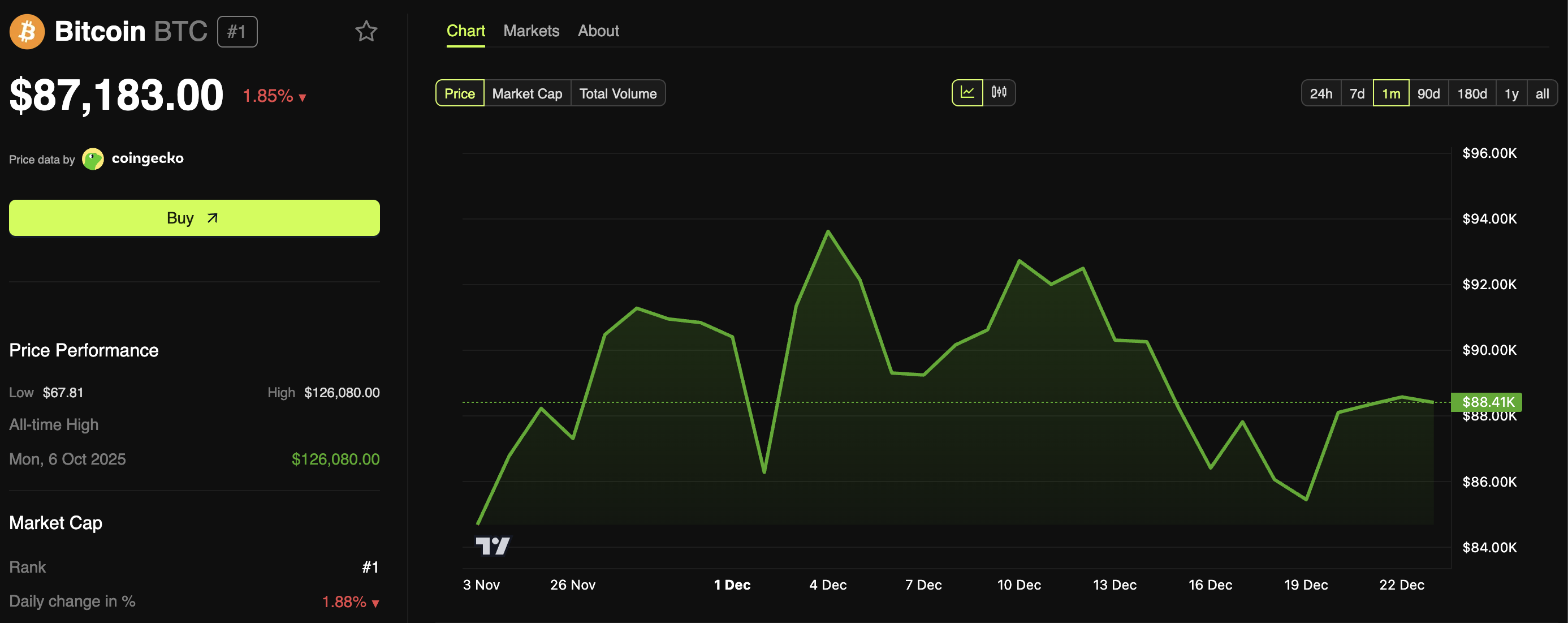

Bitcoin has fallen 22.54% so far this quarter, marking its steepest quarterly decline since 2018. With less than 10 days left in the year, it now appears unlikely that Bitcoin will reach the bullish price targets many analysts had anticipated.

Market experts are now reassessing near-term expectations, outlining how Bitcoin could finish the year and what 2026 may bring for the asset.

Expert Flags Crucial Bitcoin Levels as Markets Head Toward Year-End

Following its October peak, Bitcoin has faced market headwinds. The asset closed the past two months in the red according to Coinglass data.

It declined 3.69% in October, followed by a sharper 17.67% drop in November. So far this month, Bitcoin is down 2.31%.

The cryptocurrency has struggled to regain a firm foothold above the $90,000 level. It now trades at prices lower than those seen at the start of the year. Meanwhile, weakening demand growth, slowing spot ETF inflows, and smart-money selling are amplifying downside risks for Bitcoin.

Selling pressure has persisted in recent sessions, with Bitcoin falling another 1.8% over the past 24 hours. At the time of writing, it was trading at $87,183.

Ray Youssef, CEO of NoOnes, told BeInCrypto that Bitcoin remains “stuck in a compressing, range-bound action bout.” The complex macroeconomic backdrop has made it tough for Bitcoin to regain upward momentum below $90,000, as liquidity conditions tighten and risk appetite deteriorates.

He added that bulls have defended the $85,000 support. Yet, they have failed to overcome the intense selling pressure at the year’s open around $93,000.

Options market data echoes the standoff between market participants. Put options are clustered around $85,000, with call options between $100,000 and $120,000.

According to Youssef, the upcoming options expiration, additional US government shutdown data, and the Fed’s $6.8 billion liquidity injection could trigger short-term volatility. However, the market’s directional bias remains unresolved.

“Until Bitcoin decisively breaks above the overhead resistance at $93,000 or loses the structural support at $85,000, BTC is likely to remain range-bound and volatile heading into the year-end,” he stated.

The executive explained that despite a drawdown of more than 30% from the October highs, US spot Bitcoin ETF holdings have not declined by more than 5%. This suggests that institutional allocators are largely holding their positions through the current market downturn.

He revealed that the bulk of selling pressure is coming from retail investors, particularly leveraged and short-term participants. Youssef pointed to $85,000 as a critical level to monitor as 2025 draws to a close.

A break below this zone could increase the probability of a deeper correction toward the $73,000 demand area.

“A break of the support level could also leave institutional allocators with a decision to make as prices approach their cost basis of approximately $80,000. A $94,000 reclaim is required for the market to reassert bullish momentum and move towards previous market highs,” Youssef predicted.

Bitcoin’s 2026 Outlook

Meanwhile, Farzam Ehsani, CEO of VALR, noted that the final stretch of the year has become one of the most challenging periods for cryptocurrencies in recent years. He cited seasonal weakness, persistently overbought conditions, and a renewed shift in investor interest toward more conservative instruments, particularly US government bonds.

Ehsani added that market liquidity remains constrained. At the same time, institutional participants are increasingly adopting a wait-and-see approach, prioritizing capital preservation.

Furthermore, Ehsani pointed out that the current correction highlights the market’s fragility and its continued vulnerability to panic-driven selling. According to him, only two logical conclusions can explain this.

First, one or more large market participants such as funds, banks, or even sovereign entities may be positioning for a substantial purchase.

“In this case, the exchange rate decline is potentially artificial, and the rate will likely rise again after a temporary decline.”

Alternatively, the market may be oversaturated. The weakening dollar, driven by expanding US government debt, has dampened demand for cryptocurrencies as high-risk assets.

“A trend further exacerbated by Federal Reserve policy. In this case, the crypto market may take more than a year to recover,” he mentioned.

The executive also forecasted that Bitcoin could set a renewed historical price high as early as the first half of 2026, with prices potentially returning to the $100,000 to $120,000 range by Q2.

“A renewed historical price high could occur as early as the first half of 2026, with the price expected to return to the $100,000–$120,000 range in the second quarter. Historically, the first months of the year have not been particularly dynamic: traders tend to adopt a wait-and-see approach, while markets search for new growth drivers and opportunities,” he remarked.

The VALR CEO emphasized that the determining factors next year will be the degree of institutional adoption, regulatory policies in the US and globally, and, to a certain extent, the macroeconomic conditions of the world’s largest economies.

The post Bitcoin Is on Track for Its Worst Quarter Since 2018: What Could Happen Next? appeared first on BeInCrypto.