[PRESS RELEASE – Zug, Switzerland, December 18th, 2025]

The dYdX Foundation recently hosted its Monthly Analyst Call for December, together with dYdX Labs, providing an overview of protocol activity, governance actions, ecosystem integrations, and incentive programs during a period of mixed market conditions. The call is part of the Foundation’s ongoing commitment to transparency and structured communication with analysts, token holders, and ecosystem participants.

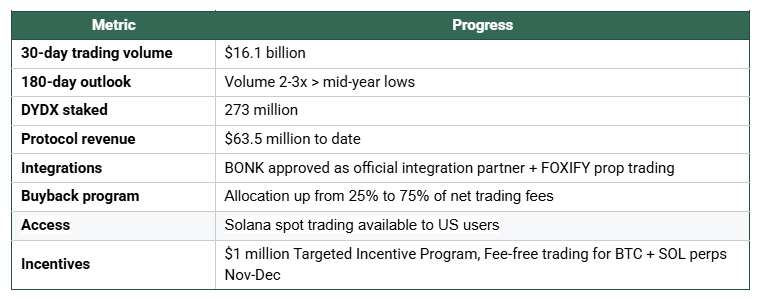

Despite softer trading activity across the broader crypto derivatives market in November, dYdX demonstrated continued momentum. Over the most recent 30-day period, the protocol recorded $16.1 billion in perpetual trading volume, representing the strongest rolling month of Q4 and a clear step-up. Daily volumes frequently exceeded $600–800 million, a 2-3X growth in trader engagement and growing on-chain liquidity even amid more cautious market sentiment.

A central theme of the December call was the role of governance in shaping protocol growth. During the month, dYdX Governance approved Surge Season 9, including a 50% fee rebate for UI and API traders and a $1 million Targeted Incentive Program designed to support trader retention during periods of elevated volatility.

Governance also approved the extension of fee-free trading for BTC and SOL perpetuals from November into December. This initiative was designed to stimulate on-chain activity and market depth following broader market volatility earlier in the quarter, while offering traders direct cost relief on two of the protocol’s most actively traded markets.

December also marked an important expansion of dYdX’s product surface with the launch of Solana Spot trading on dYdX. The addition of spot markets marks a strategic step toward broadening dYdX’s addressable user base and supporting a wider range of trading strategies beyond perpetuals.

Notably, Solana spot trading on dYdX is also available to users in the United States, positioning spot markets as a key entry point for U.S.-based participants. This launch reinforces dYdX’s longer-term vision of supporting multiple asset classes and user segments through on-chain infrastructure, while navigating evolving regulatory environments.

December further highlighted the expanding scope of dYdX’s ecosystem integrations. Governance formally approved BONK as an official dYdX integration partner, enabling a first-of-its-kind, community-aligned derivatives deployment. BONK’s newly launched perp DEX, powered by dYdX infrastructure, redirects 50% of all trading fees directly to the BONK DAO, aligning protocol usage with community value creation. Fee-free BONK perpetuals on bonk.trade mark an additional step in experimenting with new distribution and revenue-sharing models.

Network security and alignment remained strong. Approximately 273 million DYDX were staked as of mid-December, representing a substantial portion of the circulating supply. During the period, DYDX buybacks continued alongside staking of the bought-back tokens, reinforcing long-term incentives for tokenholders and validators.

Charles d’Haussy, CEO of the dYdX Foundation, commented:

“December demonstrated the strength of dYdX’s governance-led model. The protocol continues to grow volumes, ship new integrations, and deploy targeted incentive programs. These outcomes reflect a maturing ecosystem where governance and infrastructure work together to support sustainable growth.”

About the dYdX Foundation

The dYdX Foundation is an independent not-for-profit organization based in Zug, Switzerland. Its mission is to support the current and future implementations of the dYdX protocol and foster community-driven governance and growth across the ecosystem.

Disclaimer

The content here is for informational and educational purposes only; it should NOT be taken as legal, business, tax, or investment advice or be used to evaluate any investment or security. All figures and charts are based on the most accurate data available and may be subject to updates. For more details, please see https://www.dydx.foundation/terms-of-use.

The post dYdX Shares Key Highlights from December Analyst Call appeared first on CryptoPotato.