Ethereum continues to trade below key resistance levels after weeks of correction. While a short-term bounce is playing out, the overall market structure remains uncertain. The price action shows signs of recovery, but there is no confirmed shift in momentum yet.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH is still trading below a significant descending trendline, which has been acting as dynamic resistance over the past few weeks. The asset bounced from the $2,700 support zone but hasn’t yet broken above the wedge or the 100-day and 200-day moving averages, which are converging around the $3,600 mark.

A potential bearish crossover between the moving averages is also very likely in the short-term, which could signal a deeper drop in the coming weeks. On the other hand, for buyers to regain control, the price must break above the $3,500-$3,700 supply zone. Yet, everything should begin with a breakout from the falling trendline.

The 4-Hour Chart

The 4-hour chart shows a clearer bounce after a false breakdown below the lower channel boundary around $2,750. The price quickly reclaimed the level, and a short-term uptrend has resumed inside the ascending channel.

The price is now testing the same $3,000 level, which has previously triggered the last sell-off. If buyers can flip that zone into support, another bullish leg toward the $3,400–$3,500 zone could be expected. However, failure here would likely drag ETH back toward $2,900 and likely below the channel once more.

The RSI is also rising steadily, but not yet overbought. This indicates that momentum is there, but the price will still be vulnerable to resistance zones.

On-Chain Analysis

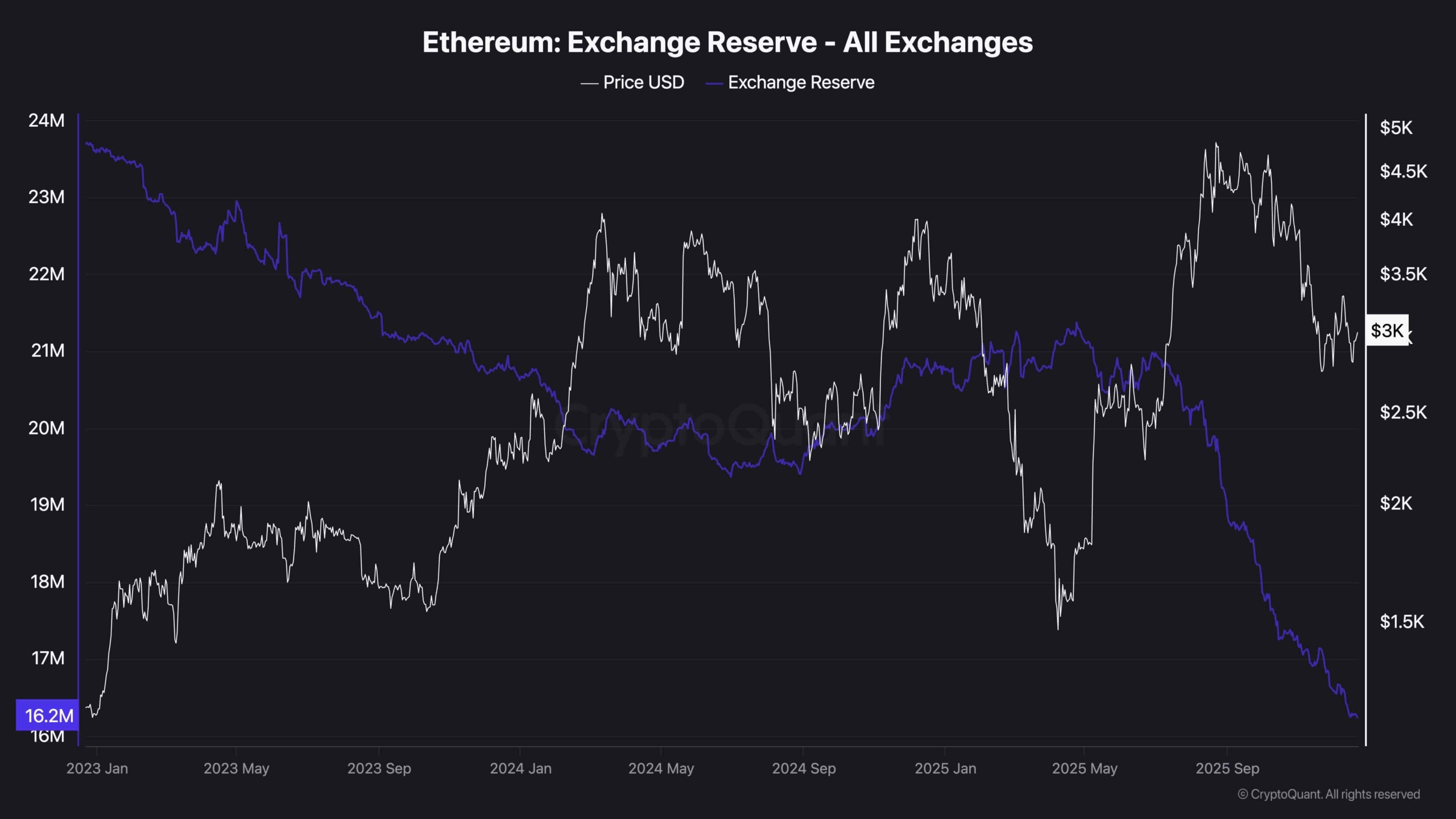

Exchange Reserve

Ethereum’s exchange reserves continue to drop aggressively, now reaching the lowest levels in years (around 16.2 million ETH). This suggests long-term accumulation and reduced sell-side pressure from holders.

Historically, declining exchange reserves are bullish over the medium term, indicating coins are being moved off exchanges and into cold storage. However, price has yet to reflect this, which could imply market participants are still waiting for macro confirmation or external catalysts before buying aggressively.

So, while on-chain data supports the long-term bull case, short-term technicals are still fragile.

The post Ethereum Price Analysis: Is ETH Out of the Woods After Reclaiming the $3K Level? appeared first on CryptoPotato.