advice, the project hasn’t yet been able to launch that instance.

Additionally, Sun has entered into a very public spat with the project after the project chose to blacklist a large number of WLFI tokens that he was moving.

In September, Sun had moved WLFI tokens from a HTX/TRON DAO-affiliated address to various exchanges.

In response to this, WLFI blacklisted the address, preventing further dispersal of these funds.

Read more: Justin Sun clashes with World Liberty Financial over frozen WLFI

At the time, World Liberty took to X to explain that it had blacklisted 272 addresses, where one address was “suspected of misappropriation of other holders’ funds.”

Sun also took to X to note his belief that “tokens are sacred and inviolable” and asked that the project he advises “unlock my tokens.”

Despite this call, a review of the WLFI contract on Etherscan shows that World Liberty chose to ignore Sun’s advice and keep those tokens blacklisted.

The total amount of WLFI on exchange has fallen substantially, falling more than 50% since the peak it reached in the October snapshot.

USDC

USDC, the stablecoin issued by Circle, is a vastly smaller portion of the HTX reserves than USDT.

However, USDC suffers a similar fate to USDT in the sense that a large portion of the reserves are lent out.

However, instead of lending on Aave, it instead lends on Morpho via Steakhouse Financial.

The December snapshot had approximately $53 million worth of USDC on the exchange; of this, nearly $30 million — more than half the total amount — was lent on Morpho.

All of these assets tell a tale of an exchange doing extraordinarily strange things. It’s lending out the majority of its stablecoin; a majority of its BTC is a tokenized variant with no transparency about the collateral.

All of this activity raises obvious questions about the internal controls at HTX, questions about how the reserves are managed, and what steps the company has taken to secure the value of these assets for customers.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

The post ‘Someone’ is taking advantage of HTX’s reserves appeared first on Protos.

(@justinsuntron)

(@justinsuntron)