Global markets turned risk-off on Tuesday after US Treasury Secretary Scott Bessent openly reaffirmed the Trump administration’s willingness to use tariffs as a primary geopolitical weapon. His statements reignited fears of trade-driven inflation just as crypto markets were showing signs of stabilization.

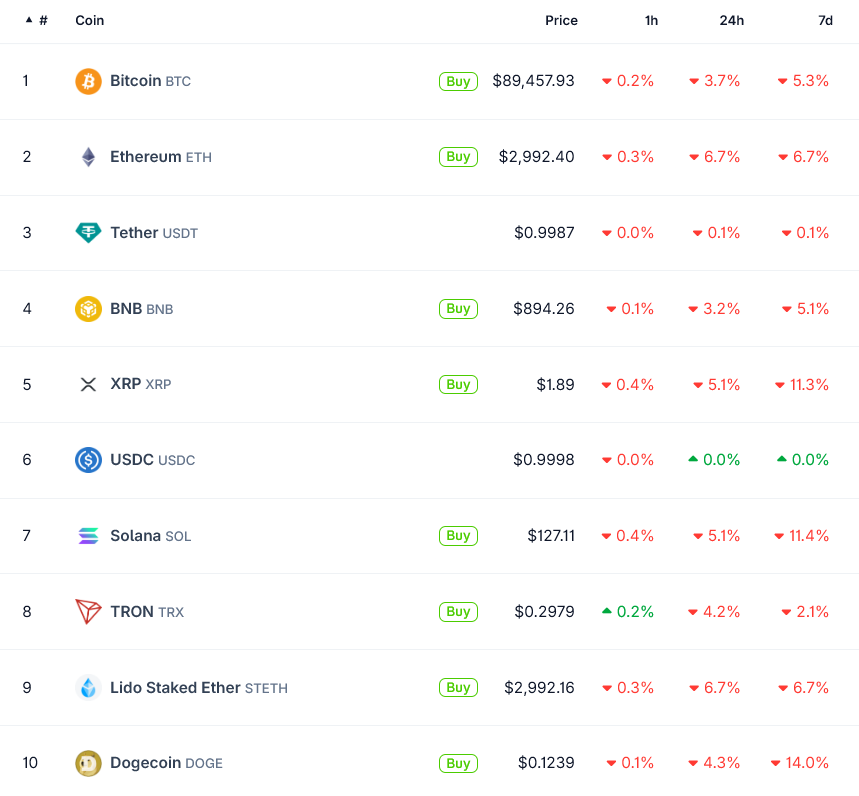

Bitcoin fell back below $90,000, while Ethereum slipped under $3,000, as investors reassessed macro risks following Bessent’s remarks at the World Economic Forum in Davos.

Tariffs Framed as Leverage, Not a Last Resort

Speaking at Davos, Bessent made clear that tariffs remain central to US foreign-policy strategy. He described them as an effective tool rather than a temporary measure.

“Sit back, take a deep breath, do not retaliate. The president will be here tomorrow and he will get his message across,” Bessent said, responding to European backlash over tariff threats tied to Greenland.

The language signaled that the White House expects resistance from allies and is prepared to escalate if necessary. Markets interpreted this as confirmation that trade friction risks are rising again, particularly between the US and Europe.

Bessent also revealed a concrete timeline, noting that President Trump could impose a 10% tariff as early as February 1 if Denmark and allied countries refuse to cooperate on Greenland.

Inflation Risk Returns to the Macro Narrative

Beyond geopolitics, Bessent defended tariffs as economically effective and dismissed concerns that they would backfire domestically.

“It’s very unlikely that the Supreme Court is going to strike down a president’s signature economic policy,” he said, adding that tariffs have already generated “hundreds of millions of dollars” in revenue.

However, this stance clashes with recent research showing that US consumers absorb the vast majority of tariff costs.

New data from European and US economists indicates that tariffs act more like a hidden consumption tax, tightening household liquidity over time.

That dynamic matters for crypto. Reduced discretionary spending and higher price pressures directly weaken speculative capital flows, particularly into high-volatility assets.

Markets react as rate Volatility Resurfaces

Bessent attempted to downplay the bond-market reaction following his remarks, arguing that rising yields were driven by turmoil in Japan rather than US policy.

“Japan over the past two days has had a six standard deviation move in their bond market,” he said, calling it difficult to isolate US-specific factors.

Still, traders focused on the bigger picture: renewed tariff threats, geopolitical escalation, and higher rate volatility—a combination that historically pressures crypto markets.

Bitcoin’s failure to hold above $90,000 and Ethereum’s drop below $3,000 reflected this reassessment. Altcoins fell harder, consistent with leverage unwinds and risk reduction.

A Familiar Pattern for Crypto Markets

The sell-off mirrors earlier episodes where tariff announcements drained liquidity without immediately triggering broader economic contraction.

Tariffs are one of the key reasons crypto remained range-bound after October’s liquidation shock, even as institutional interest quietly grew. Davos brought that risk back to the forefront.

While Bessent emphasized US economic strength and accelerating private-sector growth, markets reacted less to optimism and more to policy direction.

Tariffs framed as leverage, rather than contingency, signal persistent uncertainty—and crypto remains one of the first assets to price that in.

For now, the message from Davos is clear: trade-war inflation risk is back on the table, and crypto markets are adjusting accordingly.

The post US Treasury Secretary Revives Trade-War Inflation Risk at Davos as Crypto Sinks appeared first on BeInCrypto.