Ethereum remains in a corrective phase, with recent price action showing compression rather than expansion. Volatility has contracted, and the market is currently rotating within clearly defined technical boundaries.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH is trading inside a well-defined range. The upper boundary of this range is capped by a long-respected descending trendline that continues to act as dynamic resistance. Each recent attempt to push higher has been rejected near this trendline, confirming that sellers remain active on rallies rather than the price transitioning into a breakout phase.

On the downside, the asset is holding above a major static support zone around the $2.5K area. This level has repeatedly absorbed sell pressure in recent sessions, preventing deeper continuation to the downside. As a result, Ethereum is effectively trapped between descending trendline resistance and horizontal demand, forming a compression structure that reflects indecision rather than trend continuation.

As long as the price remains below the descending trendline and above the $2.5K support, the daily structure favors range-bound conditions. A daily close outside of this range will be required to resolve the current consolidation and define the next directional leg.

The 4-Hour Chart

On the 4-hour timeframe, recent price action has clarified short-term market intent. Ethereum previously formed a flag structure following a reaction off local lows, but the breakout attempt failed to hold. The asset briefly pushed below the flag support before quickly reversing, resulting in a clear false breakout.

This failure shifted short-term momentum back in favour of buyers and led to renewed upside pressure. The false breakout trapped longs below the flag, contributing to the impulsive rejection that followed. Since then, the price has rotated higher and is now trading back within the broader range structure rather than initiating a new bullish leg.

The inability to break above the flag resistance suggests that bullish strength remains limited in the current environment. Unless Ethereum can reclaim and hold above the broken structure with strong follow-through, upside attempts are likely to remain corrective and vulnerable to rejection.

Overall, Ethereum continues to show signs of consolidation rather than expansion. With the daily price compressed between descending trendline resistance and the $2.5K support, and the 4-hour chart confirming failed bearish continuation, the market remains in a neutral-to-bearish posture until a clear resolution emerges.

Onchain Analysis

By Shayan

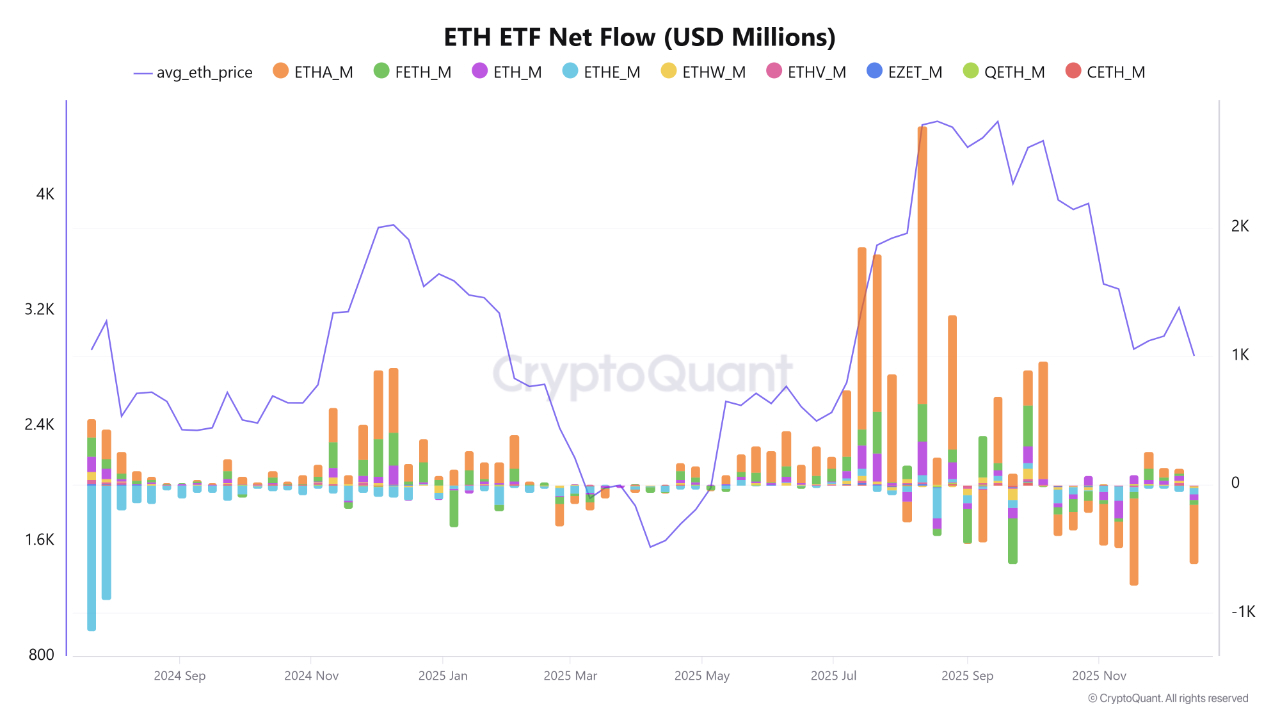

While the broader crypto market remains highly volatile, recent spot Ethereum ETF data paints a cautious picture for the second-largest cryptocurrency. A wave of institutional capital outflows during the week beginning December 15 has introduced meaningful sell-side pressure on ETH’s price action.

According to the latest figures, Ethereum ETFs recorded notable net outflows, led by BlackRock’s Ethereum ETF (ETHA), which alone saw roughly $467M exit the fund. Aggregate weekly outflows surpassed $600M, highlighting a clear contraction in institutional risk appetite for Ethereum at current price levels, with the asset trading near the $2.8K region.

The timing of these flows is particularly important. Sustained negative netflows at the very start of the weekly candle significantly weaken buy-side liquidity. When large institutions begin the week by actively reducing exposure, Ethereum’s ability to defend key support zones deteriorates.

Overall, the visible hesitation among institutions to accumulate Ethereum at current levels, most clearly reflected in the heavy outflows from BlackRock’s ETF, stands out as a clear warning signal. Until ETF flows stabilize and shift back into positive territory, Ethereum is likely to remain under pressure, with an elevated probability of a move toward lower support levels.

The post Ethereum Price Analysis: Is ETH Ready for Sustained Recovery or Another Rejection Looms? appeared first on CryptoPotato.