Bitcoin remains under short-term pressure as the price continues to consolidate below key resistance levels. While volatility has compressed, multiple technical and on-chain signals suggest the market is approaching a decisive phase.

Technical Analysis

By Shayan

The Daily Chart

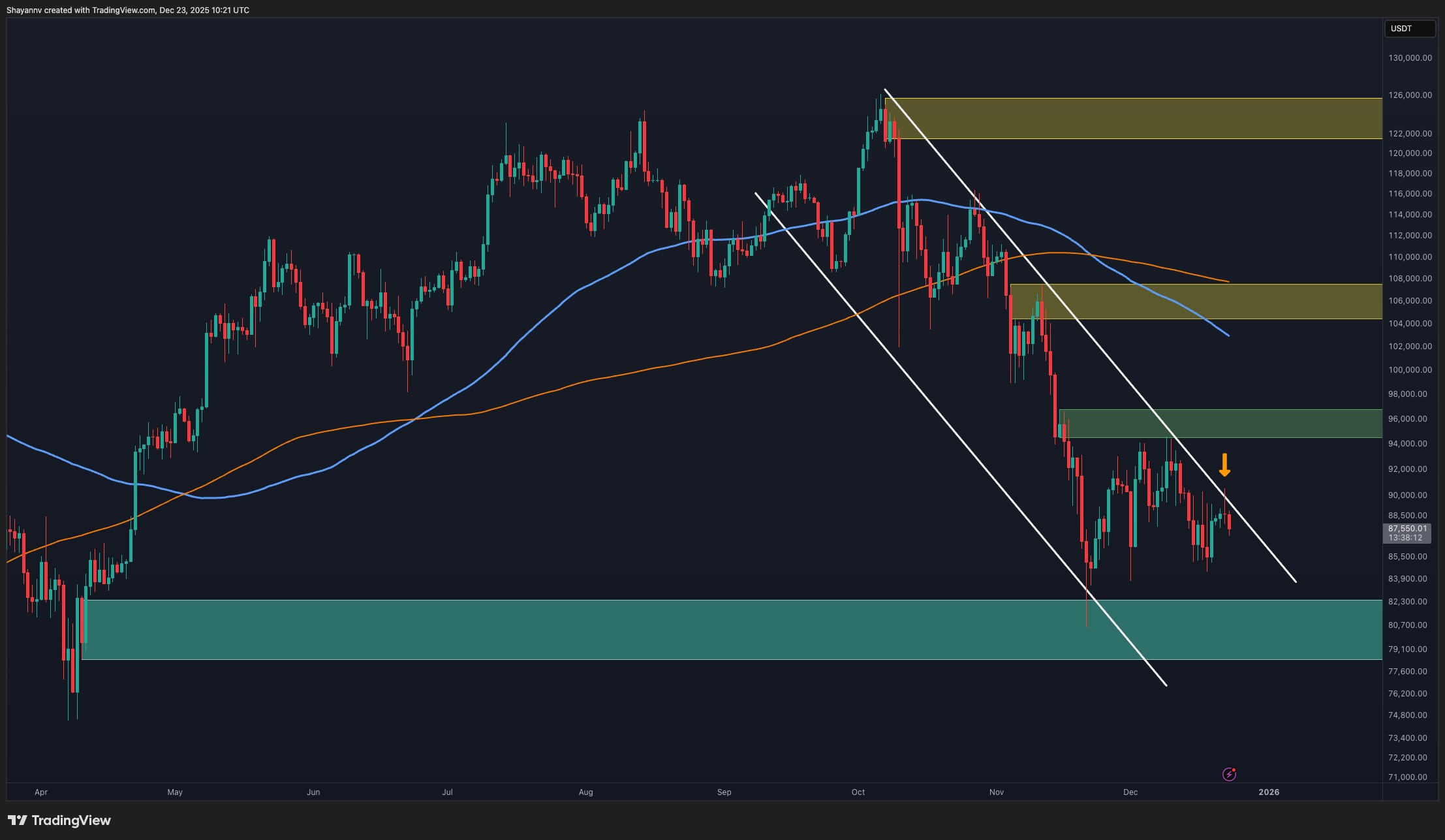

On the daily timeframe, BTC has recently experienced a rejection at its major descending trendline that has consistently acted as dynamic resistance during recent attempts to recover. Each rally into this trendline has been met with selling pressure, reinforcing its technical significance.

At the same time, Bitcoin is holding above a critical demand zone in the $82K–$84K range, which has acted as a reliable support area during the recent decline. This zone continues to absorb downside pressure, preventing deeper continuation to the downside for now.

The broader daily structure suggests Bitcoin is trapped between descending resistance and strong horizontal support, resulting in a range-bound environment. A decisive daily close above the descending trendline would be required to shift momentum in favour of buyers, while a clean breakdown below the $82K region would expose Bitcoin to bigger corrective risk.

The 4-Hour Chart

Zooming into the 4-hour timeframe, BTC’s recent price action shows weakening bullish momentum following multiple failed recovery attempts. The asset recently attempted to push higher along an ascending intraday trendline but was stopped near the $89K–$90K region, forming a local lower high.

This rejection led to a breakdown back below short-term structure, confirming the move as a failed breakout rather than a sustained reversal. Since then, Bitcoin has continued to print lower highs, keeping bearish pressure intact in the short term.

As long as the price remains below the descending 4-hour trendline, upside attempts are likely to be corrective. A sustained reclaim above $90K would be needed to invalidate the bearish structure and open the door for a broader recovery.

On-chain Analysis

By Shayan

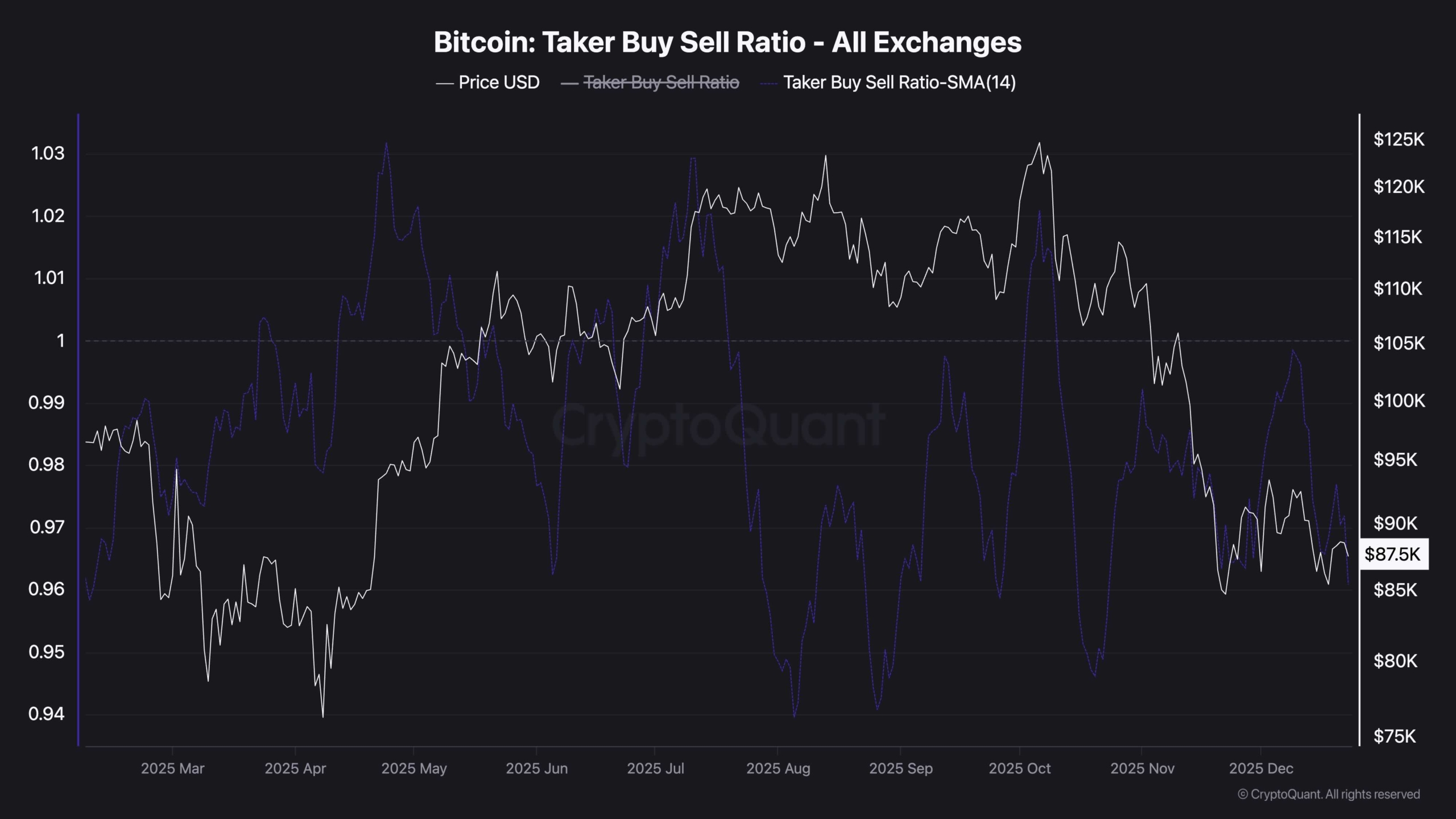

The taker buy–sell ratio continues to reflect a market environment dominated by sell-side aggression. Throughout recent price action, the ratio has remained below its neutral equilibrium, indicating that market sell orders have consistently outweighed buy orders. This behavior suggests that rallies are being met with active distribution rather than strong demand, keeping upside attempts capped.

Even during short-term rebounds, the ratio has failed to sustain a move back into positive territory. These brief reactions highlight reactive buying rather than initiative-driven demand, reinforcing the view that buyers lack conviction at current levels. As long as the taker buy–sell ratio remains suppressed, Bitcoin’s structure favors consolidation or further downside rather than a clean bullish continuation.

The post Bitcoin Price Analysis: What’s the Most Likely BTC Scenario Over Christmas? appeared first on CryptoPotato.