Crypto markets are bracing for a historic year-end event today, December 26, with more than $27 billion in Bitcoin and Ethereum options expiring on Deribit. This represents over half of the derivatives exchange’s total open interest.

The colossal “Boxing Day” expiry could mark one of the largest structural resets in crypto history.

Bitcoin and Ethereum Brace for Record $27 Billion Options Expiry on Boxing Day

Today’s options expiry is significantly higher than those witnessed last week, given it is the last Friday of the month and the year. More precisely, today’s expiring options are for the month and for the quarter (Q4 2025).

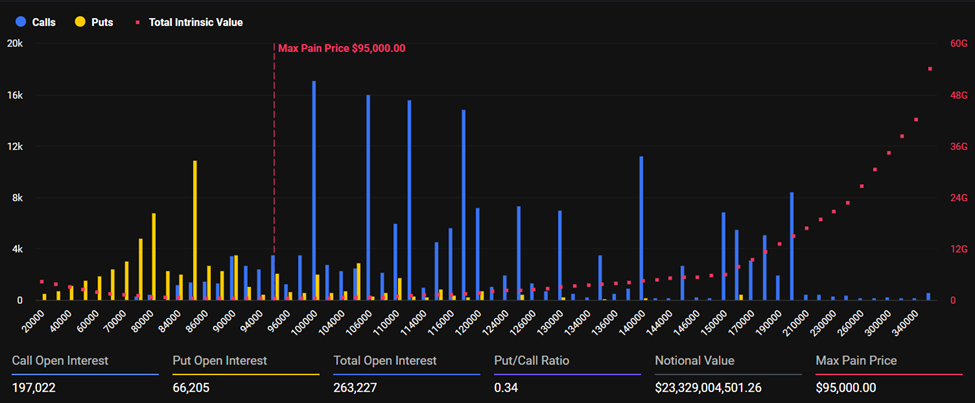

The numbers are staggering, with Bitcoin accounting for $23.6 billion of the expiring options, with Ethereum making up $3.8 billion. Current Bitcoin prices hover around $88,596, while Ethereum trades at $2,956.

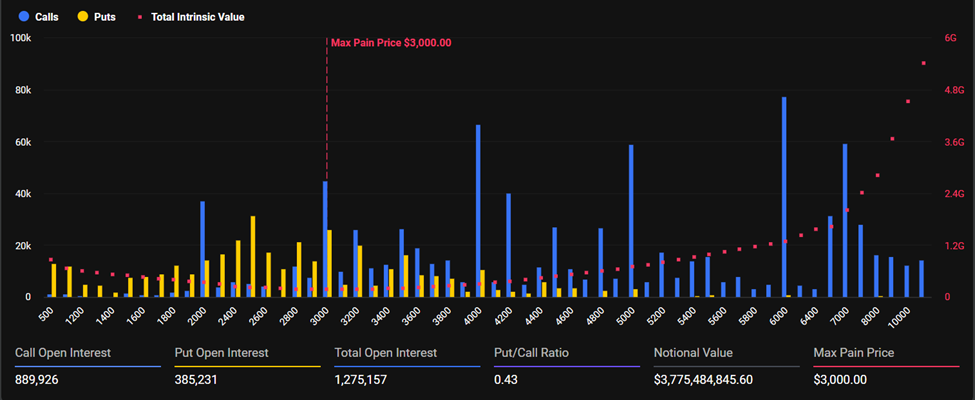

Call options dominate the playing field, outnumbering puts nearly three to one, signaling a distinctly bullish tilt among traders.

The so-called “max pain” levels sit near $95,000 for Bitcoin and $3,000 for Ethereum, the price points where options sellers stand to profit the most, while buyers experience the most financial loss.

According to Deribit, this expiry involves more than 50% of the exchange’s total open interest, making it the largest on record.

“…the largest expiry on record -representing over half of total open interest -… Post-expiry flows will matter more than price. Watch positioning. How would the market react to an expiry this big?” Deribit analysts posed.

The max pain theory, though debated, suggests that spot prices often gravitate toward these levels as traders and institutions adjust hedges before expiry.

Rollover activity is currently the dominant force in the trading market. Many institutions are shifting positions to January contracts to mitigate risk, creating noise in short-term options data.

Greeks.live notes that while puts accounted for 30% of recent block trades, this should not be interpreted as bearish sentiment. Traders picking up leftover positions discarded by institutions can find favorable pricing in this environment, according to analysts.

Volatility Falls, but Year-End Expiry Could Set the Tone for 2026

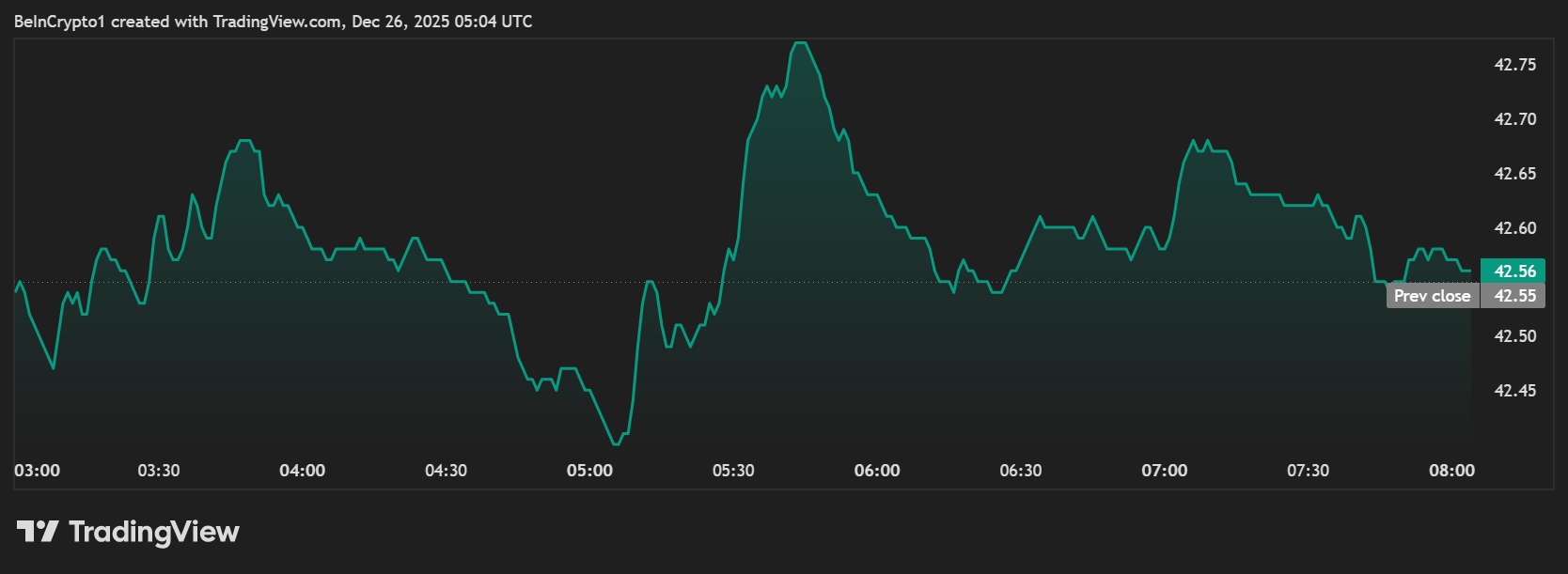

Despite the event’s sheer size, the market appears to be calm. Bitcoin’s implied 30-day volatility index (DVOL) sits around 42%, down from 63% in late November. This suggests that panic-driven swings are unlikely, and the expiry may settle more orderly than feared.

The implications extend beyond the expiry itself. Post-expiry flows are expected to drive market direction, potentially easing upside resistance.

Traders are watching key strikes:

- For Bitcoin, the $100,000–$116,000 call options dominate, while the $85,000 put remains the most popular downside bet.

- Ethereum shows a similar pattern, with concentrated call interest above $3,000.

How institutions manage leftover or rolled-over positions will likely define price action in the first weeks of 2026.

Investors should note that large expiries like this typically breed volatility as traders scramble to close trades or rollover positions. Therefore, the decision to let December put open interest expire at 08:00 UTC on Deribit, or extend them, will determine whether downside risk is year-end driven or signals a structural reset.

With more than half of Deribit’s open interest expiring in one day, Bitcoin and Ethereum are on the verge of a market-defining moment.

Today’s options expiry represents both opportunity and risk. It brings forth an extraordinary convergence of scale, positioning, and seasonal liquidity that could shape crypto trends heading into 2026.

The post The Biggest Options Expiry Ever—What $27 Billion Means for Bitcoin and Ethereum appeared first on BeInCrypto.