Nearly a billion worth of long positions have been wrecked in the past 24 hours as the positive macro developments have failed to propel a price rally for risk-on assets like crypto.

Just the opposite, bitcoin and most altcoins have headed south once again in the past hour, with numerous weekly lows.

The promises of an Uptober have crashed and burned in 2025 as the market has failed to produce any substantial gains since the early surge to a new all-time high. Bitcoin’s chart from above demonstrates that the asset has been in a free-fall state ever since that peak marked on October 6.

Even if we exclude the flash crash four days later, BTC is still nearly $20,000 down in just over three weeks. The asset was rejected at $116,000 twice in the past four days, and the bulls put all hopes on yesterday’s Fed rate cut and today’s meeting between Presidents Donald Trump and Xi Jinping. Both of those events led to what the investors expected and hoped for: a reduction in interest rates and lower tariffs on China.

Yet, the cryptocurrency market failed to capitalize. Just the opposite, bitcoin slumped from over $112,000 yesterday to $107,500 minutes ago, which became a new weekly low.

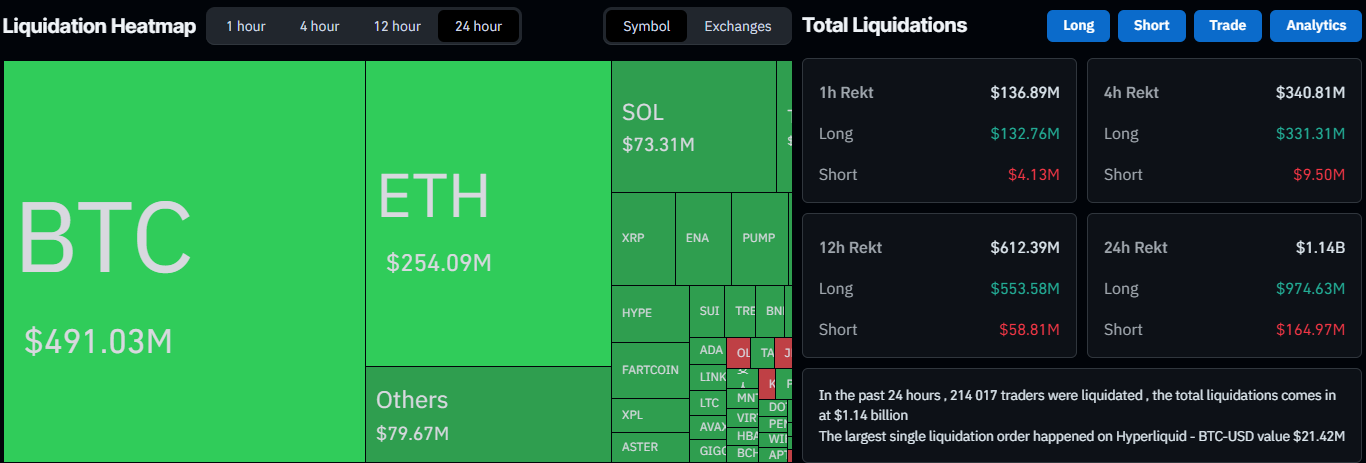

The market leader’s nosedive dragged the altcoins along, with ETH dumping by 5% to under $3,800 and XRP dropping by over 6% to $2.45. Even more painful declines come from the likes of HASH (-22%), ASTER (-13%), KAS (-11%), PI (-10.5%), WLFI (-10%), and many others.

Such big moves in either direction tend to harm over-leveraged traders, and the correction in the past 24 hours is no different. More than 210,000 such market participants have been wrecked daily, while the total value of liquidated positions has skyrocketed to more than $1.1 billion. Naturally, almost all of that amount came from longs ($974 million).

The post Bitcoin Dumps to Weekly Lows as Liquidations Skyrocket to Over $1.1 Billion appeared first on CryptoPotato.