Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and read on global finance’s foray into a new phase. As the US ventures into stablecoins amid monetary engineering to force a weak dollar, Max Keiser sees Bitcoin playing a very different role.

Crypto News of the Day: Bitcoin Plays Key Role in Failing Fiat System, Max Keiser Explains

Rate cuts remain a bone of contention in the US, with Fed chair Jerome Powell resisting political pressure from President Trump, as indicated in a recent US Crypto News publication.

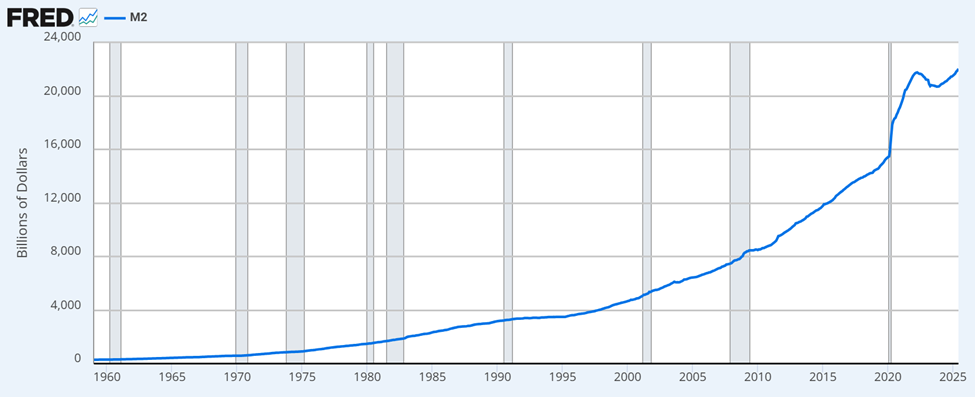

While Powell resists pressure to cut interest rates in the US, the M2 money supply is expanding, although not as fast as many would like.

Bitcoin pioneer Max Keiser recently said that M2 money supply expanding fast enough could help debase the dollar, an outcome that would please Trump’s export hopes.

According to the Bitcoin maxi, Trump is leveraging stablecoins to double the M2 money supply number.

“Your USD purchasing power is about to get cut in half,” he said in a recent post.

Echoing sentiments pushed in a recent US Crypto News publication, Keiser also indicated that stablecoins issuers are stacking Bitcoin as fast as possible.

Against this backdrop, BeInCrypto contacted Max Keiser for more insight. In a statement, the Bitcoin pioneer said Bitcoin is no longer just a speculative asset. Rather, it is a growing hedge against sovereign default and system fiat failure.

“Bitcoin has always been the equivalent of a CDS (Credit Default Swap) on the 400 trillion, global, fiat money Ponzi scheme that is now imploding as demand for securities like US Treasuries continues to radically shrink,” Keiser told BeInCrypto.

According to Max Keiser, Trump’s love of stablecoins will get seriously tested. This sentiment comes as demand for treasuries, which the US president thinks stablecoins will create but never materialize.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- BitMine estimates Ethereum’s implied value at $60,000 amid the latest market rally.

- 4 entities that could trigger a Bitcoin sell-off in August.

- CryptoPunks floor price jumps 8% amid NFT revival buzz.

- Coinbase’s roadmap update sparks price gains for two altcoins.

- Bitcoin sellers are still silent — So why hasn’t the rally started yet?

- XRP price is at risk of falling below $3 after an $840 million sell-off.

- CFX surges 12% as Conflux 3.0 upgrade sparks demand.

- Bitcoin dominance records sharp decline — Is altseason finally here?

- Why Ray Dalio suggests allocating 15% to Bitcoin (BTC) or Gold.

- Ethereum, Solana, and PYUSD in focus after PayPal’s global crypto rollout.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 28 | Pre-Market Overview |

| Strategy (MSTR) | $403.80 | $408.50 (+1.16%) |

| Coinbase Global (COIN) | $379.49 | $381.40 (+0.505) |

| Galaxy Digital Holdings (GLXY) | $29.60 | $30.05 (+1.52%) |

| MARA Holdings (MARA) | $17.16 | $17.34 (+1.05%) |

| Riot Platforms (RIOT) | $14.51 | $14.57 (+0.41%) |

| Core Scientific (CORZ) | $13.75 | $13.75 (+0.036%) |

The post Bitcoin Is Becoming the Credit Default Swap on a Collapsing Fiat System | US Crypto News appeared first on BeInCrypto.