Airdrop farming has quickly become one of the most effective ways to earn free money, especially in the early stages of a new market cycle. Hyperliquid (HYPE) is a decentralized perpetuals exchange that operates on its own blockchain.

This blockchain is now home to a vibrant ecosystem of protocols, which are quickly gaining attention as one of the most promising prospects for aidrop hunters.

In this in-depth guide, we will walk you through the basics of airdrop farming, while also giving you a step-by-step explanation on how to best position yourself for the next wave of likely airdrops that are coming not just to Hyperliquid but also to the most popular protocols within its ecosystem.

Key Takeaways:

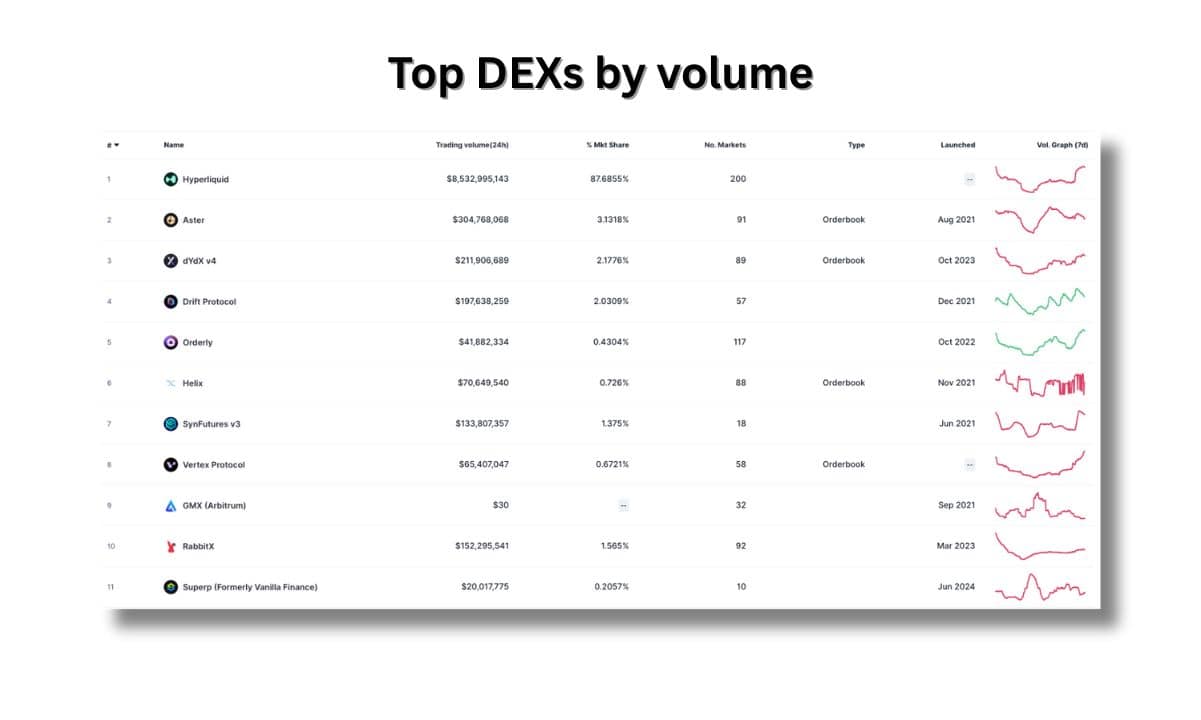

- Hyperliquid is a fast, decentralized exchange with its own blockchain and over 80% of the DEX market share for futures trading.

- Farming airdrops means to trade, stake, and use apps across the Hyperliquid ecosystem.

- A significant portion of HYPE tokens remains unclaimed and is reserved for future community rewards.

- Top projects award points, which are likely to transition into airdrops.

- There are risks – fees, no guaranteed airdrops, and disqualification for suspicious activity.

In this guide:

- Understanding Hyperliquid

- What is airdrop farming and how does it work?

- Farming the next Hyperliquid (HYPE) airdrop

- Top 5 Hyperliquid ecosystem protocols without a token

- Tips to maximize your airdrop chances

- Risks and realities of airdrop farming

- Conclusion: is Hyperliquid airdrop farming worth the time?

- Frequently Asked Questions (FAQ)

Understanding Hyperliquid

Before we dive deeper into the intricacies of airdrop hunting, it’s important to understand why Hyperliquid is so popular, why people are bullish on it, and what makes it and its ecosystem prime hunting grounds for potentially lucrative airdrops.

The following is a very brief overview, because this guide will be focused on airdrops, but if you want to familiarize yourself with Hyperliquid fully, we have prepared a few very in-depth explainers that you must check out:

- What is Hyperliquid (HYPE) and How Does it Work: The Complete Guide in 2025

- Hyperliquid Bridge: How to Bridge USDC to Hyperliquid

- How to Trade on Hyperliquid: Step-by-Step Walkthrough in 2025

What is Hyperliquid: a quick overview

Hyperliquid is a decentralized exchange that, unlike most of its competitors, runs on its blockchain (the HyperEVM). The platform offers crypto-based perpetual futures, currently denominated only in USDC, although the founder has already shared that crypto-denominated contracts are also underway.

One of its main appeals lies in its high-speed, simple, and feature-rich platform, which enables high-level trading while providing a smooth user experience, low latency (below 1 second trade finality), and reliability in a decentralized environment.

Please refer to our guide (stated above) for more detailed information on the various technical features that distinguish Hyperliquid from other decentralized perpetual futures exchanges.

In 2025, it has managed to establish itself as the leading derivatives DEX, accounting for a substantial 83% market share and boasting daily volumes that are significantly greater than those of all other DEXs combined.

Key features that make Hyperliquid and its ecosystem a top airdrop prospect

Besides capturing peak mindshare in 2025 due to its successful product (the derivatives exchange), Hyperliquid is beloved by many in the community for its tokenomics and the way the team handled its genesis token distribution.

The HYPE token was officially launched in late 2024 through an airdrop to early backers and users of the Hyperliquid exchange. There were no private presales or venture capital – the team simply rewarded its community by airdropping roughly 33% of the total HYPE supply.

However, what’s currently attracting users is the fact that nearly 40% of the remaining supply is locked for future emissions and community rewards. This has the community hopeful that there will be more airdrops in the near future.

However, beyond HYPE’s attractive tokenomics, additional mechanics are at play that draw airdrop hunters to pour millions into its ecosystem. Many protocols have active point systems that reward participation and are expected to transition into a token model, distributing parts of their supply through airdrops.

We have selected the five that are most likely to do so, and you can read about them later in the guide.

The role of HYPE in the ecosystem

HYPE is the native cryptocurrency at the heart of the entire Hyperliquid ecosystem, not just the DEX itself. It’s also the gas token of the HyperEVM.

Part of its utilities include:

- Users can enjoy reduced fees on the Hyperliquid decentralized perpetuals exchange.

- They can stake their tokens, receive yield, and support the network

- Participate in voting and help shape the network

- Become a validator

The team is also actively working on many other features, most of which will be accessible through HYPE ownership.

Additionally, all major protocols built on the HyperEVM, particularly those heavily focused on lending, are centered on HYPE. For example, many of the liquid staking protocols would allow you to stake your HYPE tokens to receive yield and, at the same time, give you a synthetic token that you can then use to stay liquid.

What is Airdrop Farming and How Does it Work?

The following is a brief overview of what airdrop farming actually means and how it works for those of you who are new to it. However, if you want to dive deeper, feel free to check the following in-depth guide:

What Are Crypto Airdrops And How to Find the Next Major One?

Airdrop farming is the process of utilizing new or upcoming crypto protocols with the aim of receiving free token distributions, commonly referred to as “airdrops.”

Unlike traditional investing, you don’t need upfront capital beyond gas fees and funds to use the platform. You interact with different decentralized applications, specifically those built on the HyperEVM or Hyperliquid itself (for the purpose of this explainer), and conduct various actions.

These can range:

- Provide liquidity

- Swap tokens

- Buy and sell NFTs

- Bridge funds into the protocols

- Conduct transactions over time, etc.

In return, projects often reward early users once they launch their token, distributing it retroactively based on activity.

Hyperliquid’s ecosystem has emerged as a key target for airdrop farmers due to a few factors. First of all, the HyperEVM was launched in March 2025, which means that a lot of the teams building on it are relatively young. Many of them have followed in Hyperliquid’s footsteps and launched their own point systems, indicating an impending airdrop.

At the same time, airdrops have become a very powerful tool for bootstrapping communities. Users who anticipate a token launch will deliberately promote the protocol and also take full advantage of its features to guarantee potential qualification.

Farming the Next Hyperliquid (HYPE) Airdrop

As we mentioned above, Hyperliquid’s team has reserved a good chunk of HYPE tokens for future community rewards. This has led many in the community to believe that a second airdrop is coming.

Below is a step-by-step process (with reasoning) on what you can do to qualify for it, potentially.

Step 1: Bridge funds to Hyperliquid’s application

The most logical first step is to send some funds to the Hyperliquid app so that you can begin using its features. Sometimes, this is more than enough to qualify for an airdrop but, to be completely honest, in the past couple of years, most of the teams require further participation.

Still, you will need funds to interact with the app and with its ecosystem, so this is the foundation for your HYPE airdrop farming.

As mentioned before, we do have a step-by-step guide on how you can bridge USDC to Hyperliquid, so make sure to check it out here:

Hyperliquid Bridge: How to Bridge USDC to Hyperliquid

Step 2: Use the Hyperliquid DEX for perps trading

Perpetual futures trading is the bread and butter of Hyperliquid. However, the first HYPE airdrop was heavily targeted at people who did that, and since then, the exchange has evolved tremendously, achieving billions in daily trading volume. This means that the competition will be fierce, and there is a high chance that this will not yield the best results in terms of HYPE airdrop farming.

Nonetheless, it’s a step that you can’t ignore because it might even be a qualification criterion. Fortunately for you, trading on Hyperliquid is extremely easy and user-friendly.

- Visit the official page

- Your bridged USDC is likely already sitting in your perps account

- Go to “Trade” and open the interface

- Adjust your preferred margin mode

- Execute trades with the leverage of your choice

Step 3: Use the Hyperliquid DEX for spot trading

This one is also pretty straightforward. All you have to do is transfer funds from your Perp account to your Spot account (which happens with a click of a button).

The spot interface looks exactly the same as the one for perpetual futures, with the exception of having to adjust margin modes and leverage, because there is none.

Step 4: Deposit USDC into the Hyperliquidity Provider (HLP) vault

In general, any action that supports the protocol can be a qualification criterion for a future airdrop, so depositing USDC into the Hyperliquid Liquidity Provider (HLP) vault is likely a good idea, and it comes at zero cost to you. On the contrary, it earns yields based on the performance of the vault.

To do so:

- Go to “Vaults” from the top navigation menu.

- Select Hyperliquidity Provider (HLP)

- Click Deposit and deposit the USDC you are comfortable with

Note: your USDC will be locked for four days and the APY varies depending on how successful the vault’s strategy is.

Step 5: Stake HYPE to secure the network and earn yield

Staking your HYPE with a validator helps secure the HyperEVM and is most likely going to be one of the more important criteria for a future airdrop.

The reasoning is simple: the team has already rewarded trading activity, but at the time the first airdrop took place, the HyperEVM wasn’t live.

It’s clear that the project is now transitioning and evolving into a new phase, which is ecosystem expansion. Staking HYPE helps ensure that.

To do so:

- Transfer USDC to your Spot account and buy HYPE

- Go to Staking from the main navigation menu

- Transfer HYPE to your staking balance

- Select a validator and stake

Note: Transfers from staking balances to spot balances are locked for 7 days, so act accordingly.

Step 6: Transfer HYPE to the HyperEVM and interact with various dApps

Using the HyperEVM will likely be another important qualification factor for potential HYPE airdrops, for reasons similar to those we shared above. I personally think that sending HYPE to the EVM itself is unlikely to do a lot in terms of helping you get an allocation and you will need to interact with various dApps on the blockchain. That’s what the next part is all about, but before you get to do it, you will still need to send funds.

Here’s how:

- Get a HyperEVM-compatible wallet. MetaMask works just fine.

- Send USDC to your Spot account and buy HYPE

- From there, all you need is to hit “transfer to/from EVM”

- Have fun.

Top 5 Hyperliquid Ecosystem Projects Without a Token

Below are some of the most popular HyperEVM-based protocols that have point systems and provide an expanded suite of functionalities for those who want to both get involved in the ecosystem and also farm potential airdrops.

Hyperlend

HyperLend is a high-performance lending protocol that’s centered around capital efficiency. It’s also built on Hyperliquid’s EVM.

The platform offers real-time leverage, deep liquidity, dynamic interest rates, loops, and whatnot – all features designed to maximize the potential of your HYPE.

Why farm for a HyperLend Airdrop?

HyperLend has an official system where users receive points for their activity. The speculation is that this will eventually translate into tokens.

How to farm for a HyperLend Airdrop?

Here are a few steps you can take:

- Connect your wallet to the HyperLend dApp.

- Supply assets to the lending pools.

- Borrow funds against your deposited collateral.

- Loop leverage by re-supplying borrowed assets to increase exposure.

- Swap assets within the protocol to show authentic activity.

- Refer friends.

HypurrFi

HypurrFi introduces a leveraged lending marketplace built natively on Hyperliquid’s HyperEVM. It enables users to create leverage loops, meaning that you can deposit and stake HYPE (or other assets), then use the borrowed assets to increase your exposure while still earning a yield on the original deposit.

The protocol powers the USDXL stablecoin. It’s minted against overcollateralized deposits and is also backed by a growing vault of tokenized US Treasuries, adding a layer of stability and security.

Why farm for a HypurrFi Airdrop?

For all of your activity on HypurrFi, you will receive “HypurrFi Points.” So whenever you supply liquidity, borrow, swap, and pretty much everything else you can do on the platform, you will get points that may later factor into future rewards.

How to farm for a HypurrFi Airdrop?

Here are a few steps you can take:

- Connect a wallet to the HypurrFi dApp on HyperEVM.

- Supply assets such as HYPE, stHYPE, or stablecoins to various liquidity pools.

- Borrow USDXL or other supported assets against your collateral.

- Loop some leverage (advanced) by using borrowed USDXL to buy more of the collateral asset and then redeposit.

- Utilize various features, including isolated markets, pooled markets, vaults, and swaps

- Swap and withdraw periodically to show authentic user behavior.

Hyperbeat

By this time, you’re probably expecting it – Hyperbeat is a native protocol within the Hyperliquid EVM ecosystem, designed to facilitate scaling, liquidity, and yield functionality.

It provides both dynamic and automated trading strategies that you can deposit HYPE into to receive greater APY than you would if you were using validator staking, for example. Apart from that, you can generate points for multiple protocols simultaneously, as Hyperbeat loops your staked HYPE across different projects.

Why farm for a Hyperbeat Airdrop?

For all on-chain actions that you conduct through Hyperbeat, you receive “hearts.” It looks a lot like a points system that projects are using to gauge rewards in future airdrops.

How to farm for a Hyperbeat Airdrop?

Here are the steps:

- Connect your wallet to the Hyperbeat dApp.

- Deposit assets into some of the vaults.

- Earn yield and points by supplying to vaults and staking.

- Borrow funds against your collateral.

- Invite users to the platform.

- Swap assets through the swap function.

HyperSwap

HyperSwap is a decentralized and AI-powered decentralized exchange that’s built on the HyperEVM. In case you were wondering, yes, there are many tokens already circulating on the HyperEVM, and sometimes you can only trade them through a decentralized exchange like HyperSwap because they are not listed on Hyperliquid’s DEX.

The protocol combines Uniswap-style liquidity pools with a smart routing engine that’s designed to optimize swaps across multiple networks. This router minimizes slippage and gas fees by selecting the most efficient route for each trade.

Why farm for a HyperSwap Airdrop?

HyperSwap, much like any other protocol on our list, has a points system. In other words – users are speculating that this will transition into an airdrop at some point in the future.

How to farm for a HyperSwap Airdrop?

Here’s what you can do:

- Bridge funds into HyperEVM usingthe HyperSwap cross-chain bridge.

- Make regular swaps to earn base points and engage with the router.

- Provide liquidity.

- Refer and engage with the community.

Felix Protocol

Felix is a stablecoin protocol that’s built on HyperEVM. It allows users to mint feUSD, which is a soft-pegged stablecoin. They can do so by locking collateral such as HYPE and a few other cryptocurrencies into CDP vaults.

It also offers some vanilla lending markets for dynamic borrowing and lending of supported assets. Some of its core functionalities include collateralized borrowing, seamless on-chain liquidity, yield generation, and more.

Why farm for a Felix Protocol Airdrop?

You guessed it – Felix Protocol has a points program, and it rewards different types of actions that we will outline in the next point.

How to farm for a Felix Protocol Airdrop?

Here’s what you can do:

- Connect your Web3 wallet to the Felix dApp.

- Mint feUSD using collateral in the CDP vaults.

- Deposit feUSD into different pools to earn yield.

- Use vanilla markets – borrow or lend assets ike HYPE.

- Supply liquidity to the feUSD-involving pools on Kittenswap or HyperSwap.

- Refer other users.

Tips to Maximize Your Airdrop Chances

If you’re serious about farming airdrops on Hyperliquid, simply using the platform once or twice is unlikely to be enough. This applies to the other protocols on our list as well. Projects tend to reward users who show consistent and, most importantly, organic activity over time.

Here are five practical tips that will help you improve your chances of qualifying for a future airdrop in the Hyperliquid ecosystem.

Use the features consistently, not just once

Find the core product offering of each protocol because this is (most likely) going to be the rewarding factor. For instance, if you are focusing on a protocol that specializes in lending and borrowing, it’s a good idea to lend and borrow funds. A significant number of previous airdrops have favored users who demonstrate consistent engagement, as opposed to those who have used the platform only once or twice.

Use multiple features across the platform

Don’t just focus on using one feature – check out all of them. Using the above example as a guide, you may want to provide liquidity to the protocol, utilize a synthetic token (if available), explore various lending and borrowing mechanisms or markets, and so forth. Airdrop criteria often include multiple interaction points with the ecosystem, and engaging with more parts of it can signal that you’re not a bot or just an opportunist.

Avoid obvious farming behaviors

Don’t try to game the system by making a lot of the same repetitive actions. For instance, if you’re using a trading platform within the HyperEVM, opening and closing small positions quickly is likely not going to do much for you-unless, of course, it’s part of a genuine and consistent trading strategy. Ensure that you use the protocol as intended by genuine users.

Stay active in the community and monitor updates

Sometimes, being visible within the project’s ecosystem can be beneficial. Join their official Discord or Telegram channels to stay informed and follow for updates. Some projects reward early community supporters as well as on-chain activity.

Risks and Realities of Airdrop Farming

While airdrop farming is often seen as a way to earn “free money,” it also comes with actual risks, time costs, and a certain set of limitations. Understanding these trade-offs is very important before committing serious effort to farming platforms like the ones I’m talking about in this guide.

Time vs. Reward is Never Guaranteed

One of the biggest misconceptions is that your effort will guarantee a payout. Many users spend days, even months, interacting with platforms only to receive no airdrops or one worth far less than what they expected. Protocols become a lot more selective and the qualification criteria are almost never disclosed in advance. This creates uncertainty, especially when it comes to managing multiple projects simultaneously.

Gas Fees, Trading Fees, and Real Costs

We said in the beginning that you won’t be needing to do a direct investment, and this is true, but airdrop farming is still not entirely free. You will need to pay network gas fees and also platform trading fees (in certain cases). These costs can still accumulate over time, especially when using larger volumes.

Smart Contract and Platform Risks

Vitalik Buterin said it back in 2019 – the chance of every DeFi app failing is never zero. This is especially true for new or rapidly growing platforms, as they often carry risks of bugs or exploits. Most of the protocols in this list fit that criteria – they are relatively young and, as such, it’s not recommended that you work with money that you can’t afford to lose.

Conclusion: Is Hyperliquid Airdrop Farming Worth the Time?

Despite some of the risks and challenges, Hyperliquid airdrop farming is worth it, especially in the context of potential ecosystem expansion. There are numerous examples from previous cycles where high-performance protocols (such as Solana, for instance) saw massive airdrops happen within its ecosystem and made fortunes for early participants.

Frequently Asked Questions

How to qualify for a potential Hyperliquid (HYPE) airdrop?

There are no guaranteed qualifications, but users who trade on the platform regularly, interact with multiple features, and demonstrate consistent activity over a prolonged period of time are more likely to be eligible. It’s very important to use the platform (and all other protocols) in an authentic and organic way.

Can I farm airdrops on multiple wallets?

Technically, you can. However, you must be aware of the risks associated with sybil disqualification, especially if you plan to use multiple other addresses.

When will Hyperliquid airdrops happen?

There is no official timeline for a Hyperliquid airdrop. It could happen at any given moment, or it may not happen at all.

Do I need to deposit real money to farm Hyperliquid airdrops?

Yes, you must deposit real money to farm Hyperliquid airdrops. Trading on the platform requires collateral and using all other protocols is also associated with real money.

The post How to Farm Airdrops on Hyperliquid (HYPE): The Complete Guide to Free Money This Crypto Cycle appeared first on CryptoPotato.