Bloomberg senior ETF analyst Eric Balchunas highlighted that spot Bitcoin exchange-traded funds (ETFs) are outperforming many traditional investment vehicles by their impressive start to 2025.

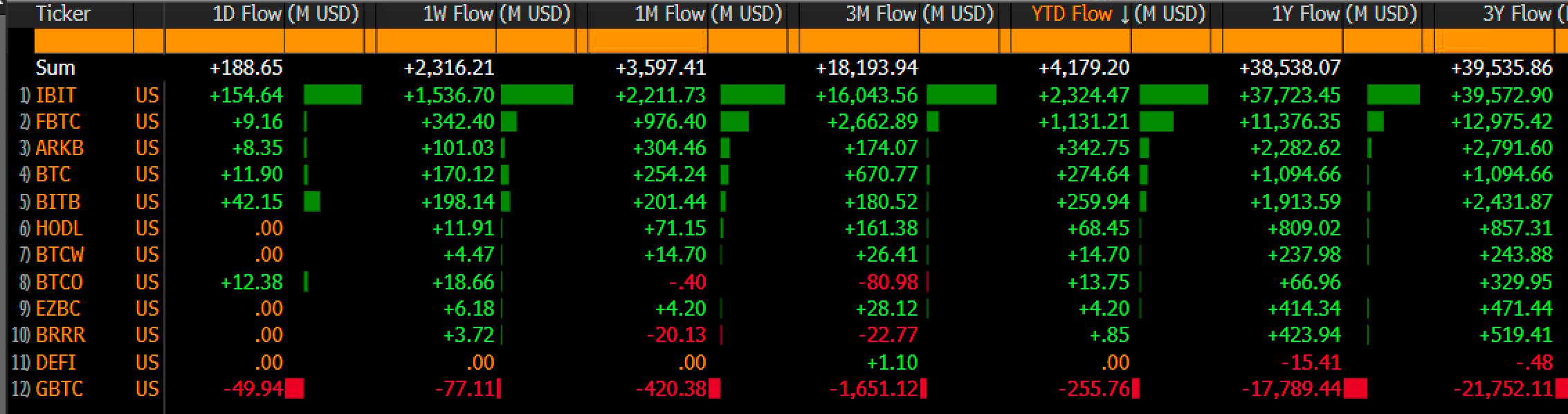

Balchunas shared data showing the funds have amassed $4.2 billion in inflows this year, accounting for 6% of total ETF inflows. To put this into perspective, the funds have attracted over $1 billion since Donald Trump’s inauguration as the US President on Jan. 20.

BlackRock’s IBIT, the largest Bitcoin ETF, has emerged as the frontrunner in 2025, capturing $2.3 billion in inflows. Fidelity’s FBTC follows closely with $1.1 billion, while Ark 21Shares’ ARKB rounds out the top three with $342 million in new investments.

On the other hand, Grayscale’s GBTC continues to experience negative flows, recording $255 million in outflows this year. Hashdex’s Bitcoin fund has also failed to gain traction, reporting zero inflows since the beginning of the year.

Since their launch, the 12 Bitcoin ETFs have collectively recorded $40 billion in net inflows. Their total assets under management (AUM) now stand at $121 billion, with a return of 127%. Bitcoin ETFs have surpassed ESG ETFs in assets ($117 billion) and now rival spot gold funds.

Balchunas noted that these numbers reflect the rising popularity of Bitcoin ETFs and further solidify their place in traditional financial markets.

The post Bitcoin ETFs eclipse traditional rivals with $4.2 billion in 2025 inflows appeared first on CryptoSlate.