Solana (SOL) has drawn significant attention from investors due to its recent volatile price movements.

Despite positive signals regarding network performance and long-term potential, whale activities indicate that SOL may be at risk of a sell-off. So, what factors will determine SOL’s next direction?

Whale Movements: Rising Selling Pressure

Recently, the market has witnessed a series of selling and unstaking activities from major wallets, raising concerns about selling pressure on SOL.

On May 12, 2025, a whale released 103,040.6 SOL, equivalent to $17.7 million. Separately, a wallet linked to FTX/Alameda has unstaked 187,625 SOL, worth $32.24 million.

On the same day, Pump.fun, a token issuance platform on Solana, transferred 132,000 SOL to the Kraken exchange.

These actions suggest that large investors are profiting after SOL’s recent price surge, reflecting a cautious sentiment amid market volatility.

Solana Network Status: Strength Still Affirmed

Despite the mounting selling pressure from whales, the Solana network continues demonstrating exceptional strength within the blockchain ecosystem. Solana led all blockchains in revenue generation for Q1 2025, reaching over $200 million, surpassing Ethereum and BNB Chain.

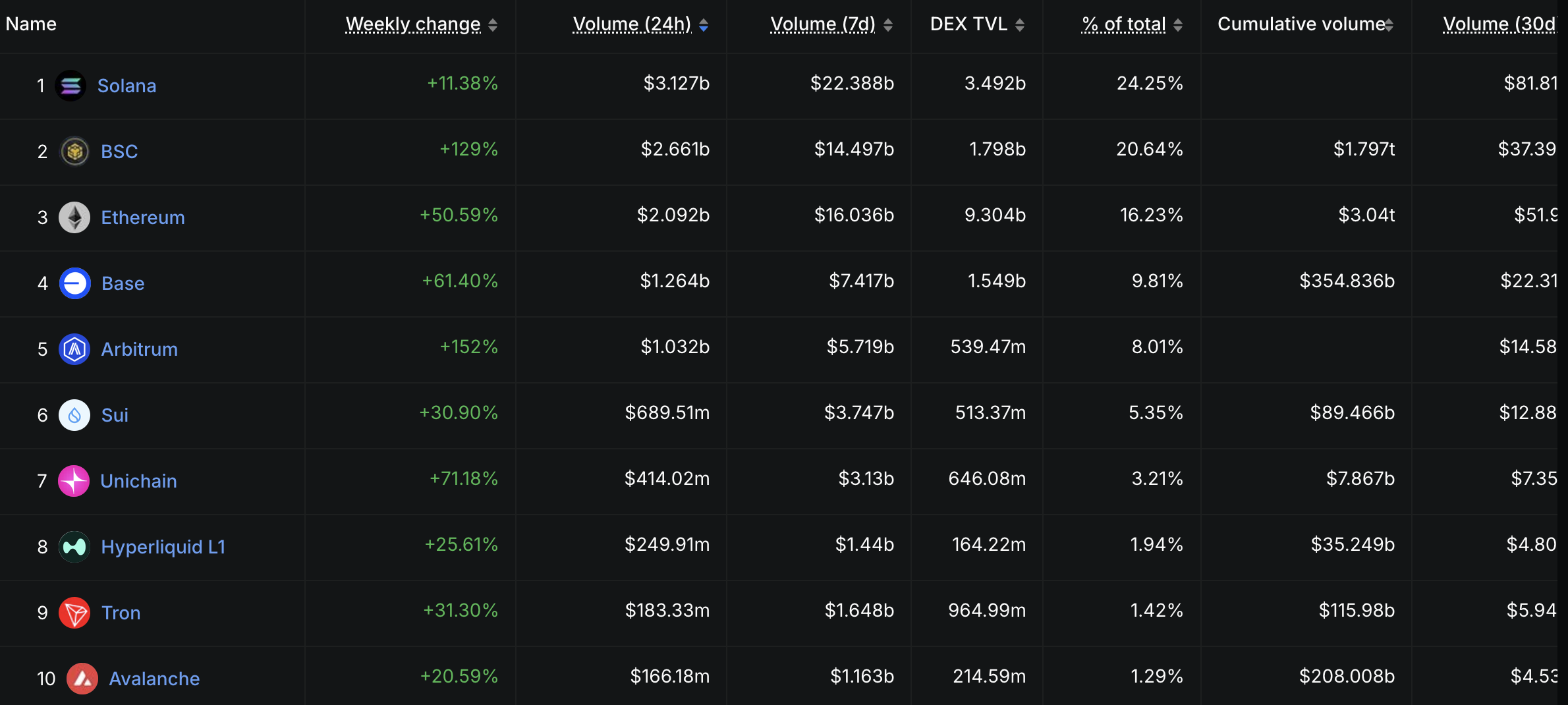

Data from DeFiLlama also reveals that Solana ranks first for DEX trading volume. Over the past 30 days, the Solana network processed more than $81.8 billion in transactions, capturing a 24.25% market share.

“Solana continues to prove itself as a powerhouse in the blockchain space! Leading DEX volume is a clear testament to its scalability and strength,” said Merlijn Trader.

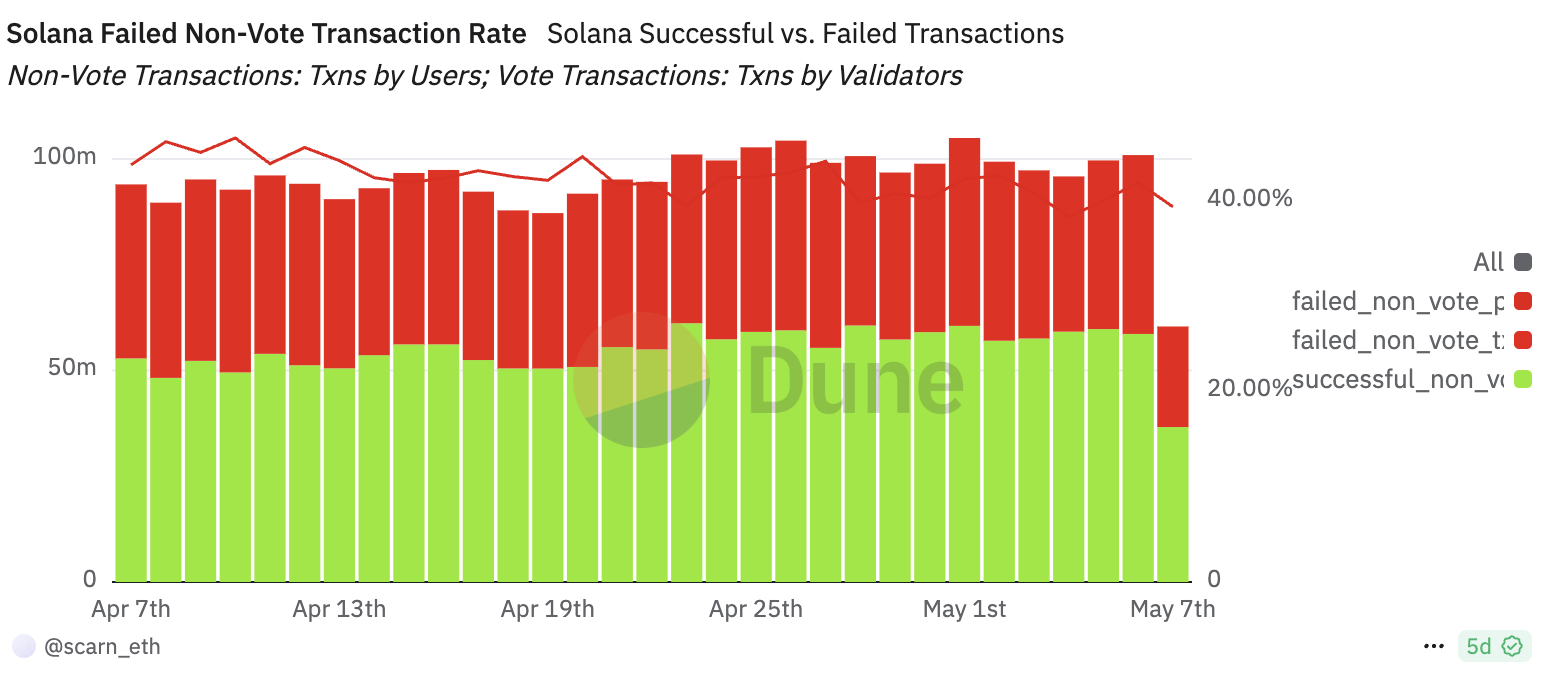

However, not all aspects are positive. According to Dune Analytics, the Solana network is grappling with a significant transaction failure rate, with nearly 40% of non-vote transactions failing.

SOL Price Analysis: Market Sentiment Divided

SOL’s price reflects a clear divergence in market sentiment, with positive and negative signals. On the bullish side, many analysts are optimistic about SOL’s potential for growth. A crypto expert declared on X that “Solana summer is coming,” predicting a strong growth phase.

Another analyst suggested that SOL might be undervalued relative to its fundamentals, based on network revenue and DeFi activity. Analyst Ali also noted that if SOL breaks the $200 mark, a major bull run could ensue.

However, negative signals cannot be ignored. Inmortalcrypto warned that weekend pumps following a green week often signal local tops, meaning SOL might see a correction. He believes the $140-$160 range would be a reasonable entry point in this scenario.

Is SOL at Risk of a Sell-Off After Its Surge?

On-chain data and market sentiment suggest that SOL is at a critical time. Selling pressure from whales, particularly from large wallets like FTX/Alameda and Pump.fun, could push SOL into a short-term correction, especially as the price has surged to $180 without significant pullbacks.

Nevertheless, with leading revenue and high DEX trading volume, Solana’s fundamental strength provides long-term support for SOL. Projects like Pump.fun, despite controversies over token qualities, still significantly contribute to network activity.

If SOL can hold above the $160 support level and overcome whale selling pressure, the $200 mark is entirely achievable, paving the way for a stronger rally, as many analysts predicted.

The post Whale Moves Spark Sell-Off Fears for Solana Amid Price Surge appeared first on BeInCrypto.