OpenAI founder Sam Altman warned of an AI bubble that might have profound implications for crypto. Many leading AI tokens might be overvalued, deriving their market presence from generalized hype.

Despite decentralized AI developers’ ambitious goals, massive LLM builders and VC funds are steering this market. Problems at the highest levels could cause nasty fallout for the crypto sector.

How Crypto and AI Impact Each Other

Sam Altman, founder of OpenAI and Worldcoin, is an important figure for both AI and crypto. However, despite the lofty promises he’s made about his company’s software capabilities, cracks are forming in the optimistic picture. In a recent interview, Altman claimed that AI is in a bubble, which might have dire consequences for the market:

“When bubbles happen, smart people get overexcited about a kernel of truth. If you look at most of the bubbles in history, like the [Dotcom crash], there was a real thing. The tech was really important, [but] people got overexcited. Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes,” Altman told The Verge.

So, what’s the evidence for this? Moreover, what are the implications for crypto’s own AI sector? Unfortunately, the concerns are pretty significant.

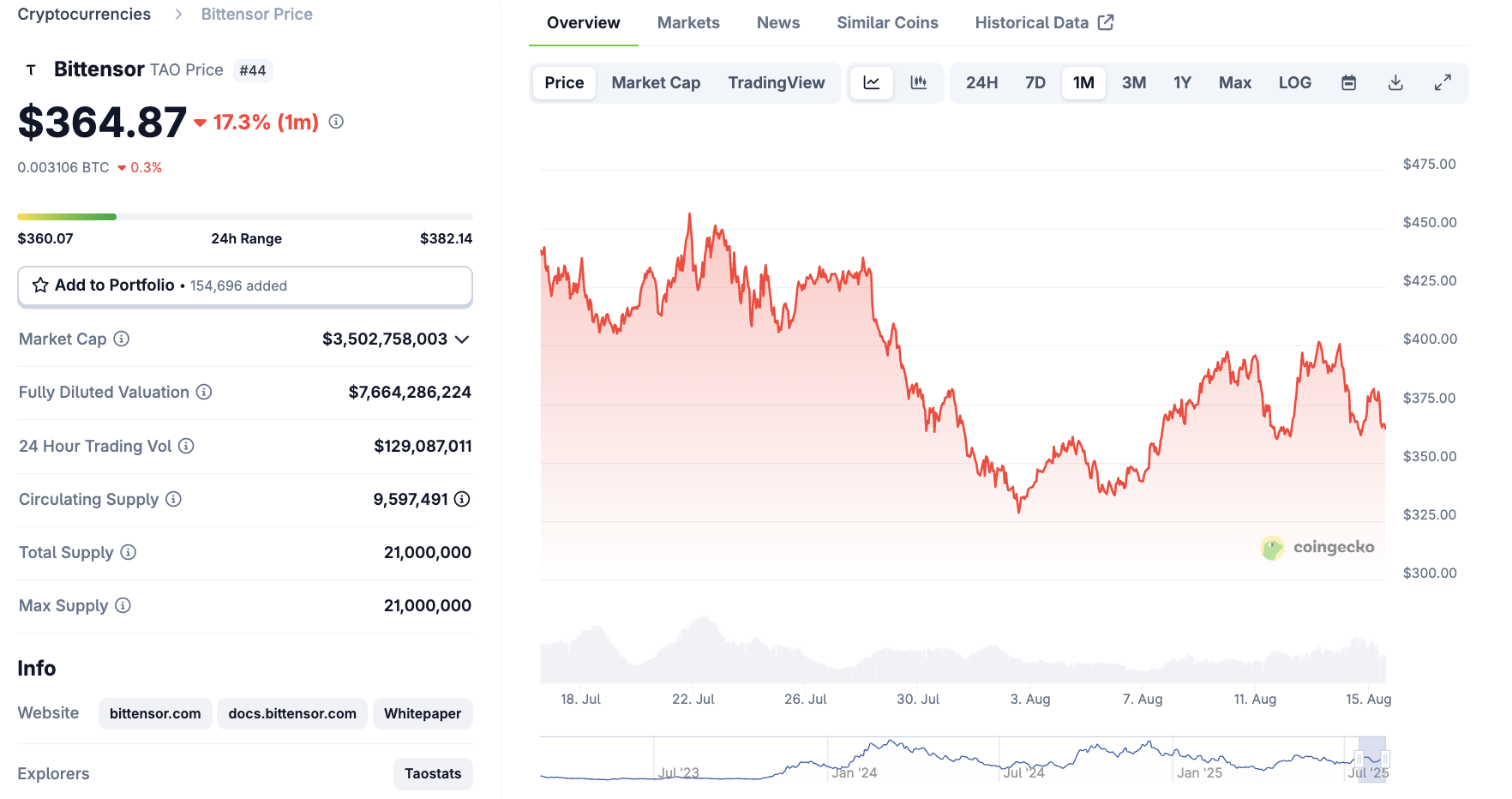

The market is giving signals that AI infrastructure building is highly undervalued, to be sure. But how was this bullish signal reflected in crypto? Most of the biggest AI tokens have shown poor or erratic performances lately.

A closer look at the largest AI tokens adds some further context. Bittensor is building blockchain infrastructure and a market for machine learning tools, but not an LLM. NEAR, which showed encouraging signs this month, is in a similar boat, and other big tokens are outright gimmicks.

In the main, this crypto sector is trailing the biggest AI firms; it’s not a market mover itself. When macroeconomic factors impact the biggest LLM developers, the AI token market falls too. Does this relationship ever go the other way around?

Concerning Data From LLM Builders

For this reason, everyone in crypto should be concerned about Altman’s comments and other warning signs:

Essentially, expert analysts fear that there’s a bubble because VC firms are the only thing keeping this technology operational. Behind the scenes, this technology is incredibly expensive, and it’s not clear if it’ll ever be affordable for consumers. Without a truly practical use case, these platforms can’t support themselves.

One data point is particularly instructive. Ed Zitron, an AI researcher, recently published documents detailing some of the changes between ChatGPT-5 and 4o. To make a long story short, its new “router” system can potentially burn twice as many tokens per query as ChatGPT-4o.

Based on the community’s lukewarm response, the software’s new functionality probably isn’t worth this high cost. If problems like this start reverberating for the biggest AI firms, the corresponding crypto market is especially vulnerable.

All that is to say, investors should be highly cautious at the moment. This industry is famed for its volatility; many assets, businesses, and software models have burned up in spectacular crashes. An AI bubble might do the same thing to this whole crypto subsector.

The post Sam Altman Says AI Is in a Bubble—Are Crypto “AI” Tokens Next to Pop? appeared first on BeInCrypto.