Multiple headlines are in the pipeline for the top crypto news this week, spanning various ecosystems and even the political arena.

Traders and investors can capitalize on the expected volatility by front-running the following developments this week.

Kaito Capital Launchpad for Token Launches

Among the expected headlines for this week’s top crypto news, Kaito will release a capital launchpad for token launches. According to Kaito founder Yu Hu, the launch is expected to drive significant revenue growth, with stakers positioned for rewards.

Based on Yu Hu’s assertions about staking rewards, the mechanics of this launchpad could involve staking KAITO tokens. While ecosystem participants will likely monitor good distribution, the ecosystem may reward participation.

Those who joined Kaito after the controversial first airdrop might not have enough tokens. Similarly, those who joined much later might not hold any KAITO tokens.

To attract these new groups of Kaito users to the upcoming Kaito capital launchpad, airdropping some KAITO tokens would make sense. Doing so would also allow them to activate a larger pool of Kaito participants.

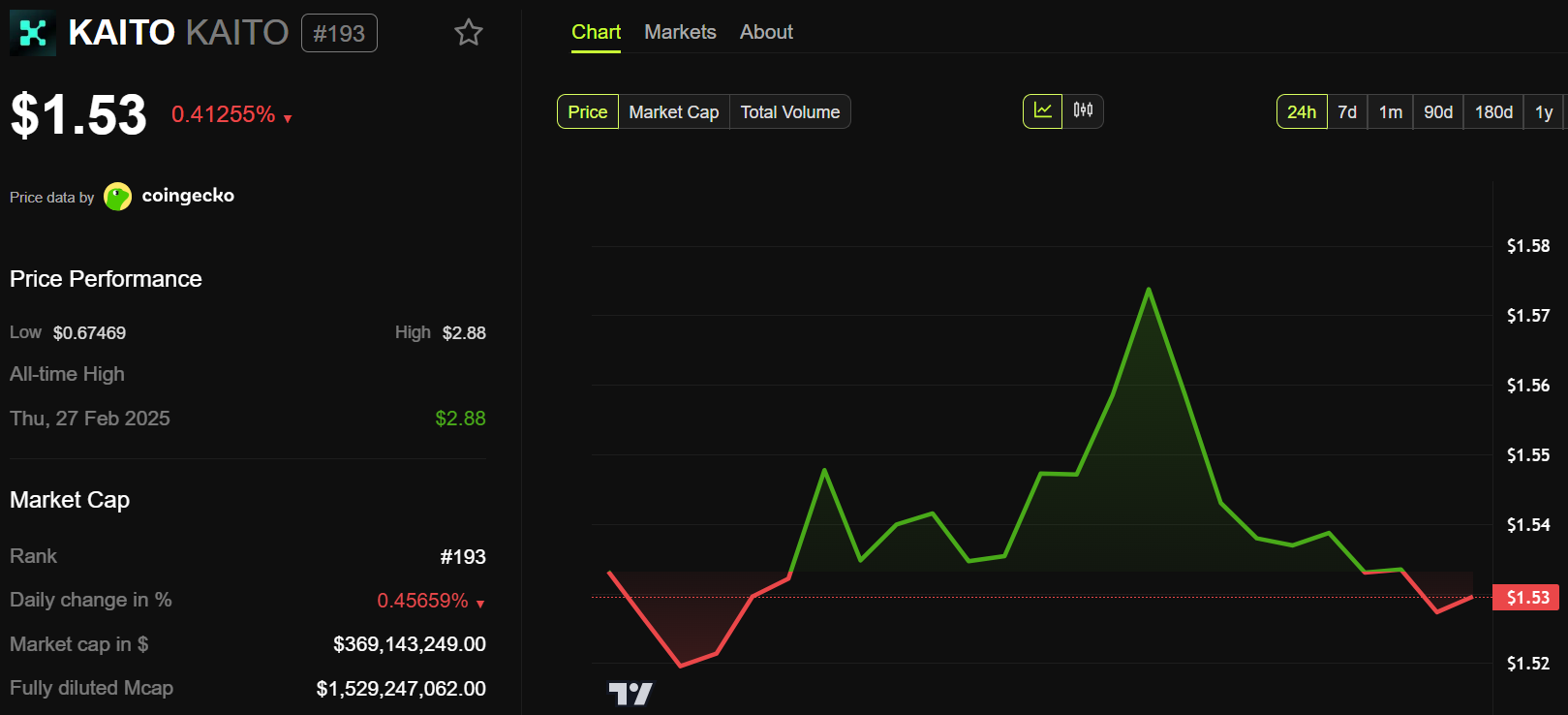

BeInCrypto data shows that the KAITO token was trading for $1.53 as of this writing, down by 0.41% in the last 24 hours.

Senate to Discuss Tokens’ Commodity Status

Traders can also front-run the US Senate’s tokens’ commodity status. On Wednesday, July 9, the US Senate will debate whether tokens like XRP qualify as digital commodities under US law.

Lawmakers will examine these tokens’ fundamental characteristics, weighing their similarities to traditional commodities more closely. The Senate will also assess whether they meet the necessary criteria for this classification.

If the Senate recognizes tokens like XRP as digital commodities, it would pave the way for a new wave of financial products. The general sentiment is that this may be crucial in approving altcoin ETFs (exchange-traded funds).

Such a development would allow investors to gain direct exposure to altcoins through regulated investment vehicles. This could bring billions of dollars in institutional capital into the market and significantly boost mainstream adoption.

SOL community members continue to face similar challenges in the race for a Solana ETF, with SEC Commissioner Hester Pierce saying the regulator needs more convincing before green-lighting the financial instrument.

Amidst questions about what regulators think is a security and not, Solana must meet the SEC’s strict regulatory requirements. A demonstration that Solana can operate successfully within regulated environments globally could support the case for US approval.

These include compliance with financial regulations, anti-money laundering laws (AML), and know-your-customer (KYC) protocols. It must also demonstrate strong market demand, liquidity, and secure custody solutions.

Meanwhile, VanEck’s head of research, Mathew Sigel, believes an Ethereum ETF qualifies Solana for the same market. This is based on the assumption that the same qualities that qualify ETH as a commodity also apply to SOL.

End of Trump’s 90-Day Tariff Negotiations

From a US macro-economic front, the end of Trump’s 90-day tariff negotiations is also a key crypto news this week. In May, the US and China reached a trade agreement, indicating a 90-day pause, with both countries cutting tariffs by 115%.

Before that, there was another tariff hiatus on April 2, with NBC reporting that steep tariff rates could resume after the 90-day pause that rocked financial markets elapses.

Market participants from traditional and speculative sectors remain curious about what happens afterward.

As President Trump’s 90-day tariff pause ends, the focus shifts to whether new trade penalties will move markets.

Despite threats of sweeping hikes, global investors seem unfazed, raising concerns about whether tariffs still matter.

FOMC Minutes and Crypto Tax Policy Hearing

BeInCrypto reported two US economic signals that could influence Bitcoin price this week. Beyond the FOMC minutes from its May meeting, the US House will hold a digital asset tax policy hearing on Wednesday.

The House intends to build a tax framework for Bitcoin and crypto, aligning with President Trump’s initiative to make the US the crypto capital of the world.

Ripple CEO Brad Garlinghouse, who will speak before the US Senate Banking Committee, is among the expected attendees to testify.

The session is pivotal, marking the first major step toward reshaping how crypto is taxed, regulated, and adopted in the US.

Perhaps it will be the gateway to unlocking trillions in capital for the industry, as it could tick all the boxes on institutional investors’ list of considerations.

The post Top Crypto News This Week: Senate Discusses Altcoins, Trump’s Tariff Pause Ends, and More appeared first on BeInCrypto.

(@Punk9277)

(@Punk9277)

30%

30%