With positive developments regarding the GENIUS Act, many industry experts have expressed optimistic predictions about a “stablecoin summer” in the near future.

Will a “stablecoin summer” bring significant opportunities for investors and businesses?

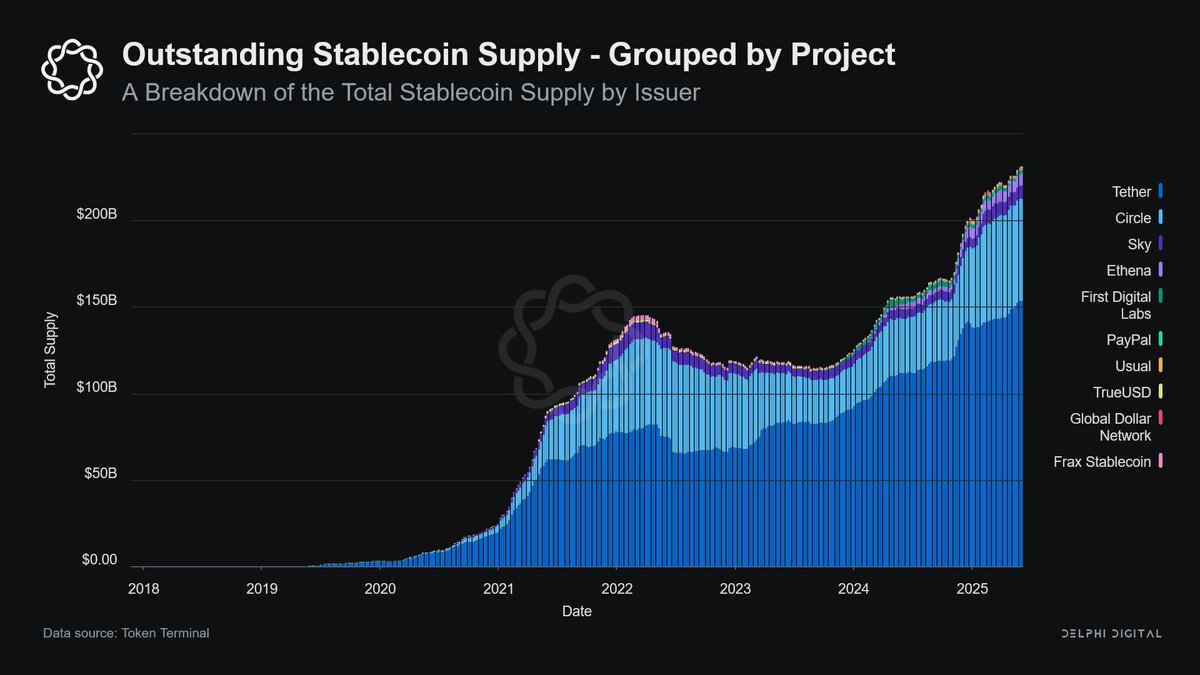

Stablecoin Supply Surpasses $250 Billion

According to a report from Delphi Digital, the stablecoin supply has exceeded $250 billion, with Tether and Circle accounting for 86% of the market share. Over $120 billion in US Treasury bonds are locked in various stablecoins.

With increasing issuer diversification, more than 10 stablecoins now have a circulating value exceeding $100 million. This indicates a fiercely competitive yet highly promising market.

The founder of 1confirmation even predicted that the stablecoin market value could increase tenfold following the approval of the GENIUS Act. If this prediction comes true, the market capitalization of stablecoins could potentially reach $2.5 trillion.

“The GENIUS Act is great for crypto and stablecoin market cap will 10x from here ASAP because of it,” Nick Tomaino stated.

Stablecoins now account for over 60% of all crypto transaction volume, up from 35% in 2023, despite lacking clear federal regulation. In this context, Coinbase CEO Brian Armstrong expressed optimism, calling stablecoins a “viral loop” that makes it easier for users to enter the cryptocurrency field.

Meanwhile, Eric Golden from Canopy Capital emphasized that stablecoins will become the primary transaction mechanism for all types of payments, gradually replacing traditional methods.

Challenges in a New Era

However, the accompanying challenges cannot be ignored. The locking of over $120 billion in US Treasury bonds in stablecoins creates a “liquidity sink” outside the traditional financial system, as pointed out by Delphi Digital. This raises questions about risk management and long-term stability, particularly as new stablecoins like Ethena and First Digital Labs are still in their development stages.

Top stablecoins have consistently made up at least 4% of the total cryptocurrency market cap throughout 2024 and 2025. Additionally, while Tether and Circle’s dominance provides temporary stability, it makes the market reliant on these two “giants,” posing potential risks in case of disruptions.

Nevertheless, the “Stablecoin summer” promises significant opportunities for investors and businesses. The approval of the GENIUS Act establishes a clear regulatory framework and fosters innovation.

The post ‘Stablecoin Summer’ Incoming? Market Eyes 10x Growth Post-GENIUS Act appeared first on BeInCrypto.