Metaplanet, a Japan-based investment firm, has acquired 1,241 Bitcoin (BTC) for approximately $126.7 million.

With this latest purchase, Metaplanet has surpassed El Salvador in total Bitcoin holdings, strengthening its position as one of the largest institutional holders of the asset.

Metaplanet Tops El Salvador in Bitcoin Holdings

According to a company disclosure issued today, the firm acquired more Bitcoin at an average price of approximately $102,119 (14,848,061 yen) per coin. This brings its total holdings to 6,796 BTC—up from 5,555 BTC just last week.

Metaplanet, which began acquiring Bitcoin in April 2024, now holds more than El Salvador’s national reserves. According to data from El Salvador’s Bitcoin Office, the country, a prominent state-level adopter since 2021, has 6,174 BTC, trailing Metaplanet by 622 BTC.

“Metaplanet now holds more Bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” Metaplanet CEO Simon Gerovich wrote in a post.

In another post on X (formerly Twitter), Gerovich highlighted the company’s growing commitment to Bitcoin, revealing a cumulative investment of approximately $608.2 million. At the current BTC price of $104,003, Metaplanet’s holdings are now worth around $706.8 million, representing a 16.2% unrealized profit.

Moreover, the firm has achieved a BTC Yield of 170.0% year-to-date (YTD) in 2025, a metric that tracks the growth in Bitcoin holdings per fully diluted share. For the current quarter alone—April 1 to May 12, 2025—the BTC Yield stands at 38.0%, reflecting continued shareholder value creation through its treasury strategy.

The company’s stock is also benefiting from its Bitcoin pivot. Following today’s announcement, Metaplanet shares (3350.T) rose 3.8% in Monday trading.

Furthermore, BeInCrypto reported that the stock’s value has surged 15x since it began accumulating BTC. This signaled investor confidence in the firm’s Bitcoin-focused strategy.

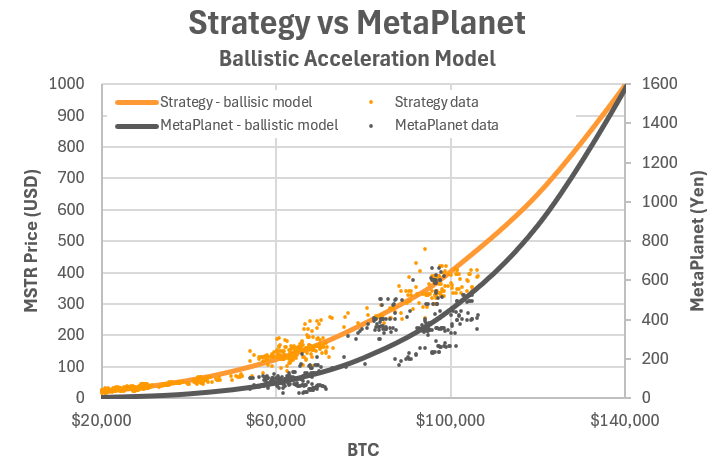

Metaplanet vs. Strategy: Analyst Sees Bigger Upside for Japan’s Bitcoin Bet

Metaplanet’s approach mirrors that of US-based Strategy (formerly MicroStrategy)—a first mover in corporate Bitcoin accumulation. However, an analyst recently suggested that Metaplanet may offer even greater upside relative to Bitcoin’s price growth.

In a ballistic acceleration model, the analyst projected that at a $120,000 BTC price, Metaplanet stock could double (2.0x), while Strategy’s might rise 1.6x. At $150,000, Metaplanet could see a 4.5x surge compared to Strategy’s 3.0x gain.

As the analyst described, this “asymmetric upside” highlights how Metaplanet—still in the early stages of its Bitcoin strategy—could deliver outsized equity returns relative to its risk, positioning itself as a high-beta proxy for Bitcoin exposure.

The post Metaplanet Overtakes El Salvador with $126.7 Million Bitcoin Acquisition appeared first on BeInCrypto.