As markets brace for the Federal Reserve’s (Fed) annual Jackson Hole gathering, nearly $5 billion in Bitcoin and Ethereum options expire today.

This sets the stage for potential volatility in the Bitcoin (BTC) and Ethereum (ETH) markets, with traders weighing macro signals from the Fed against technical pressures from expiring contracts.

Bitcoin and Ethereum Options Worth $4.7 Billion At Stake

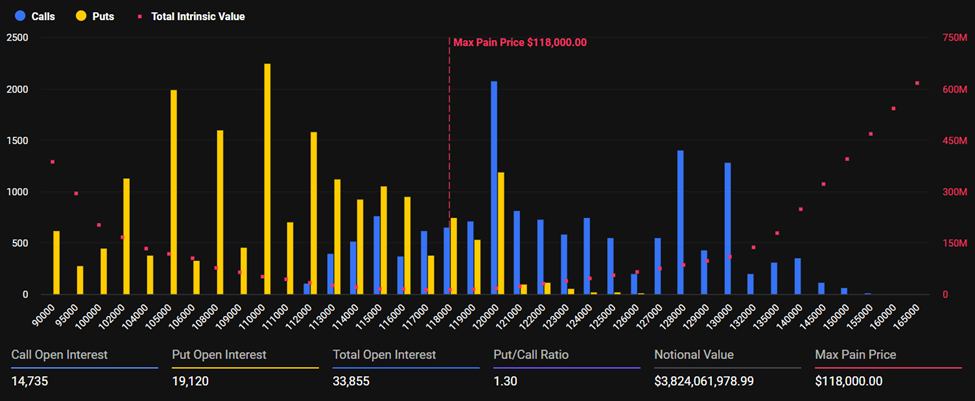

Data from Deribit shows that Bitcoin options open interest currently stands at 33,855 contracts, representing a notional value of $3.82 billion.

The put-to-call ratio (PCR) sits at 1.30, suggesting a tilt toward downside hedging as traders seek protection.

The max pain point, which is the strike price at which option holders experience the most collective losses, is at $118,000.

This is well above Bitcoin’s spot price of $113,019 at the time of writing.

Meanwhile, analysts at Deribit indicate that Bitcoin expiries remain put-heavy, reflecting persistent skepticism in the near term.

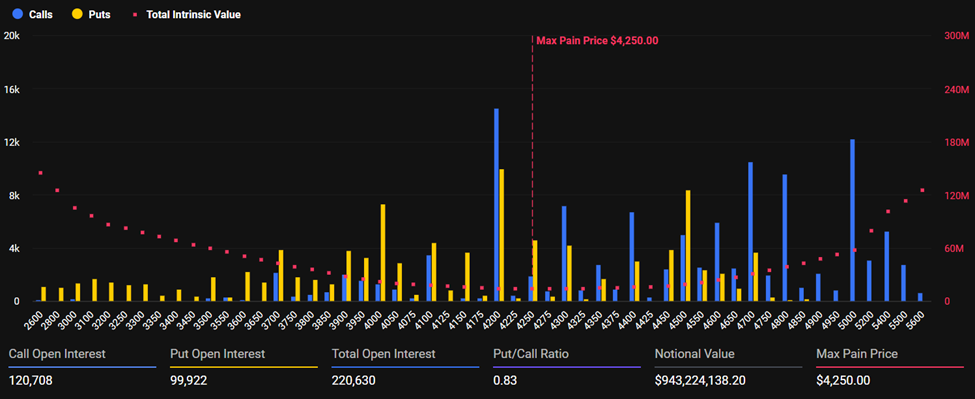

Elsewhere, the playing field for Ethereum’s options market is different, with traders eyeing a reversal. Open interest stands at 220,630 contracts, equivalent to $943 million in notional value.

The put-to-call ratio is 0.83, showing relatively stronger call demand (Purchase contracts). Ethereum’s max pain level is at $4,250. It stands slightly below its current price of $4,284, suggesting traders are positioned closer to equilibrium.

The scale of open interest reflects the stakes for both Bitcoin and Ethereum, whether prices can sustain momentum amid macro headwinds or falter under pressure from hedging flows.

Divided Market Ahead of Fed’s Jackson Hole

Analysts at Greeks.live highlight that sentiment among ETH traders is cautiously bullish, with many believing the asset has already bottomed.

“Key focus is on ETH’s outperformance relative to BTC, with traders managing risk by taking profits on calls while maintaining some delta exposure through short puts,” they noted.

One strategy gaining traction involves waiting for a potential pullback to the $4,100 level before re-entering short-term call positions. This signals optimism and tactical patience with the $4,100 target standing barely 5% below the current Ethereum price levels.

These expiring options coincide with the Fed’s Jackson Hole Economic Symposium, a critical US economic event this week.

Traders expect policymakers to signal the direction of interest rates and liquidity conditions for the remainder of 2025 during the Symposium. Based on this, Jerome Powell’s speech later today will be the key highlight.

“There is much attention to any hint from the Fed, particularly this Friday’s speech at the Jackson Hole symposium in Wyoming…Markets will be looking to the Fed speech for direction on the future of monetary policy,” Nic Puckrin, Founder of Coin Bureau, said in a statement to BeInCrypto.

According to Greeks.live, block bullish and bearish trades reached $1.61 billion and $1.14 billion, accounting for two-thirds of daily option turnover.

Short-term implied volatility (IV) has declined despite the sheer positioning scale. This indicates that institutional investors are not anticipating a dramatic market reaction to this week’s policy event.

Meanwhile, the convergence of nearly $5 billion in expiring crypto options with the Fed’s most closely watched policy gathering creates a high-stakes backdrop for Bitcoin and Ethereum.

For Bitcoin, traders face a steep climb toward its $118,000 max pain, 4.4% above current levels. For Ethereum, confidence in a bottoming process may provide resilience, though strategies remain cautious.

Whether Jackson Hole delivers a volatility shock or reinforces the current calm, options markets show traders are positioned, hedged, and waiting, with positioning across derivatives markets reflecting a mix of caution and selective bullishness.

The post Nearly $5 Billion in Bitcoin, Ethereum Options Set to Expire Ahead of Jackson Hole Speech appeared first on BeInCrypto.

Options Expiry Alert

Options Expiry Alert