Digital Asset Treasury Companies, or DATCOs, are an emerging trend that could reshape how institutional capital approaches the crypto market, alongside traditional ETF structures.

With the ability to actively manage and allocate capital, these companies provide a strong upward force for Bitcoin and other digital assets.

DATCOs Booming Wave

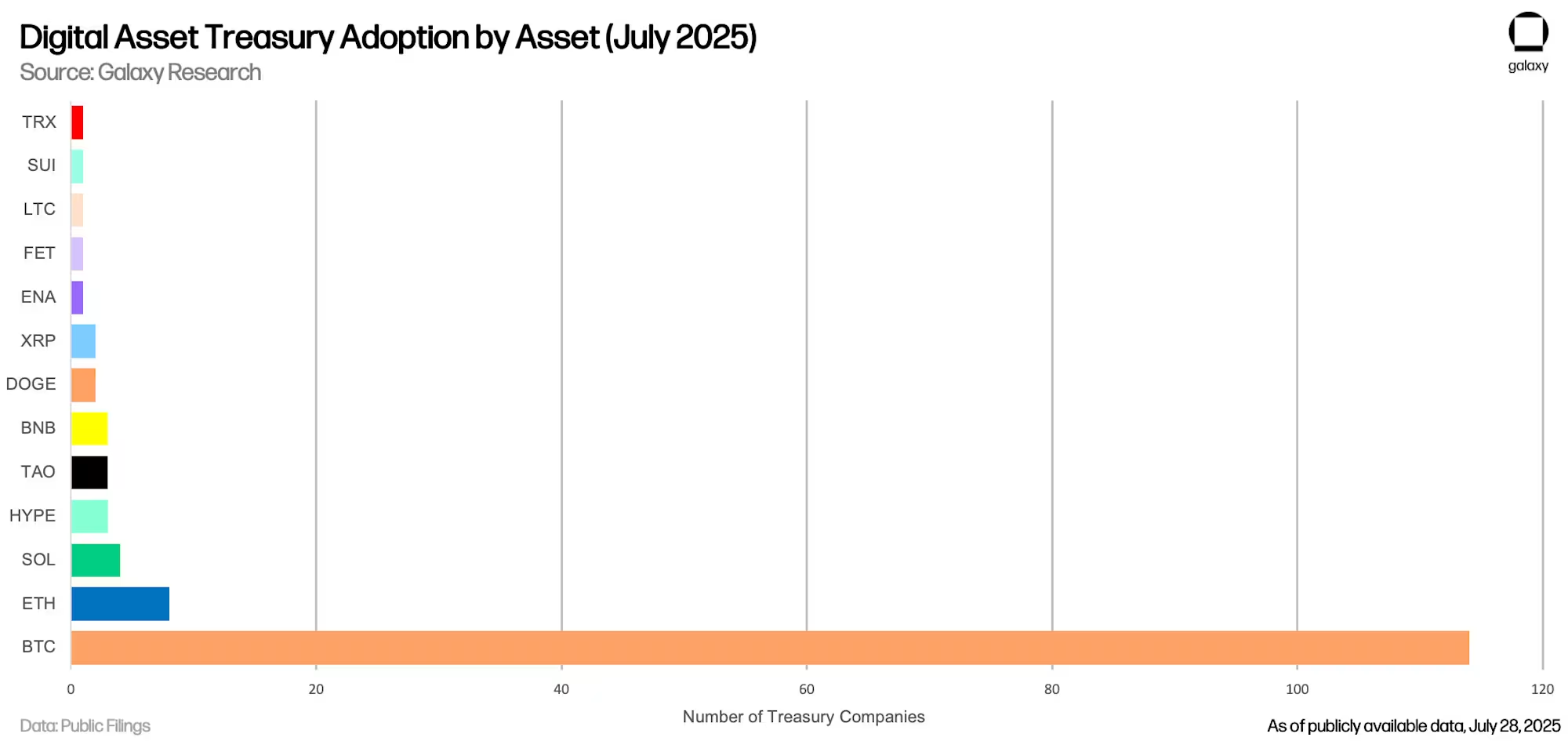

DATCOs are publicly listed companies that use their balance sheet capital to hold large digital assets, primarily Bitcoin. Prominent names in the DATCO category include MicroStrategy, Metaplanet, and SharpLink Gaming.

According to a report by Galaxy Research, the total amount of digital assets held by DATCOs has now surpassed $100 billion. This is a substantial figure, capable of significantly influencing market momentum.

Unlike ETFs bound by passive inflows and outflows, DATCOs can proactively raise and pour capital to purchase more digital assets according to their strategic plans.

As a result, DATCOs can generate a “positive feedback loop” for crypto prices, especially during strong bull markets.

“DATCOs have evolved from a novel capital allocation experiment into a structural source of buying pressure in crypto markets. Their continued rise has reshaped how market participants gain exposure to digital assets, and, increasingly, how they think about the relationship between crypto markets and TradFi,” the report said.

Strategic Advantages and Risks

When a DATCO announces a new BTC purchase or increases its digital asset holdings, its stock price often rises. This boosts the company’s market capitalization and makes it easier for it to raise additional capital (through channels like PIPEs—Private Investment in Public Equity) to continue acquiring more crypto assets.

This cycle allows the market to benefit indirectly from corporate capital flows.

A prime example is MicroStrategy, which has become one of the largest Bitcoin whales globally. Since 2020, its consistent acquisition strategy has helped MSTR attract increased shareholder capital while driving other public companies to explore the same model.

However, Galaxy Research also warns that as the scale of assets held by DATCOs grows too large, the risk of a “opposite effect” also increases. In the event of a significant market correction, DATCO stock prices could plummet, particularly for firms heavily leveraged or relying too much on short-term capital sources like PIPEs.

If such a price decline forces DATCOs to liquidate part of their holdings to cover debt or stabilize their balance sheets, the crypto market could face increased sell pressure from large institutional wallets, reminiscent of the Terra and FTX crashes.

Additionally, the DATCO model is still operating in a regulatory gray area. Changes in accounting policies, tax treatment, or oversight frameworks in major markets like the US or Japan will soon pose significant challenges for this model.

Galaxy warns that sudden shifts in the legal sector could trigger valuation collapses, similar to what SPACs experienced after their peak hype cycle.

The post The Rise of DATCOs: How Public Companies Are Reshaping Crypto Investing appeared first on BeInCrypto.