Robinhood Markets reported second-quarter revenue of $989 million, a 45% jump from a year earlier and ahead of the $908 million analysts expected. Diluted earnings per share doubled to $0.42, beating the 31-cent consensus, while net income surged 105% to $386 million. The results sent the stock up about 4% in late trading.

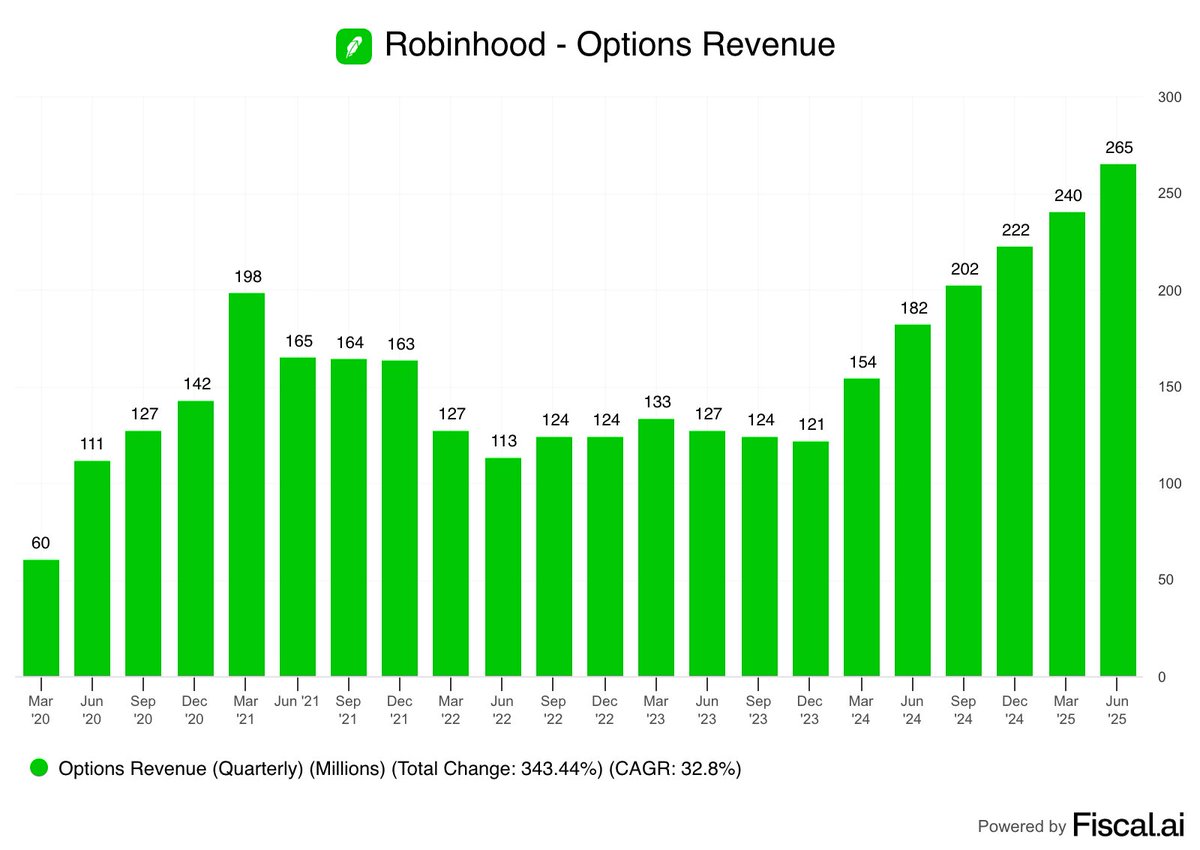

Growth was driven by a 65% increase in transaction-based revenue to $539 million, including record options revenue of $265 million and $160 million from cryptocurrency trading, up 98% year over year. Net interest income rose 25% to $357 million, and adjusted EBITDA improved 82% to $549 million. Customer metrics also strengthened: funded accounts climbed to 26.5 million, average revenue per user rose 34% to $151, and Gold subscription members reached 3.5 million.

Net deposits totaled $13.8 billion in the quarter, and management said about $6 billion flowed in during July, giving the third quarter “a great start.” The brokerage now manages $279 billion of client assets, nearly double last year’s level. After completing its acquisition of crypto exchange Bitstamp in June and announcing a pending purchase of Canada’s WonderFi, the company reiterated full-year guidance for adjusted operating expenses and share-based compensation of $2.15 billion to $2.25 billion.

To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io