Stellar’s (XLM) recent price action has faced downward pressure, causing concerns among investors. After a 97% price surge earlier this month, the cryptocurrency is now on the brink of erasing those gains.

The next few days will depend largely on broader market movements, which will play a pivotal role in determining the recovery of the altcoin.

Stellar Investors Pull Back

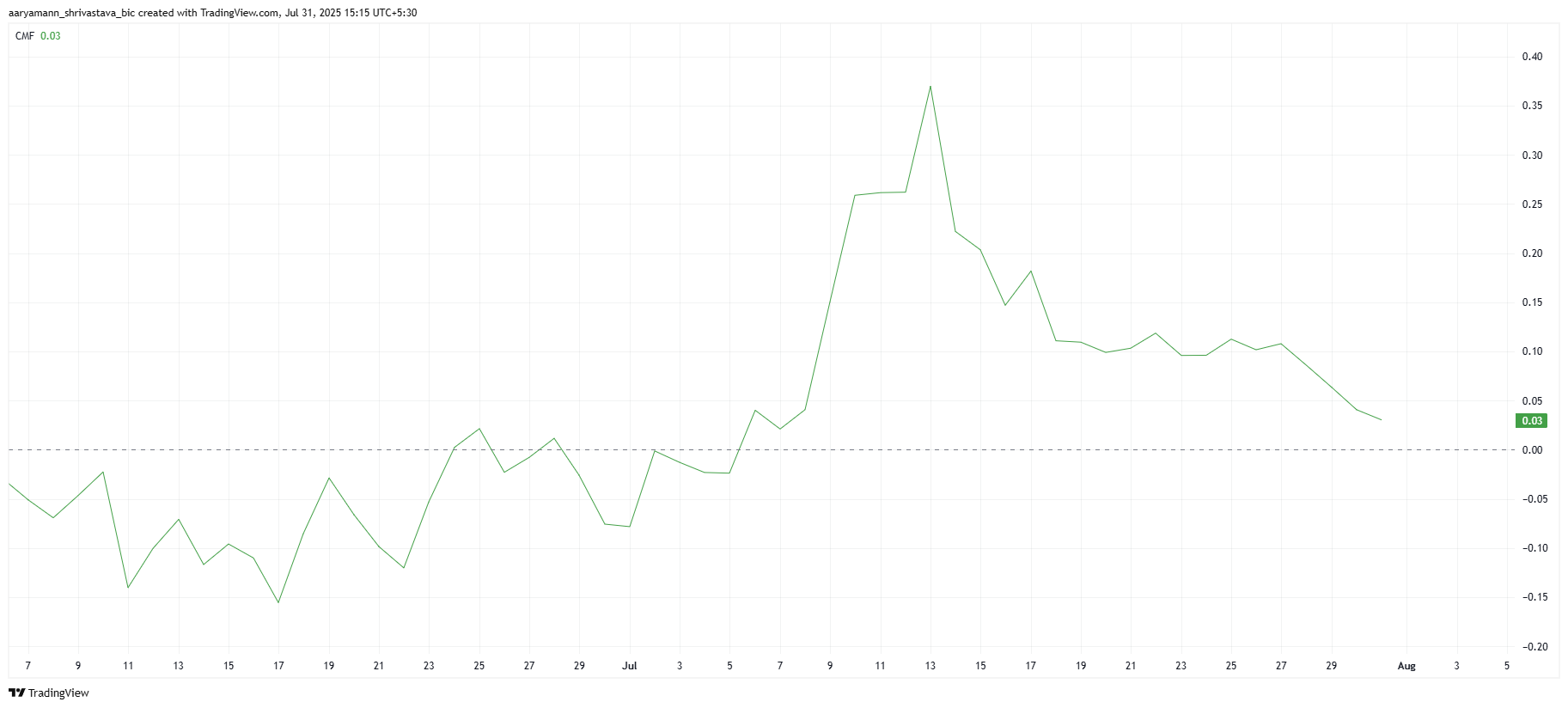

The Chaikin Money Flow (CMF) indicator has been showing a sharp decline, currently sitting at a three-week low. This suggests that outflows from Stellar are rising, which is a negative signal for the asset.

Rising outflows indicate that traders are less confident in Stellar’s short-term prospects, which is impacting the price action. Although the CMF is still in the positive zone, it is dangerously close to crossing into the negative zone.

If CMF slips into this zone, it would signal that outflows are outweighing inflows, which would further push down the price of XLM.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

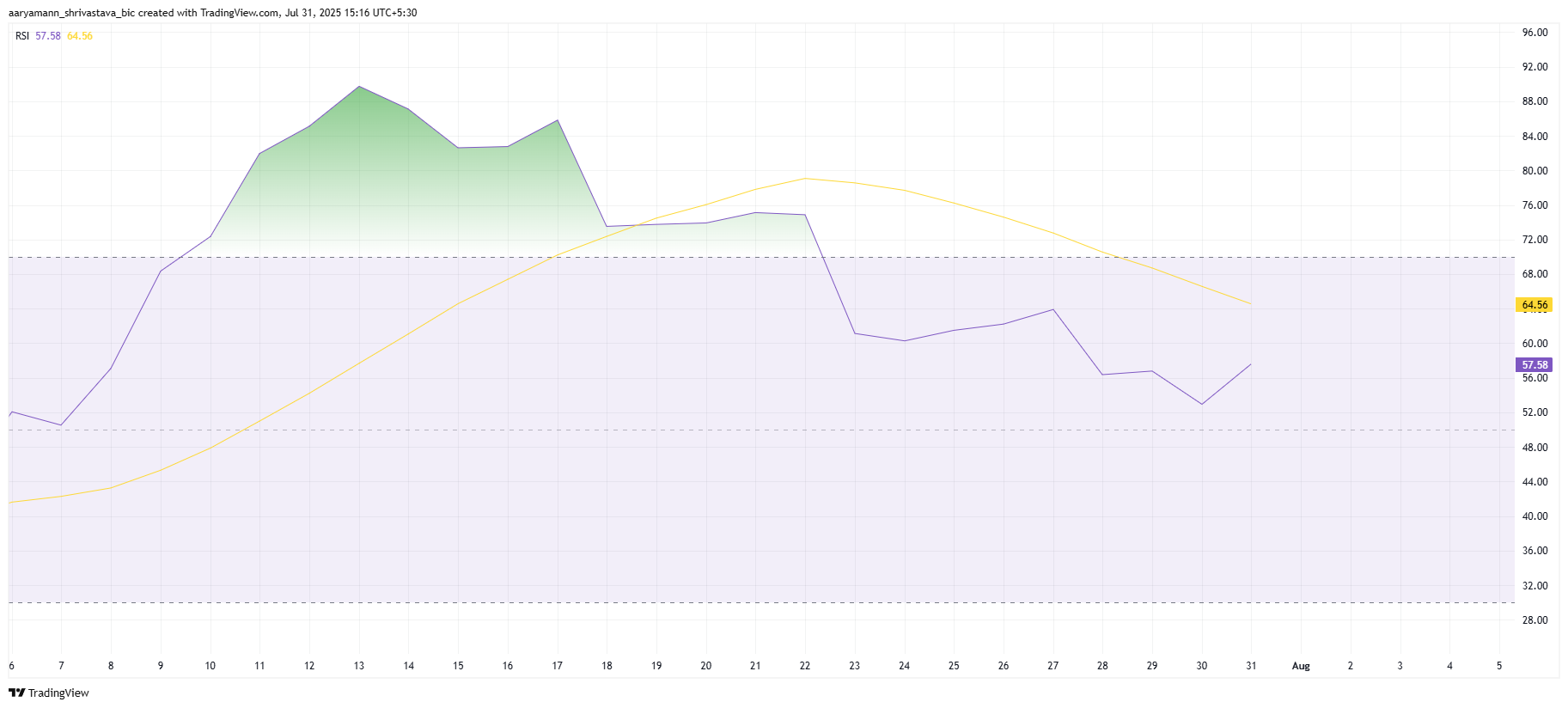

Despite the bearish trend, there are still some bullish signs in the broader market. The Relative Strength Index (RSI) for Stellar remains above the neutral 50.0 level, suggesting that the bullish momentum has not completely dissipated.

The RSI has even noted a slight uptick, indicating that there is still some buying interest in the market, especially when compared to the broader market cues. The ongoing positive momentum in the broader crypto market could help mitigate some of Stellar’s outflows.

XLM Price Needs A Push

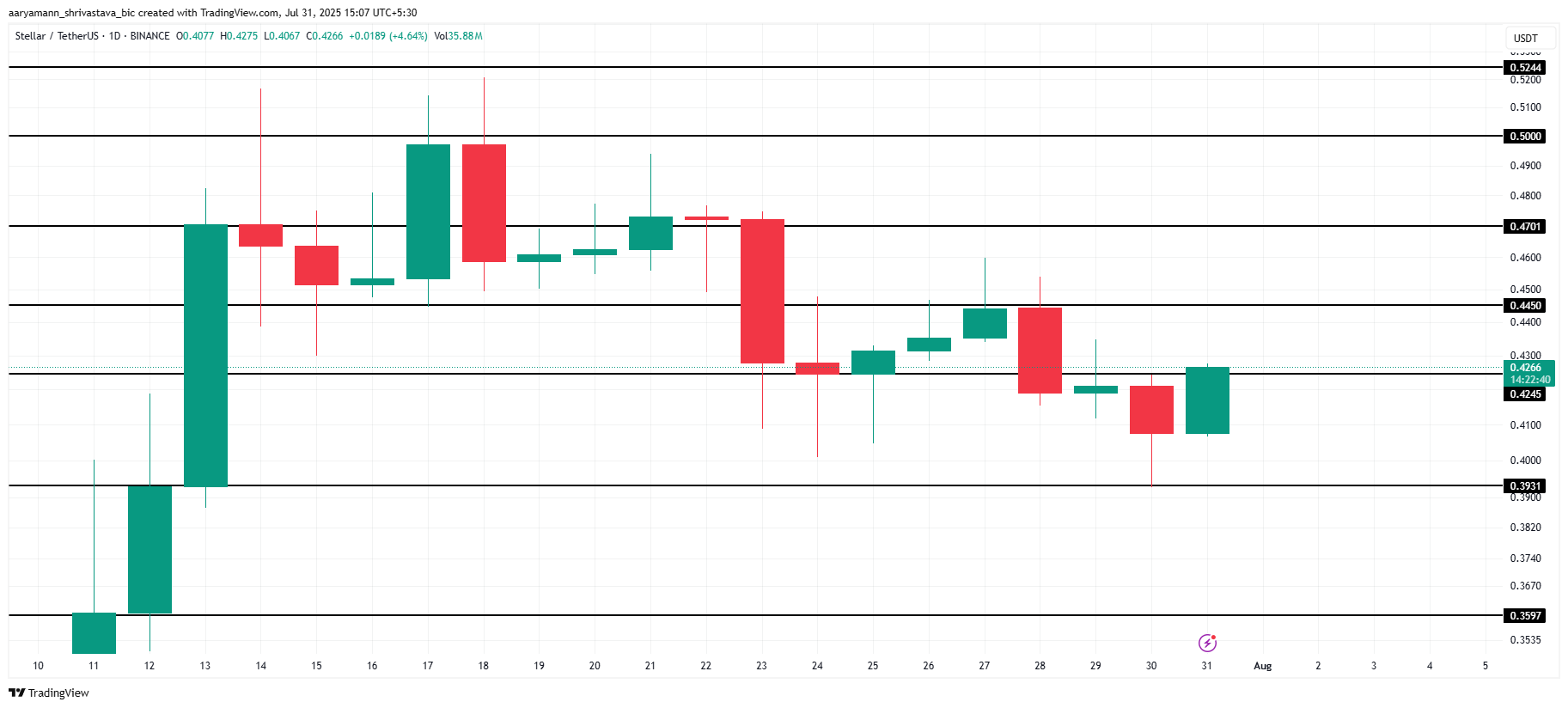

XLM price is currently at $0.426, and it is attempting to hold above the support level of $0.424. The downtrend observed over the past two weeks has threatened to reverse the significant gains made earlier this month.

If outflows continue and selling pressure builds, Stellar’s price could fall to $0.393, a crucial support level. Losing this support could push XLM’s price even lower, potentially reaching $0.359. This would wipe out much of the recent gains, further impacting investor confidence.

On the other hand, if broader market conditions remain positive, XLM may find support at $0.393, preventing further declines.

The only way to fully invalidate the bearish thesis is for XLM to reclaim $0.445 as support, although this seems unlikely under the current market conditions.

The post Stellar Faces Increasing Outflows – Is XLM Price at Risk? appeared first on BeInCrypto.