In January 2026, the Ethereum ecosystem recorded a surge in staking activity, with multiple metrics reaching all-time highs. These records may reduce liquid supply and help drive a potential price breakout.

Although the ETH price has remained below the $3,500 level for the past two months, analysts believe a breakout could be approaching due to these positive on-chain signals.

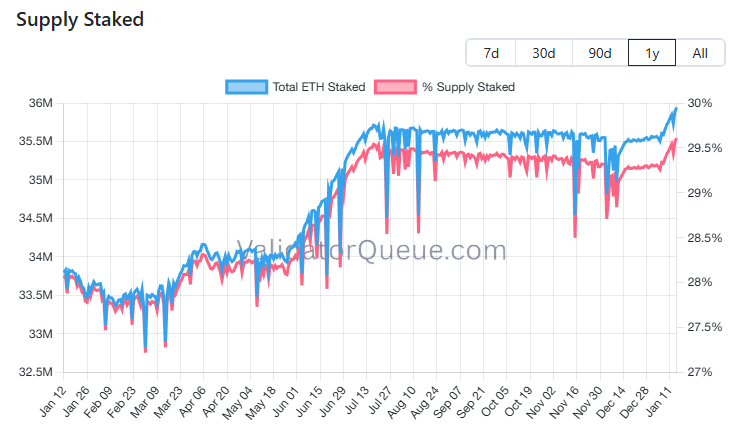

Nearly 36 Million ETH Staked, Representing Almost 30% of Supply

ValidatorQueue data shows that staked ETH has reached 35.9 million, accounting for 29.6% of the total circulating supply. At current prices, this equals more than $119 billion.

The chart highlights a notable spike since early January. Staked ETH increased from 35.5 million to 35.9 million, marking the end of a prolonged sideways phase that had lasted since August of last year.

This growth occurred despite the ETH price falling more than 30% since August. The data reflects strong long-term conviction among investors. It also reinforces the security and stability of the Ethereum network.

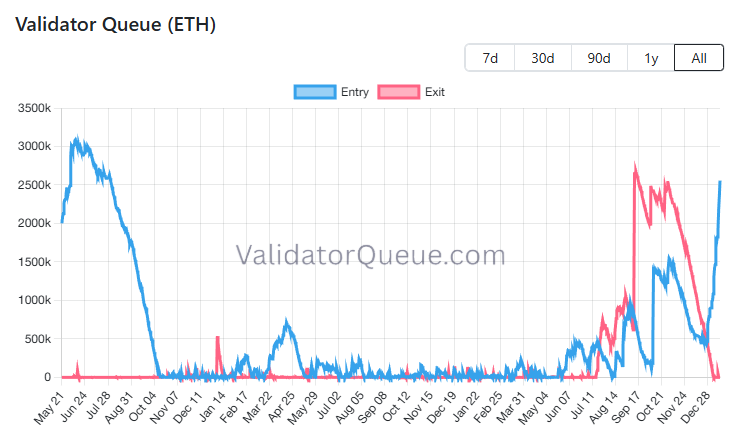

Additionally, as of January 15, the ETH staking queue surpassed 2.5 million ETH, marking its highest level since August 2023. Meanwhile, the unstaking queue dropped to zero.

These milestones are largely driven by staking activity from major institutions and publicly listed Digital Asset Treasuries (DATs).

Arkham reported that Tom Lee’s Bitmine staked an additional 186,500 ETH, worth more than $600 million. This move increased its total staked ETH to 1.53 million, valued at over $5 billion. In total, Tom Lee now stakes more than 1% of Ethereum’s total supply.

“Tom Lee is staking billions worth of $ETH. He 100% knows more than we do.” — CryptoGoos commented.

Meanwhile, SharpLink (SBET), the first publicly listed company to utilize Ethereum as its primary treasury asset, reported that staking activities have generated over $32 million since June. Total accumulated rewards now stand at 11,157 ETH.

Ethereum recorded another major milestone in January as user activity hit an all-time high. This trend reflects strong participation in stablecoin transactions and DeFi protocols across the Ethereum network.

With these bullish signals in place, analysts forecast that Ethereum could break above the current $3,450 resistance and rally toward $4,000. This outlook also gains support from a cup-and-handle pattern forming in the short term.

The post Ethereum Staking Activity Sets Multiple Records — Is ETH Price Ready for a Breakout? appeared first on BeInCrypto.