More than $2.2 billion worth of Bitcoin and Ethereum options are set to conclude today, marking the first broad-based derivatives settlement of 2026.

With both assets trading near key strike levels, the event is drawing close attention from traders watching for post-settlement volatility and early signals for the year ahead.

Over $2.2 Billion in Bitcoin and Ethereum Options Settle in First Major Derivatives Event of 2026

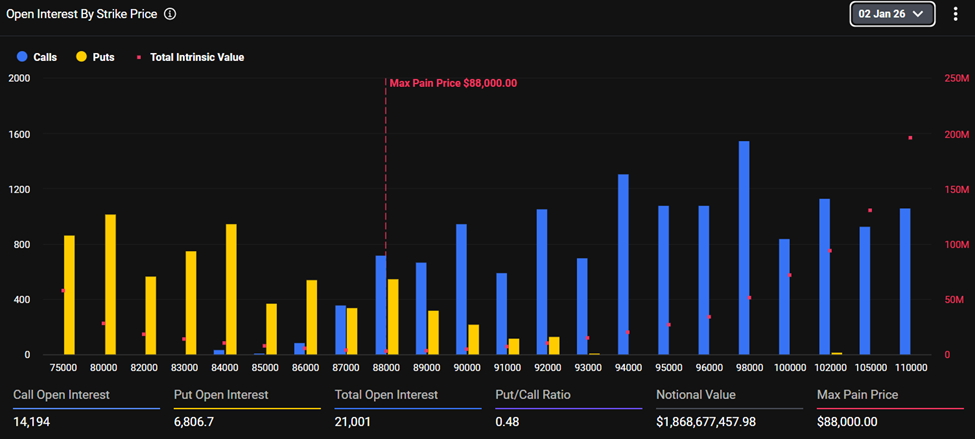

Bitcoin dominates the notional value, with roughly $1.87 billion in contracts tied to BTC. At the time of settlement, Bitcoin is trading near $88,972, just above the max pain level of $88,000.

Open interest data shows 14,194 call contracts against 6,806 puts, bringing total open interest to 21,001 and a put-to-call ratio of 0.48. This skew reflects a market leaning bullish, with traders positioning for higher prices rather than downside protection.

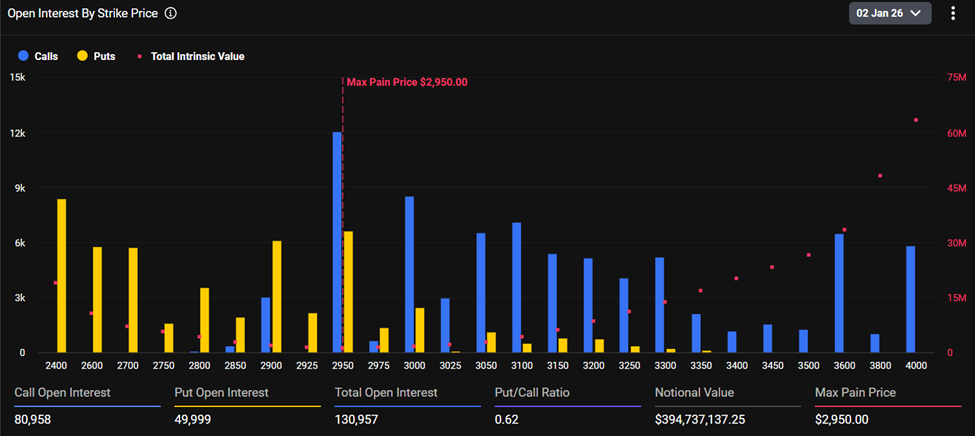

Ethereum options account for approximately $395.7 million in notional value. ETH is currently trading around $3,023, slightly above its max pain level of $2,950.

Open interest remains elevated, with 80,957 calls versus 49,998 puts, resulting in total open interest of 130,955 and a put-to-call ratio of 0.62.

While less aggressive than Bitcoin’s positioning, Ethereum’s structure still reflects cautious optimism rather than defensive hedging.

Options settlement periods are critical moments for derivatives markets. As contracts conclude, traders must either exercise their rights or allow positions to lapse, often concentrating price action around “max pain” levels where the greatest number of contracts expire out of the money.

These levels tend to benefit option sellers, who face lower payout obligations if prices gravitate toward those strikes.

Why the First Major Options Settlement of 2026 Could Set the Tone for Market Volatility

The timing of this settlement adds further significance. As the first large-scale derivatives conclusion of 2026, it may help set the tone for the quarter ahead.

Historically, major options events have acted as volatility unlocks, particularly when spot prices sit meaningfully above or below max pain zones.

Positioning data reinforces the bullish narrative. Bitcoin block trades, typically associated with institutional strategies, show calls accounting for 36.4% of volume compared to 24.9% for puts.

Ethereum’s block trade activity is even more skewed, with calls representing 73.7% of executed volume. Such flows suggest longer-term strategic positioning rather than short-term speculation.

This optimism also extends beyond near-dated contracts. Bitcoin options volume is concentrated in later 2026 maturities, especially March and June, while Ethereum shows sustained interest across quarterly tenors throughout the year.

These patterns suggest that traders are positioning for near-term price movements, as well as for broader upside over the coming months.

Still, the concentration of expiring contracts introduces risk. As hedged positions are unwound, price stability can weaken, especially if spot prices drift away from key strike levels.

A bullish skew creates a binary setup: failure to break higher could result in many calls expiring without value, while a sustained move upward may trigger gamma-driven momentum.

As traders roll over positions and reassess their exposure, the aftermath of this settlement could shape volatility across the Bitcoin and Ethereum markets into the weekend.

Whether bullish sentiment translates into sustained gains or meets resistance will become clearer once the pressures driven by derivatives fully unwind.

The post Over $2.2 Billion in Bitcoin and Ethereum Options Expire as 2026 Begins appeared first on BeInCrypto.