Pump.fun price action turned sharply negative after a strong rally earlier this week. The token surged alongside heightened activity on the platform, but gains quickly unraveled. Over the past 24 hours, PUMP dropped 18%, erasing momentum and rendering recent milestones ineffective in supporting price.

The decline highlights fragile confidence among participants. While Pump.fun reached record usage levels, price action failed to reflect that growth.

PUMP Holders Show No Conviction

Pump.fun reached a major operational milestone on January 6, recording $2.03 billion in daily DEX volume. Such activity typically supports bullish price movement.

However, PUMP failed to rally following the announcement, signaling weak translation of platform success into token demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

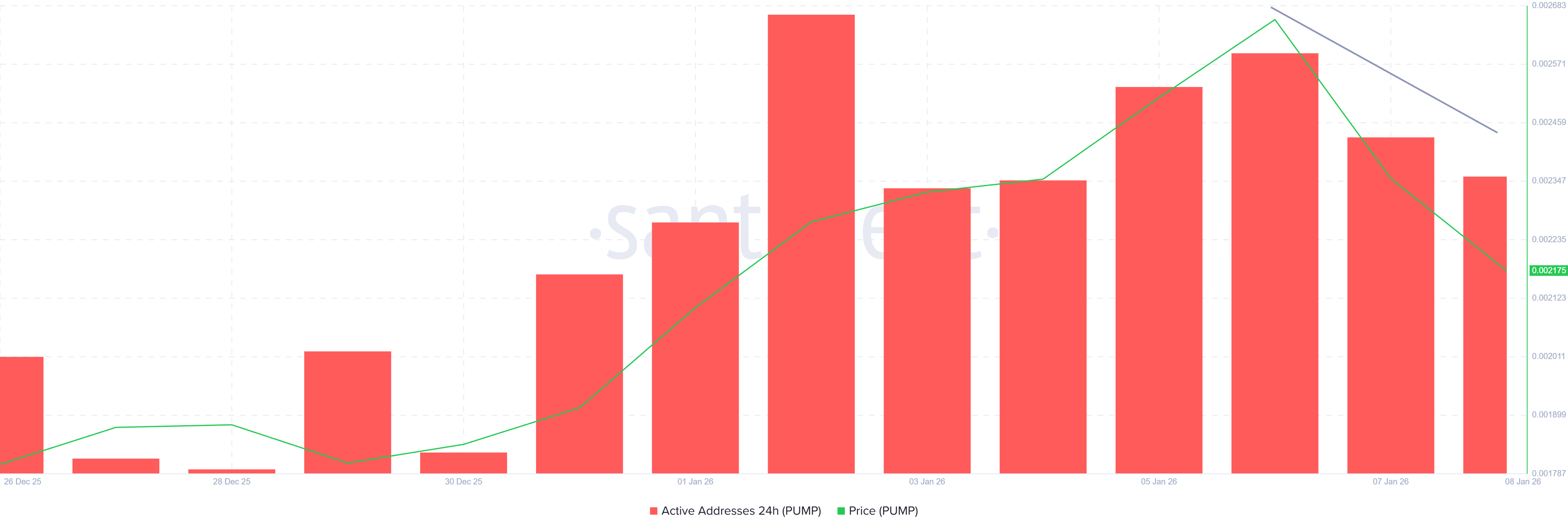

Investor participation initially increased alongside the volume spike. Active addresses rose, suggesting heightened engagement. That participation proved conditional.

As the PUMP price began falling, many users exited positions, indicating behavior driven by anticipated gains rather than confidence in long-term value.

This reaction suggests speculative positioning dominated activity. Instead of reinforcing price stability, the milestone became a sell trigger. The lack of sustained follow-through implies that market participants viewed the event as an opportunity rather than a foundation for higher valuation.

PUMP Buying Remains Weak

Macro indicators offer limited support for a recovery. Data shows the top 100 PUMP holders modestly increased positions over the past week. Their combined holdings rose by just 0.87%, reflecting restrained accumulation rather than strong conviction.

Large holders often lead trend reversals through decisive buying.

In this case, accumulation remains minimal. The marginal increase suggests caution among influential wallets, which reduces the likelihood of a sustained rebound driven by long-term investors.

Weak accumulation limits upside durability. Without meaningful capital inflows from top holders, price rallies rely heavily on short-term traders. That structure leaves PUMP vulnerable to rapid reversals during periods of volatility.

PUMP Price Needs To Rally 50%

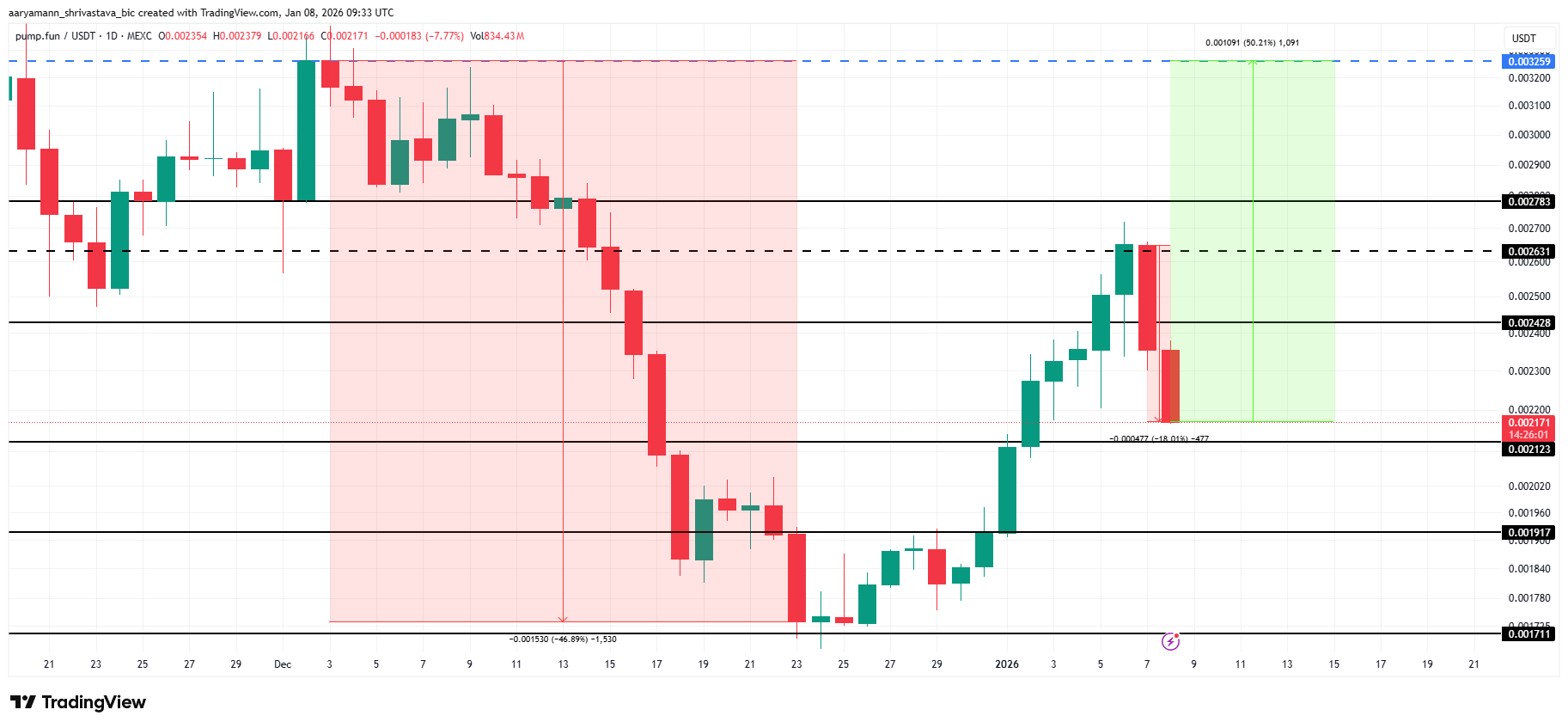

PUMP trades near $0.00217 at the time of writing after an 18% daily decline. Price is currently holding above the $0.00212 support level. This zone now acts as immediate defense against further downside.

Despite recent gains, PUMP remains far from recovering December losses. A full recovery would require another 50% rally, which appears unlikely under current conditions.

If bearish momentum persists, the price may fall below $0.00212 and test $0.00191 support.

A bullish alternative depends on stronger accumulation and improved participation quality. If investor demand increases and selling pressure eases, PUMP could rebound toward $0.00242.

A move above this level would invalidate the bearish thesis and signal renewed confidence.

The post Pump.Fun DEX Volume Crossed $2 Billion, Will the Token Price PUMP? appeared first on BeInCrypto.