TL;DR

- OP breaks past 50-day average as RSI nears 60, signaling bullish strength building.

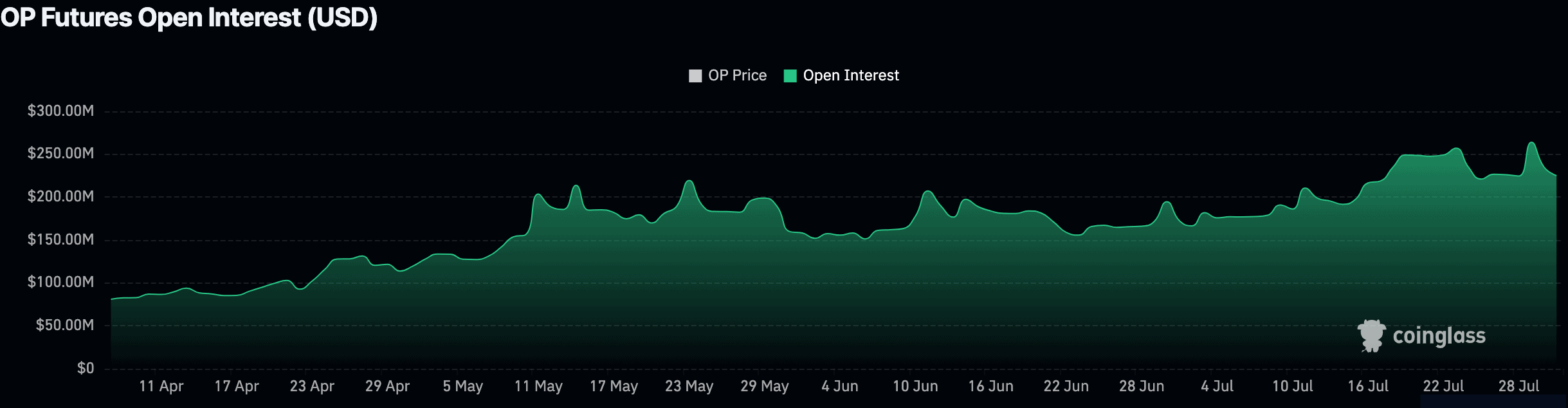

- Open interest hits $233M while volume drops, showing traders are positioned for the next big move.

- Price targets from $0.93 to $2.10 emerge if OP breaks above $0.80 resistance zone.

Price Approaches Key Resistance

Optimism (OP) is now testing the top of a descending channel that has shaped its price movement for close to nine months. The asset has been trading within a structure marked by lower highs and lower lows, forming a clear downward pattern on the daily chart.

Optimism was trading at $0.71 as of press time, showing a 3% increase in the past 24 hours and 5% over the past week.

Analyst Jonathan Carter notes that the price is nearing the channel’s upper edge, with volume showing signs of increase. A daily close above the $0.80 to $0.82 range may confirm a breakout.

Optimism is approaching breakout from the descending channel on the daily timeframe

Volume is growing as the price tests the upper boundary of the channel pattern

A decisive break above resistance could drive the price toward targets at $0.80, $0.93, $1.20, $1.60, and… pic.twitter.com/rXvxjGzWog

— Jonathan Carter (@JohncyCrypto) July 31, 2025

If that happens, traders are watching for potential moves toward $0.93, $1.20, $1.60, and $2.10. These levels align with previous trading activity and match areas with higher volume on the chart.

On the downside, support is seen around $0.50 to $0.55. This zone has provided a base for price during past drawdowns and continues to serve as a key level to watch if the price action weakens. Any failed attempt to break resistance could push the asset back toward this area.

Indicators Show Early Signs of Strength

The 50-day moving average, currently near $0.628, was recently crossed to the upside. This level had acted as resistance in previous weeks and now may act as support if the price continues upward.

Meanwhile, the Relative Strength Index (RSI) is near 60. This suggests that price strength is building, but the market is not yet overbought. This setup allows room for further upside if momentum builds over the coming sessions.

Futures Data Shows Trader Interest Rising

Open Interest (OI) in OP futures has grown 6% in the past day, reaching $234 million, based on Coinglass data. Since April, open interest has grown steadily, more than doubling from earlier levels.

At the same time, daily futures volume has dropped by 21% to $583 million. This contrast between rising OI and falling volume suggests that traders may be positioning early, waiting for a confirmed move. The increase in attention follows an 8% intraday price jump after South Korea’s Upbit exchange announced new OP trading pairs on July 28.

The post Optimism Breakout Looms: Is $2+ the Next Stop After Upbit Boost? appeared first on CryptoPotato.