Although both bitcoin (BTC) and its US ETFs have declined over the past eight weeks, ETF outflows have further amplified these losses.

After peaking at $168 billion on October 7, the top 12 bitcoin ETFs trading on US exchanges had lost 35% of their assets under management (AUM) by November 19 — far worse than BTC’s 28% decline over the same period.

Of course, investors can blame BTC itself for most — but not all — of that $58 billion loss. From its October 7 all-time high of $126,300 to its $91,500 close on November 19, BTC itself declined 28%.

ETF fund outflows explain those extra 700 basis points, i.e. the 35% decline in AUM versus the 28% decline in BTC. Indeed, net flows from BTC ETFs have been negative for 21 of the past 35 trading days.

Although spot ETF sponsors must keep shares of their funds tracking the price of BTC, minus pre-disclosed fees, their overall assets (with commensurate adjustments to share counts) can grow or shrink depending on how investors move assets between Blackrock, Grayscale, Fidelity, or other products.

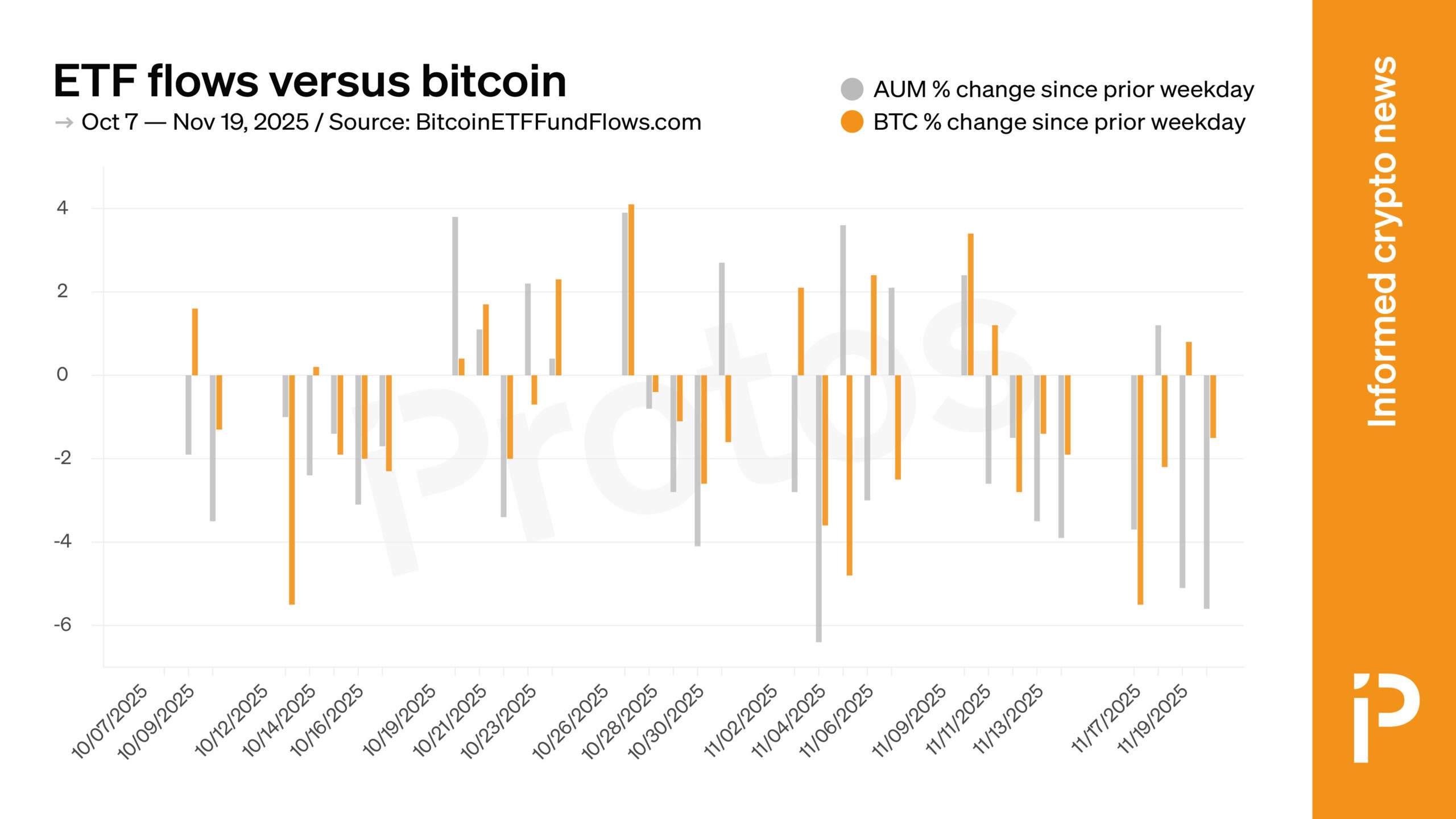

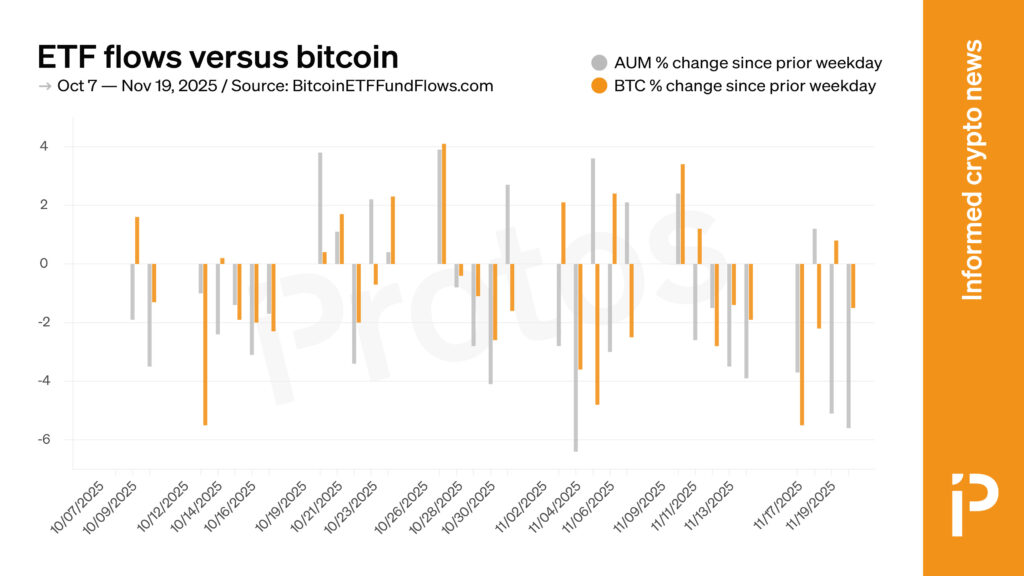

Protos has compiled a chart to illustrate the outsized outflows from US BTC ETFs, using data from Bitcoin ETF Fund Flows.

Although changes in AUM at BTC ETFs often have a lead or lag time relative to the price of BTC, the chart illustrates the overall losses in AUM far exceed the price impact of BTC itself.

Read more: Community Notes debunks spot bitcoin ETF rehypothecation

Investors, not ETF sponsors, pulled assets out of BTC ETFs

To be clear, investors pull their assets out of ETFs by selling or redeeming, and these actions aren’t attributable to the sponsor.

Simplistically, many social media users blamed Blackrock itself for selling BTC over the past eight weeks.

In fact, those sales originated from thousands of investors who owned Blackrock’s IBIT ETF via hundreds of third-party brokerages and funds. Blackrock never placed those sell orders.

Similarly misplaced anger circulated against other ETF sponsors like Grayscale and Bitwise that, to be clear, didn’t originate the alleged selling pressure against BTC.

Unless a separate division at the same company is trading with corporate funds, most ETF sponsors merely follow their customers’ instructions.

The charts and screenshots attached to these social media posts simply showed the results of customers’ orders — not corporate trading.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

The post CHART: Bitcoin ETFs shed $58B, dropping faster than BTC appeared first on Protos.