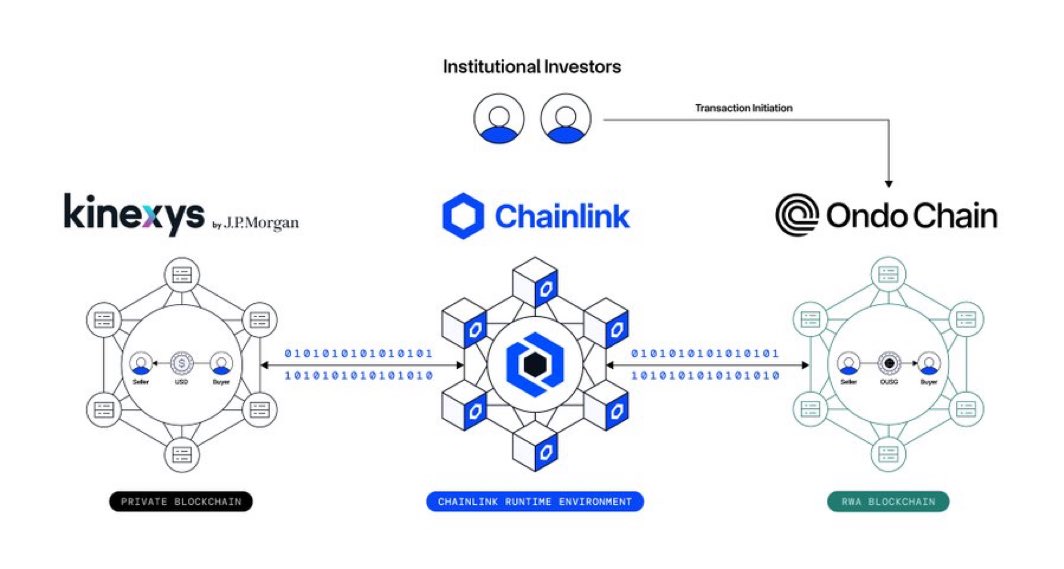

JPMorgan Chase & Co., managing $4 trillion in assets, has executed its first public transaction of tokenized U.S. Treasuries using Ondo's public blockchain. The transaction, facilitated by Chainlink and Ondo Finance, involved the use of Chainlink's technology to settle the OUSG tokenized fund on Ondo's public ledger. This marks a shift from JPMorgan's traditional private blockchain approach, executed through its Kinexys Digital Payments division, which processes an average of $2 billion in daily transaction volume.

The transaction represents the debut of a Delivery versus Payment (DvP) transaction on Ondo Chain's testnet, a new layer-1 blockchain designed for institutional-grade real-world assets. This first testnet transaction showcases a collaboration between JPMorgan's Kinexys division, Chainlink, and Ondo Finance, moving beyond the bank's 'walled garden' strategy.

To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io