The US dollar fell to its 3-year low against the Euro and British Pound, possibly creating new opportunities for crypto as the global reserve currency hits new difficulties.

The European Central Bank again cut interest rates today, but the US has yet to do so. The dollar’s falling dominance reflects that decade-old fiat warning from Bitcoin’s creator, Satoshi Nakamoto.

Could Dollar Troubles Benefit Crypto?

The US dollar is the world’s most important fiat currency for several reasons: powering a massive consumer economy, the global flow of petroleum, US Treasury bonds, and more.

However, the dollar’s 3-year low could represent a problem for TradFi and an opportunity for crypto as de-dollarization fuels Bitcoin adoption worldwide.

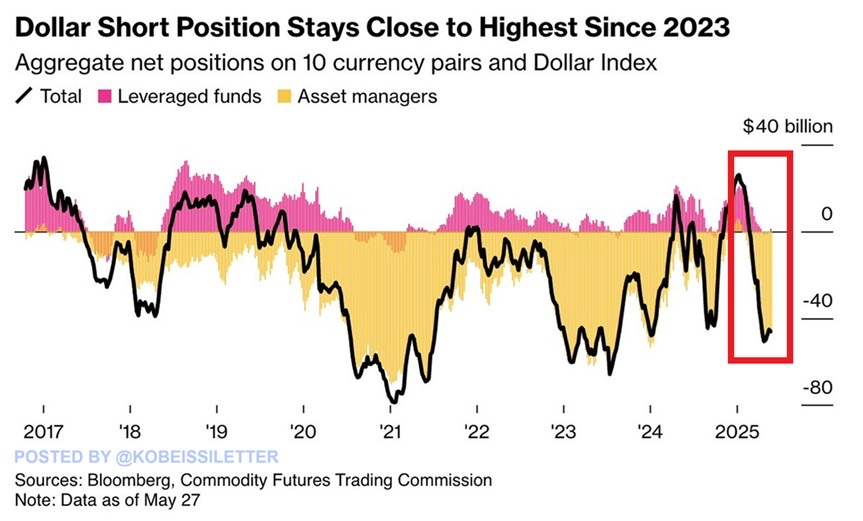

Despite a recent bullish report from the Atlanta Fed, warnings of a US recession are becoming increasingly apparent. The dollar is down relative to the Euro, British pound, and other currencies, while the crypto market is in a state of greed.

There are also distressing signals from the housing market, which could have very serious implications.

Nic Puckrin, crypto analyst and founder of The Coin Bureau, discussed these topics and more in an exclusive commentary shared with BeInCrypto. According to Puckrin, however, crypto is immune to some of these concerns in a way that the dollar is not:

“Even if we do experience stagflation, Bitcoin can still protect portfolios as it is increasingly being seen as a fallback option for investors fleeing US assets or losing faith in the US economy, and it is inflation-proof by design. Bitcoin is very different from the rest of the crypto market – there really are no other assets that possess the same safe-haven characteristics,” he said.

Puckrin described a Bitcoin maximalist vision for crypto investment, as Satoshi Nakamoto designed it to resist dollar turmoil.

Bitcoin and the whole crypto ecosystem were born out of the wreckage of the 2008 collapse, hence its strong emphasis on trustless, decentralized governance.

Unfortunately, today’s community can forget the hard experience that forged this ethos.

Questions of Governance

How are US institutions responding to the dollar’s trouble, especially compared to the crypto community? The European Central Bank lowered its interest rates today, which President Trump has repeatedly begged Fed Chair Jerome Powell to do.

However, it may not be that simple. The EU is an important consumer bloc and economic region, but the US is the bedrock of the modern economy.

If the Fed cuts rates now, it might exhaust its ability to respond to future crises. After all, it can’t cut rates below zero, and it only has so many tools to use.

Meanwhile, institutional investors are fleeing the dollar and largely moving to Bitcoin.

Furthermore, President Trump’s insistence on imposing tariffs may be a complete mistake. Despite tariff relief pumping the US economy, he recently announced plans to impose them on the EU.

Similarly, Trump reported positive negotiations with President Xi today, but threatened sanctions on China less than a week ago.

These chaotic trade policies are causing havoc on the dollar, whereas crypto liquidations are at a relative low. All this discord reaffirms the reasons that Satoshi built Bitcoin to be separated from the world’s governments.

Trustless and leaderless, Bitcoin is immune to concerns that highly impact nation-states. Puckrin predicts this to fuel BTC investment:

“We could see the split that already exists between Bitcoin and altcoins intensifying, as investors turn to Bitcoin as a store of value, but shun more speculative, risky assets like altcoins. The only other safe haven options would be real-world assets (RWAs), like gold-backed tokenized assets, for example,” he claimed.

Still, although there are very bearish signs, the crisis hasn’t fully matured yet. If a savvy investor wants to pull assets from dollars into crypto before further devaluation occurs, there’s still time.

Ultimately, there’s no absolute way to predict which way the market will go.

The post US Dollar Drops to 3-Year Low – Is Fiat Failing as Satoshi Predicted? appeared first on BeInCrypto.