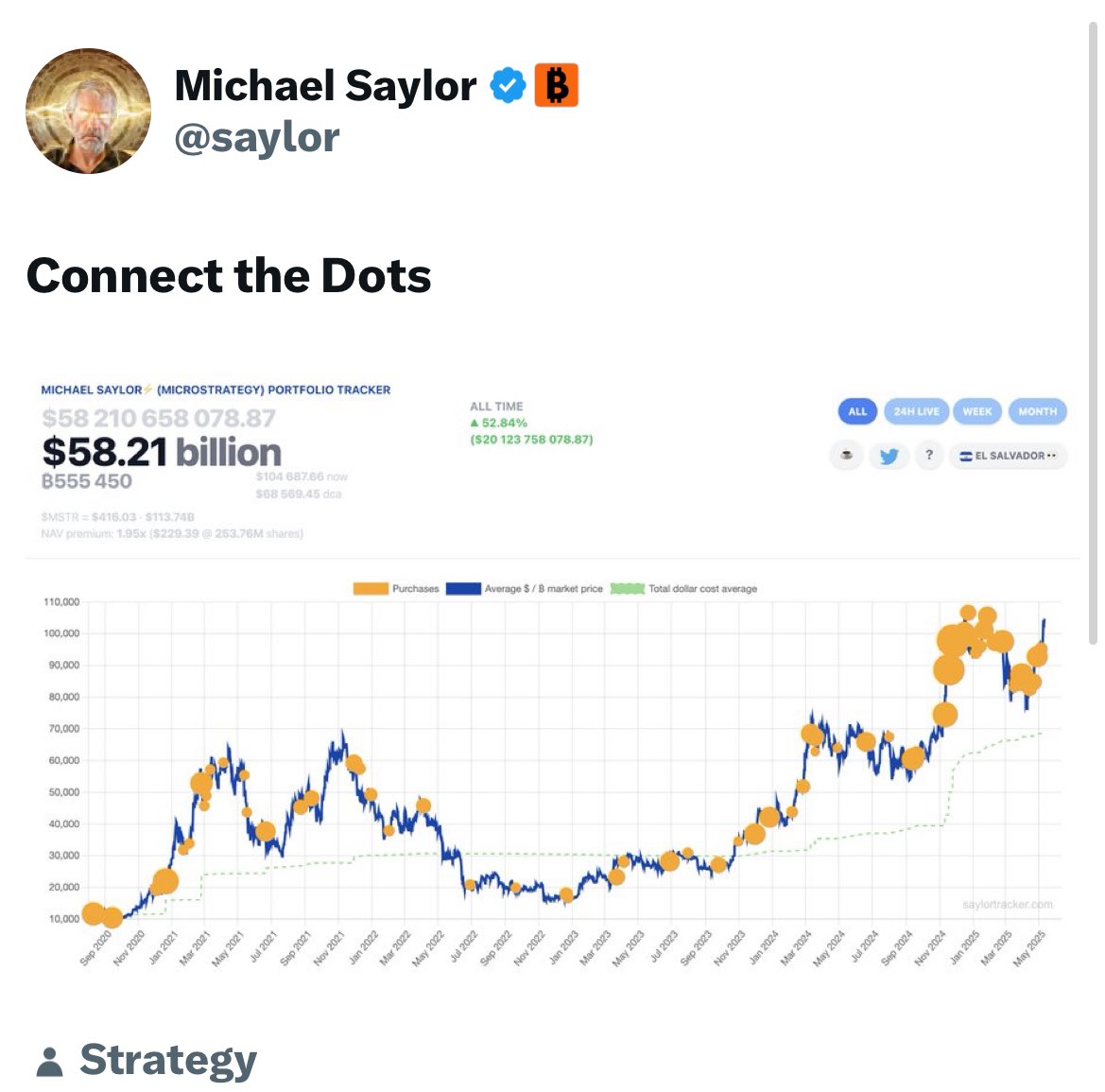

Coinbase Global Inc. announced the acquisition of Deribit, a leading Bitcoin options exchange that handles approximately 85% of all open interest in Bitcoin options, for $2.9 billion. The deal consists of $700 million in cash and 11 million shares of Coinbase Class A common stock, with the transaction expected to close by the end of the quarter. This acquisition represents the largest merger and acquisition deal in the cryptocurrency sector to date and is expected to enhance Coinbase's market infrastructure and global expansion. Despite this strategic move, Coinbase's stock experienced a decline following weaker-than-expected earnings. In its Q1 2025 earnings report, Coinbase reported an adjusted EBITDA of $930 million and a net income of $66 million. The company also introduced a new profitability metric, adjusted net income. Coinbase disclosed that it purchased approximately $150 million in new cryptocurrency investments, predominantly Bitcoin, bringing its investment portfolio's fair market value to about $1.3 billion, which represents 25% of its net cash. CEO Brian Armstrong revealed that over the past 12 years, Coinbase considered adopting a Bitcoin-heavy treasury strategy similar to that popularized by Michael Saylor, which would have involved allocating up to 80% of its balance sheet into Bitcoin. However, the company ultimately decided against this approach due to concerns about liquidity risks and the potential impact on core operations. Coinbase's revenue mix is evolving, with retail transaction revenues declining from 90% in 2019 to 52% last year, while institutional transaction revenues now account for nearly 9%, and subscription and services revenues make up 35% of total revenue.

This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz.

To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io