BitMine Immersion Technologies (BMNR) is sending mixed signals to traders. On one hand, the company continues to expand its Ethereum staking operation, reinforcing its long-term treasury strategy. On the other hand, the BMNR stock price structure is weakening, and a bearish pattern is taking shape on the daily chart.

BMNR is down roughly 21% over the past six months, showing sustained pressure despite a short-term bounce of about 4% over the past five days. This contrast sets up the core conflict. Staking-driven optimism is growing, but the chart is flashing risk. Whether the bullish narrative can overpower the technical damage now comes down to one key price zone.

A Bearish Head-and-Shoulders Pattern Keeps BMNR Under Pressure

BMNR is forming a clear head-and-shoulders pattern on the daily chart. This pattern usually appears after a long advance and signals that buyers are losing control. The left shoulder and head are already in place, while the right shoulder has formed near recent highs.

What makes this setup more concerning is where the price sits relative to its trend indicators. BMNR is trading below all its major exponential moving averages. The 20-day EMA was the last short-term support holding the structure together, and it has now been lost. When price trades below these averages, rebounds tend to fade rather than turn into trends.

The neckline of this pattern slopes slightly downward, adding to the downside risk, as sellers remain in control. If that neckline breaks, the structure opens the door to a deeper 33% decline, potentially extending the broader six-month downtrend. This is the technical backdrop traders are facing, even as staking headlines continue to build.

That tension brings the focus to capital flow and whether fresh demand is actually entering the stock to save the collapse.

Ethereum Staking Supports Capital Flow, but Correlation Adds Risk

BitMine’s ongoing Ethereum staking expansion is the strongest bullish factor supporting the stock right now. Staking locks tokens, generates recurring yield, and signals long-term commitment rather than short-term speculation. This helps explain why selling pressure has not accelerated despite the bearish chart structure, as some buyers might be responding to the positive staking-specific narrative.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Capital flow indicators reflect this optimism. Chaikin Money Flow, which tracks whether big money is entering or leaving an asset, is pressing against a descending trendline. That suggests accumulation pressure is building beneath the surface, even while the BMNR stock price remains weak.

However, this signal is not new. Similar CMF setups earlier this month failed to follow through and were followed by sharp pullbacks. For this signal to matter now, CMF must first break above the descending trendline and then reclaim the zero line. Without those confirmations, inflows remain tentative rather than decisive.

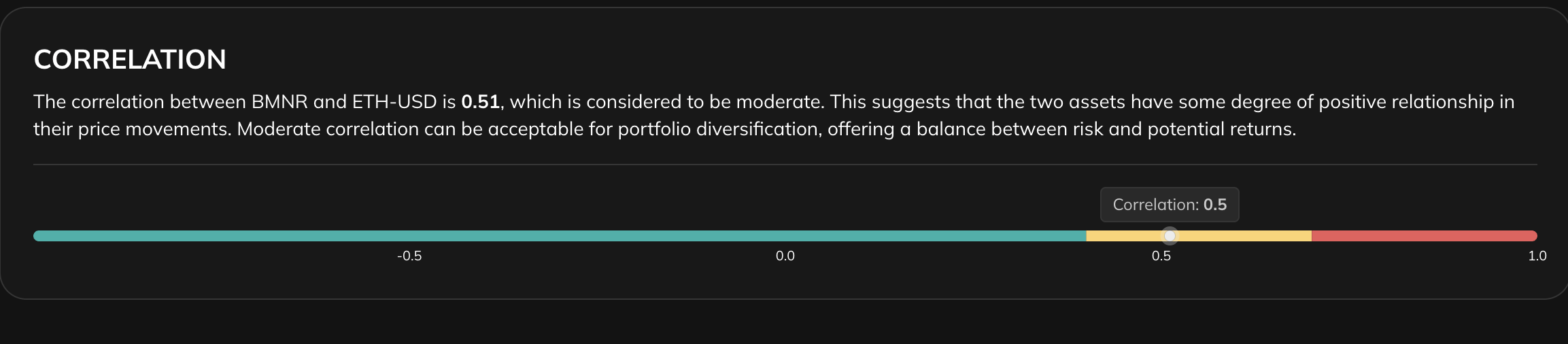

Correlation adds another layer of risk. BMNR has a moderate positive correlation of around 0.51 with Ethereum. That means weakness in ETH often spills into the stock. With Ethereum down 2.5%, day-on-day at press time, continued ETH pressure could limit capital inflows and stall any CMF breakout attempt.

That makes price behavior at key levels the final decision maker.

$30 Stands Between Stabilization and the BMNR Stock Price Breakdown

Everything now funnels toward one level. The $30 area sits as one of the key support lines. The BMNR stock price briefly lost this level in early January but reclaimed it immediately, showing the demand at the point. Staying above $30 would give BitMine a chance to reclaim the 20-day EMA as well.

A sustained break below $30 would expose $25. Breaking under that confirms the head-and-shoulders breakdown and exposes BMNR to deeper downside, with targets extending into the $19 zone even.

Holding $30 does not automatically mean recovery. It simply prevents structural damage. For the bearish setup to weaken, BMNR would need to reclaim the $34 and stabilize above the right shoulder area. That would also require a recovery back above key moving averages, something the stock has struggled to achieve in recent weeks.

BitMine has spent months building a powerful Ethereum staking position, and that strategy continues to attract long-term capital. But in the short term, the chart still leads.

Until the $30 level is decisively defended, the risk of a larger breakdown remains active, regardless of how strong the staking narrative becomes.

The post Can The BitMine (BMNR) Staking Juggernaut Prevent a Pattern Breakdown? $30 Decides Fate appeared first on BeInCrypto.