Bitcoin Magazine

Fidelity Flags Short-Term Crypto Risks, Discusses Bitcoin’s Historic 4-Year Cycle

Bitcoin and the broader crypto market is heading into 2026 with more questions than clear answers.

A new outlook from Fidelity urges caution for investors chasing short-term gains, while arguing that long-term holders may still have room to enter the market.

The message reflects a broader shift: crypto is no longer just a high-beta trade for speculators. It is being treated as a strategic asset by governments, corporations, and institutional investors.

That shift accelerated this year.

This year, more governments and companies added digital assets to their treasuries, creating a new source of demand that didn’t exist in prior cycles.

In March, President Donald Trump signed an executive order establishing a Strategic Bitcoin Reserve for the United States. The order formally designated BTC and select cryptocurrencies already held by the federal government as reserve assets.

The long-term impact of that decision remains unclear. But the symbolism matters. BTC is now officially recognized by the U.S. government as a store of value. That recognition is feeding debate over whether crypto’s familiar four-year market cycle still applies, the report argued.

Is Bitcoin’s four-year cycle over?

Bitcoin has historically moved in boom-and-bust patterns tied loosely to its halving schedule. Major tops formed in 2013, 2017, and 2021. Each was followed by deep drawdowns. Today, prices are again pulling back around the four-year mark, raising the question of whether the current bull market has already peaked.

Some investors think the cycle is breaking down. The argument is simple: structural demand is changing. Sovereign adoption and corporate balance sheet buying could dampen volatility and reduce the severity of future bear markets.

Others go further, suggesting bitcoin may be entering a “supercycle” that extends higher for years, with only shallow corrections along the way.

Fidelity Digital Asset’s Chris Kuiper isn’t convinced cycles are dead. Human behavior hasn’t changed, he notes, and fear and greed still drive markets. If the four-year pattern holds, bitcoin would need to have already set its cycle high and be entering a sustained bear market.

So far, it’s too early to say. The recent drawdown could mark the start of a downturn. Or it could be another mid-cycle shakeout.

Governments and corporations are buying Bitcoin

Also, government adoption adds another layer of complexity. A growing number of countries already hold crypto, but few have formally designated it as a reserve asset.

That may change. Kyrgyzstan passed legislation establishing a crypto reserve in 2025. In Brazil, lawmakers advanced a proposal that would allow up to 5% of foreign reserves to be held in bitcoin.

Kuiper points to game theory. If one country adopts bitcoin as a reserve, others may feel pressure to follow. Any incremental demand, he says, could support prices, though the scale matters and selling pressure can offset buying.

Corporations are also playing a larger role. More than 100 publicly traded companies now hold crypto, with roughly 50 firms controlling over one million bitcoin combined, per Fidelity. Strategy remains the most visible buyer, but it’s no longer alone. For some firms, bitcoin offers a way to access capital markets and arbitrage investor demand for exposure.

That demand cuts both ways. Corporate buying can lift prices. Forced selling in a downturn could amplify losses.

So, is it too late to buy?

Fidelity’s Kuiper says it depends on the time horizon. Short-term investors may face poor odds if the cycle is near its end. Long-term holders face a different equation. On a multi-decade view, Kuiper argues bitcoin’s fixed supply remains its core appeal. If that holds, the question isn’t timing the cycle. It’s whether adoption continues. In 2026, that answer is still unfolding.

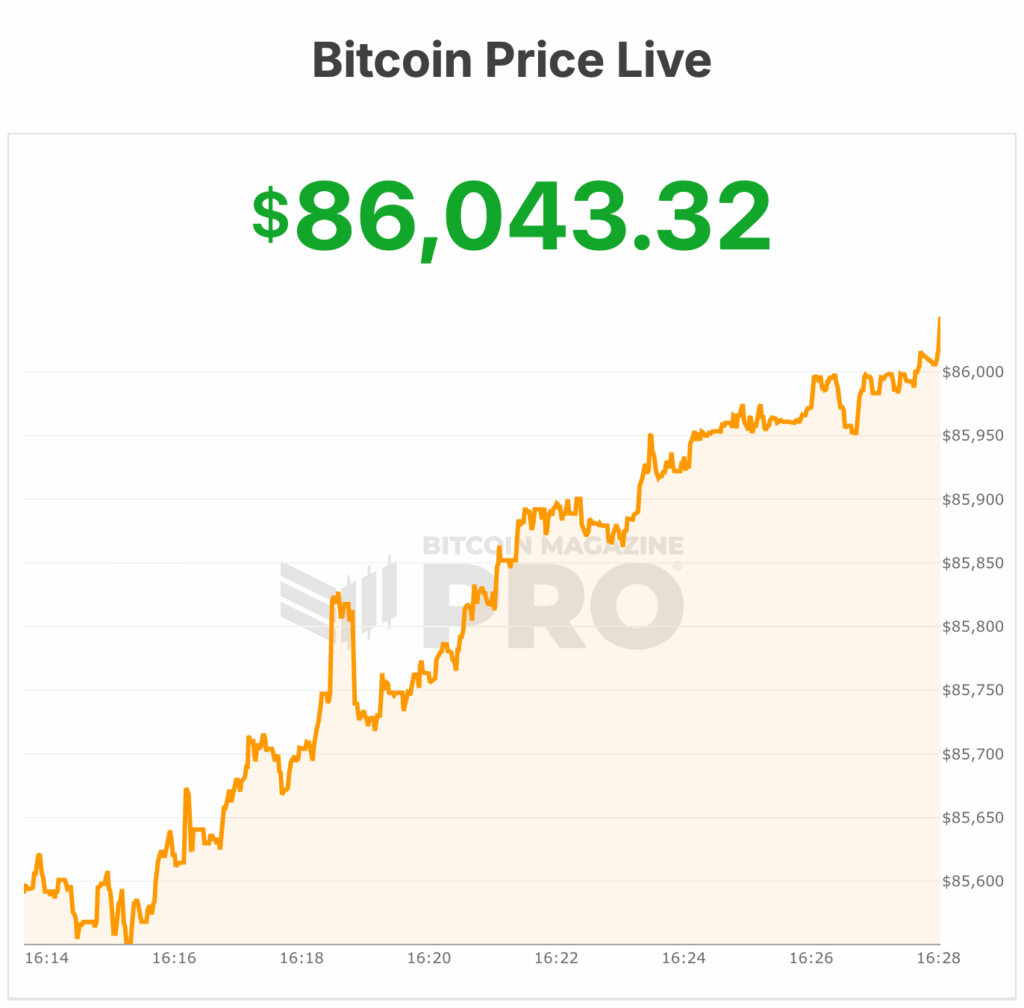

At the time of writing, Bitcoin’s price is rapidly dipping near $86,000.

This post Fidelity Flags Short-Term Crypto Risks, Discusses Bitcoin’s Historic 4-Year Cycle first appeared on Bitcoin Magazine and is written by Micah Zimmerman.