CFX, the native coin of Conflux Network, which claims to be China’s only regulatory-compliant public blockchain, has surged by 12% today, making it the top-performing token across the crypto market.

This rally comes despite a broader market pullback. It appears to be fueled by mounting optimism ahead of the highly anticipated Conflux 3.0 upgrade, set for launch in August.

Conflux Gains Momentum Ahead of 3.0 Tree-Graph Upgrade

CFX has surged by double digits today as excitement builds around its upcoming mainnet upgrade. During the recently concluded Conflux Technology & Ecosystem Conference, the network unveiled details of Conflux 3.0, codenamed Tree-Graph, set to launch next month.

The Tree-Graph upgrade introduces parallel processing blocks that will boost the blockchain’s throughput to over 15,000 transactions per second. It will also integrate Conflux with the artificial intelligence (AI) industry by enabling on-chain invocation of AI agents.

Additionally, the upgrade will lay the groundwork for cross-border trade and Real-World Asset (RWA) tokenization on the network.

The anticipation of these enhancements, and the belief that they will significantly boost Conflux’s utility and adoption, has triggered a surge in investor demand. This renewed interest is now driving up the value of CFX amid growing investor attention.

CFX Signals Strong Rally Potential With Bearish Fade

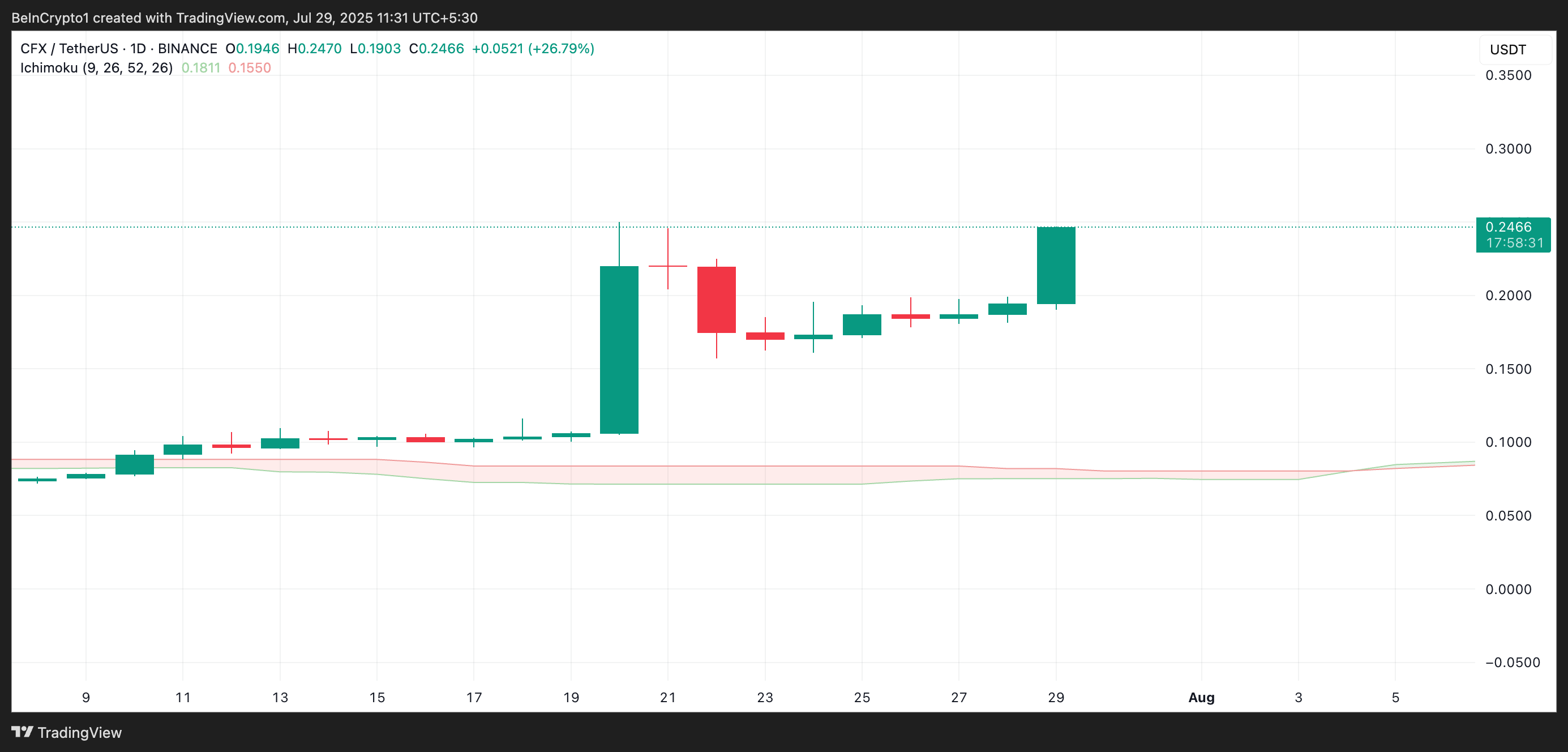

On the daily chart, CFX trades significantly above the Leading Spans A and B of its Ichimoku Cloud, reflecting the bullish sentiment among coin holders. These lines currently form dynamic support levels below CFX’s price at $0.1811 and $0.1550, respectively.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset trades above this indicator, it signals a strong bullish trend and upward momentum. Market sentiment is positive, and the asset may continue rising if it holds above that support zone.

The area above the Cloud is a bullish zone, indicating positive market sentiment toward CFX. If this trend holds, the coin could post fresh gains over the next few trading sessions.

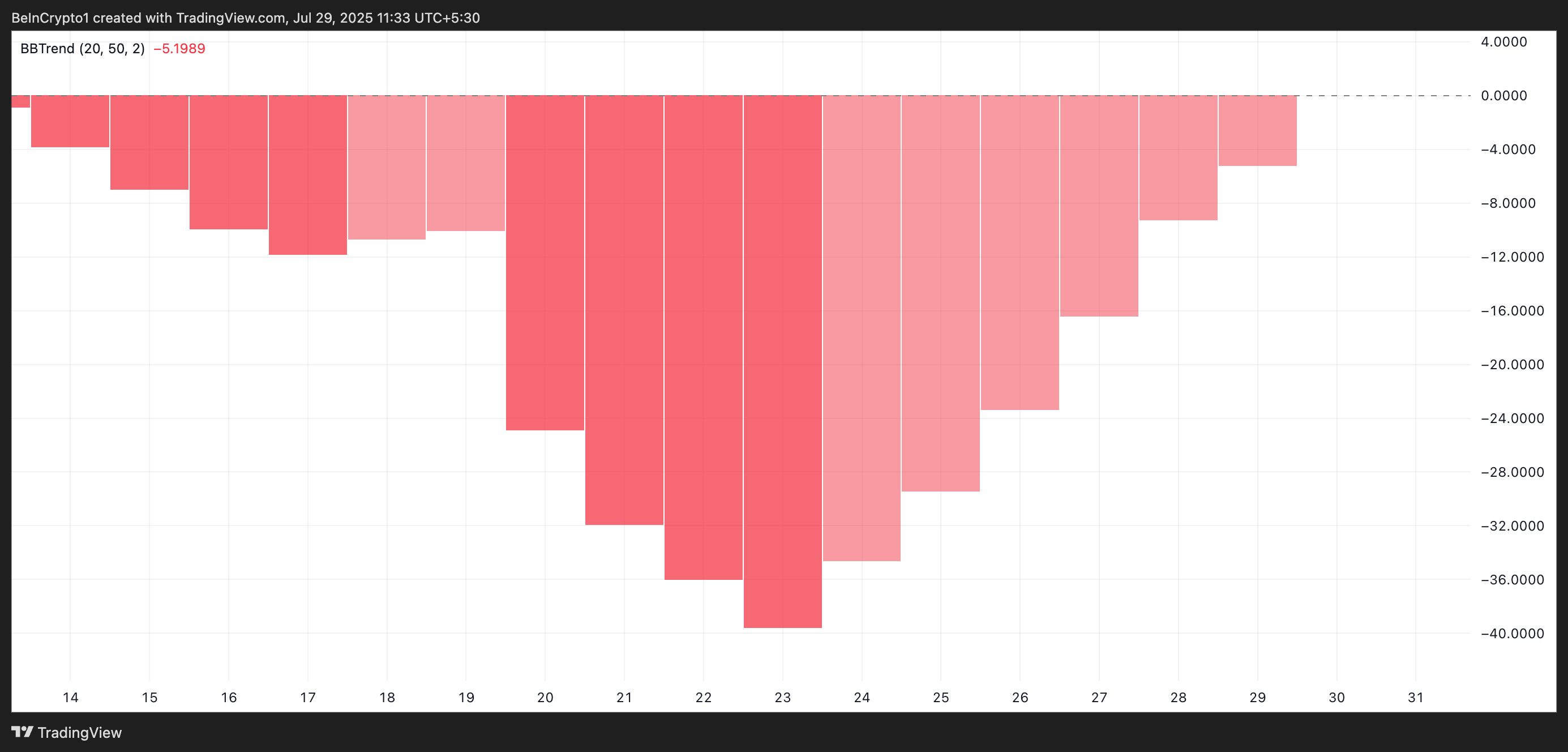

Additionally, readings from the CFX/USD one-day show that the red bars of its BBTrend indicator have begun to shorten. This indicates waning bearish pressure and could potentially pave the way for sustained price growth.

The indicator measures the strength and direction of a trend by analyzing price movement relative to Bollinger Bands. When it returns shortening red bars, the bearish momentum in the market is weakening.

This signals the potential beginning of a new bullish phase for CFX, especially as it is accompanied by other positive indicators like rising trading volume and a positive price performance.

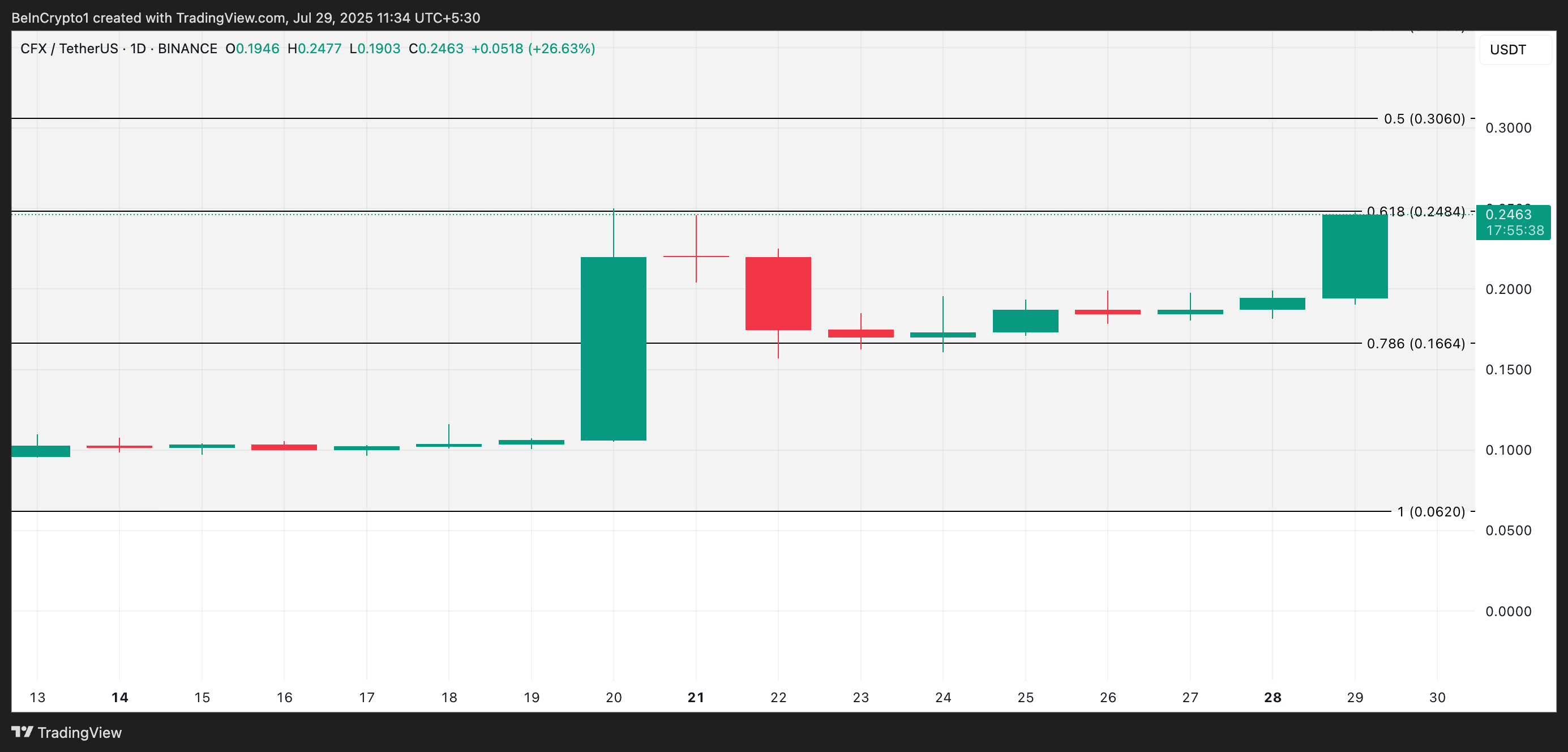

Can Bulls Push Past the $0.24 Barrier Toward $0.30?

CFX trades just below the long-term price barrier formed at $0.2484. With climbing buy-side pressure, a successful breach of this resistance could propel CFX’s price toward $0.30.

However, if profit-taking starts, this bullish outlook will be invalidated. In that case, CFX’s value could fall to $0.1664.

The post CFX Surges 12% as Conflux 3.0 Upgrade Sparks Demand appeared first on BeInCrypto.