Bitcoin’s recent rally has captured investor attention as its price inches closer to $105,000. The leading cryptocurrency has gained momentum throughout the past month, fueled by strong institutional interest and renewed market optimism.

However, conflicting market conditions may hold Bitcoin back from reaching a new all-time high.

Bitcoin Holders Heavily Accumulate

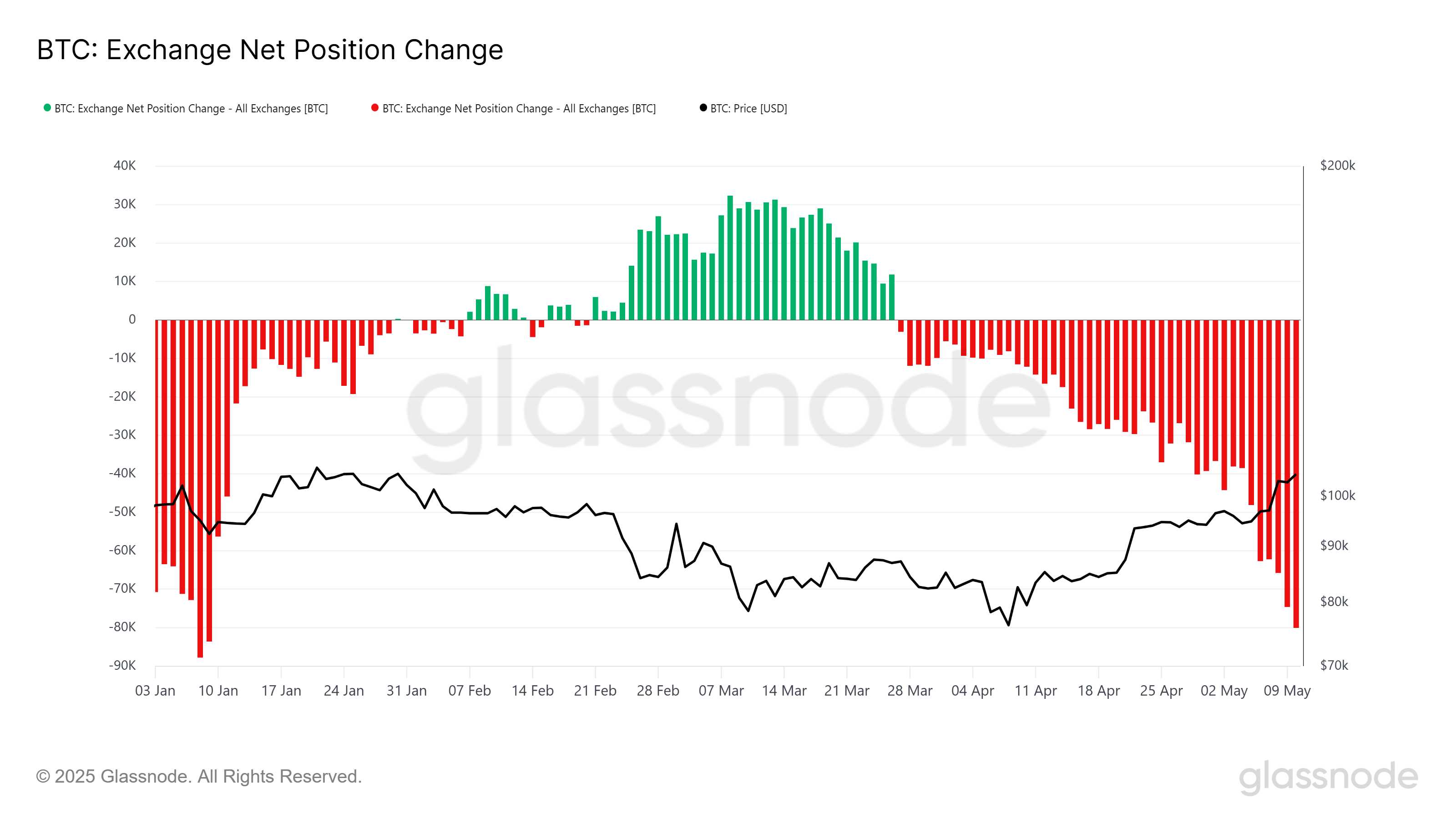

Investor activity has been overwhelmingly bullish. Over the past week alone, more than 30,072 BTC, valued at over $3.13 billion, were purchased. This surge in buying activity has driven the exchange net position to its lowest level in four months.

The metric indicates that more coins are being withdrawn from exchanges than deposited, a classic sign of accumulation.

Fear of missing out on profits is pushing Bitcoin holders to accumulate at a rapid pace. As Bitcoin hovers near its record highs, long-term investors appear to be adding to their positions, betting on a fresh breakout.

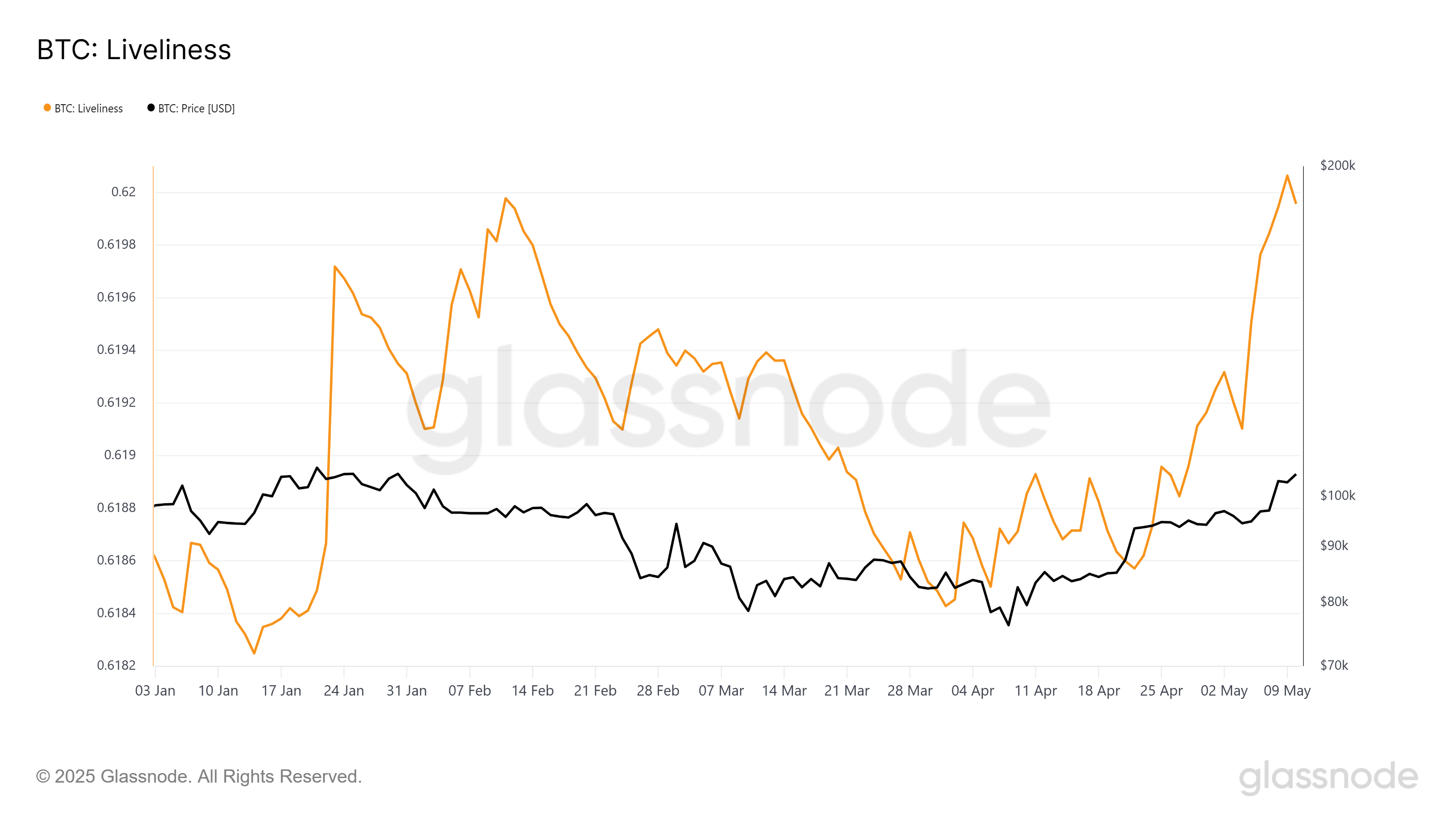

While accumulation remains strong, the macro trend presents a mixed picture. The Liveliness indicator, a key on-chain metric, has seen a notable spike since the start of May. Currently sitting at a multi-week high, it suggests that long-term holders (LTHs) are beginning to liquidate.

An increase in Liveliness typically means that dormant coins are becoming active again, often signaling that early adopters are taking profits. This behavior may introduce new selling pressure into the market.

If Bitcoin LTHs continue to offload their holdings, it could undermine the bullish sentiment driven by fresh accumulation.

BTC Price Aims For New ATH

Bitcoin is currently trading at $104,231, just below the key psychological resistance of $105,000. However, technical data shows that the actual resistance sits at $106,265. This price level has acted as a ceiling since December 2024, preventing Bitcoin from gaining further traction.

Despite the all-time high standing at $109,588, the $106,265 mark is Bitcoin’s immediate hurdle. Market dynamics—including the selling from LTHs and conflicting investor sentiment—make this level particularly difficult to breach.

Should Bitcoin fail to overcome this resistance, a price correction back to $100,000 remains a strong possibility.

Conversely, if BTC manages to break and flip $106,265 into a support floor, it could reignite bullish momentum. Such a move would pave the way for Bitcoin to reclaim $109,588 and potentially form a new all-time high.

Surpassing this level would invalidate the bearish outlook and could set the stage for a run to $110,000.

The post Why Bitcoin’s $105,000 Rally Might Fall Short of a New All-Time High appeared first on BeInCrypto.