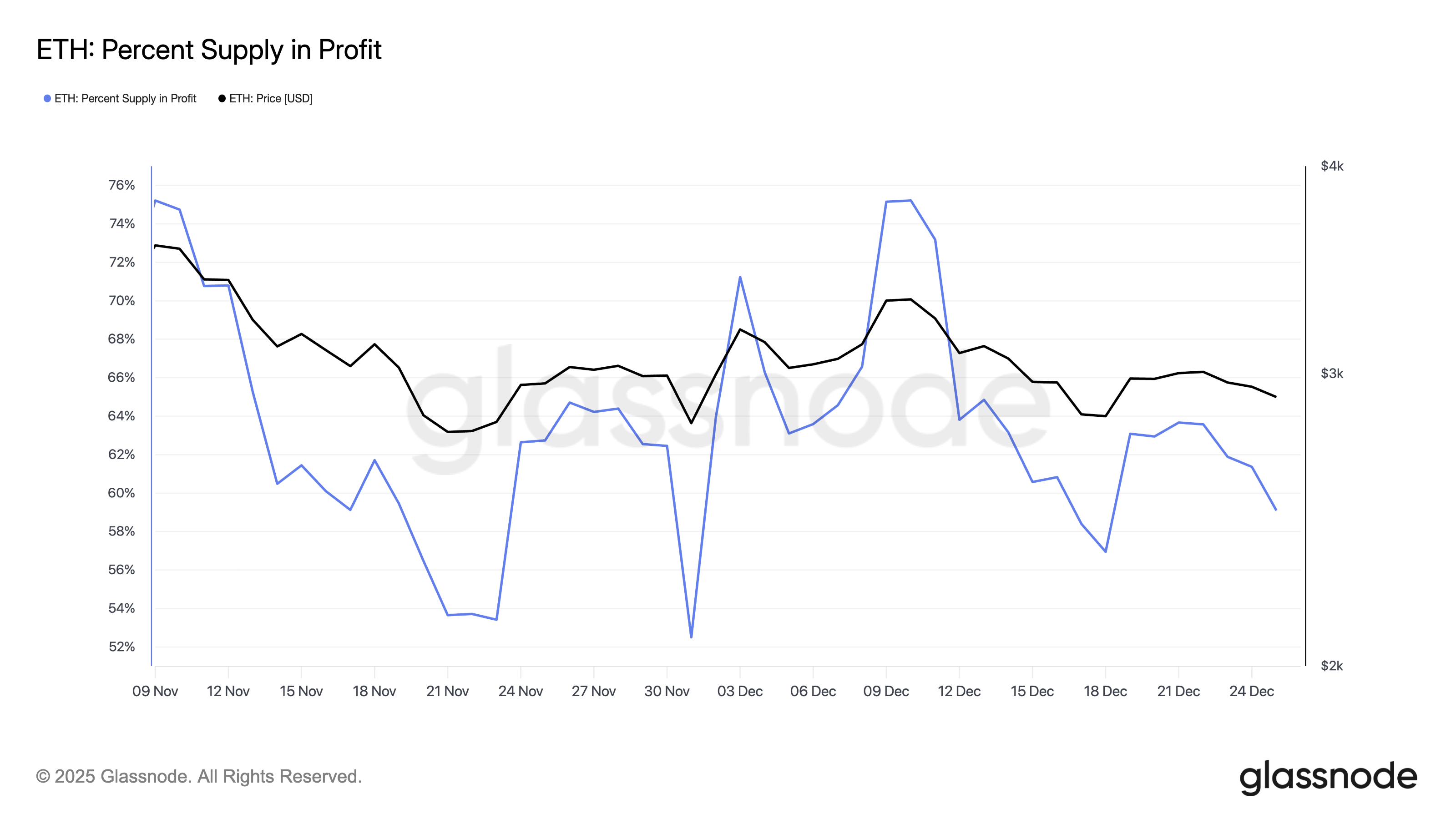

As December draws to a close, Ethereum (ETH) holders are facing increasingly challenging market conditions. On-chain data shows that more than 40% of Ethereum’s supply is currently held at a loss.

Notably, ETH holders are responding to mounting losses in sharply different ways, with some capitulating and others continuing to accumulate despite deep unrealized drawdowns.

Ethereum Holders’ Positions Sink Underwater as ETH Slides

Ethereum has closed the past three consecutive months in the red, with November alone posting a steep 22.2% decline. In December, the asset has continued to face volatility.

Despite briefly reclaiming the $3,000 level, ETH failed to hold above it and has since slipped back below the key threshold.

At the time of writing, Ethereum was trading at $2,973.78, up 1.10% over the past 24 hours, in line with the broader cryptocurrency market.

However, the recent price weakness has significantly impacted holder profitability. Glassnode data shows that earlier this month, more than 75% of Ethereum’s circulating supply was held at a profit. That share has now fallen to 59%, reflecting the growing number of underwater positions.

Ethereum Whales React Differently as Losses Deepen

Against this backdrop, several prominent holders have begun repositioning. Lookonchain reported that Erik Voorhees, founder of Venice AI, deposited 1,635 ETH, worth approximately $4.81 million, into THORChain to swap for Bitcoin Cash (BCH).

The move follows a similar transaction earlier this month, when Voorhees swapped ETH for BCH from a wallet that had remained inactive for nearly nine years, signaling a notable portfolio shift.

Meanwhile, Arthur Hayes has also been transferring ETH to exchanges. Commenting on the strategy, Hayes said he is “rotating out of ETH and into high-quality DeFi names,” citing expectations that select tokens could outperform Ethereum as fiat liquidity conditions improve.

In another on-chain move, Winslow Strong, a partner at Cluster Capital, transferred 1,900 ETH along with 307 cbBTC to Coinbase, bringing the total value of the transfer to approximately $32.62 million. Such transfers do not automatically confirm selling activity.

However, movements to centralized exchanges are commonly viewed as potential sell-side signals, particularly during periods of heightened market uncertainty.

“The ETH was withdrawn one month ago at an average price of $3,402.25, while the cbBTC was accumulated between August 2025 and December 2025 at an average price of $97,936.68. If sold, the total loss would amount to approximately $3.907 million,” an on-chain analyst stated.

Persistent Buying Among Major Holders

Not all whales are exiting the market. Whale address 0x46DB has maintained aggressive buying throughout December. The investor has accumulated 41,767 ETH since December 3 at an average price of $3,130.

The current position shows an unrealized loss of over $8.3 million. BitMine, with an unrealized loss of approximately $3.5 billion, has also made notable purchases this week.

This divergence highlights a clear split in market outlook. While BitMine believes ETH could be positioned for potential upside over the coming months, the ongoing selling activity suggests that other large players remain less confident about ETH’s prospects.

BeInCrypto’s analysis has also identified four key warning signals indicating that Ethereum could face further downside pressure. These include rising exchange reserves, an elevated Estimated Leverage Ratio, and continued ETF outflows. At the same time, the Coinbase Premium Index has fallen to -0.08, its lowest level in a month.

This combination of losses, high leverage, and outflows presents a challenging outlook for Ethereum as 2025 draws to a close. Contrarian buying among big holders reveals some bullish sentiment, but selling pressure has so far overwhelmed these isolated efforts. Whether the sentiment could ultimately shift in 2026 remains to be seen.

The post 40% of Ethereum Supply Slips Into Loss as Whales Take Opposing Positions appeared first on BeInCrypto.