Recent analyses largely agree that retail investors have yet to return to the crypto market, even though Bitcoin has reached new all-time highs. However, there are new signs that Bitcoin’s price surge may soon lure back retail participants.

But is it wise to start buying Bitcoin now that it has entered six-figure territory? Analysts are divided on the matter.

Should You Start Dollar-Cost Averaging into Bitcoin Weekly?

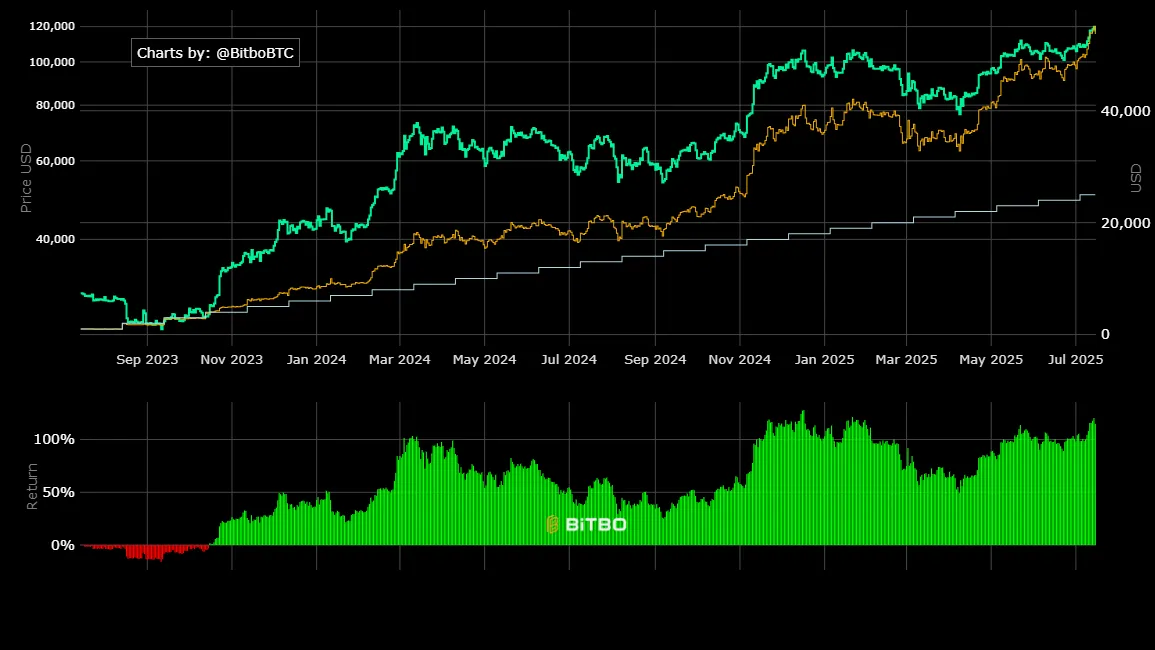

According to Bitbo’s calculations, if a retail investor had invested $1,000 per month in Bitcoin over the past two years, they would have accumulated approximately 0.4588 BTC, yielding a 114.8% return.

This result demonstrates that Bitcoin continues to reward long-term investors. While Bitcoin’s performance may no longer match previous cycles, it still appeals to anyone looking to preserve value amid inflation concerns.

But what if this strategy starts now, with Bitcoin already priced above $100,000?

Recently, an investor named Steve—who openly admits he’s not a hardcore Bitcoin fan—announced that he would invest $1,000 per month in Bitcoin throughout Trump’s presidential term.

That amount reflects the average contribution of a retail investor. Steve’s decision raises a question: Could this signal a broader movement of retail investors preparing to flood into Bitcoin?

Jake Claver, managing director at Digital Ascension Group, believes this is the worst possible time for such a strategy.

“This is the cycle top. Might have 10% left in it before the next bear market. You should DCA at the bottom of the bear market. Buying anything other than BTC in crypto right now would be better, prior to Alt season. The rotation out of BTC has already started,” Jake Claver explained.

However, Udi Wertheimer, a well-known crypto investor on X, holds a different view. He argues that it’s not about price levels—it’s about making the right decision at the right time, even in uncertainty.

“The most expensive mistake you can make is refusing to buy Bitcoin at $120,000 because you sold it at $30,000.

Me and my friends sold all our Bitcoin at $100 and only started buying back around $500–$1,000. You think we’re losing sleep over it? Don’t be stupid. Do whatever you need to trick yourself out of that attitude. We’re going so much higher, it’s not going to matter that you missed 4x along the way,” Udi Wertheimer said.

Only time will tell whether Steve’s strategy works. However, the debates surrounding this DCA approach highlight two opposing forces in the market. One side remains cautious, anchored in past cycles. The other embraces current momentum and positive signals.

Is This the “Final Dance” Before a Peak?

Data from CryptoQuant offers a more optimistic perspective.

A recent analysis by Joohyun Ryu on the platform suggests that Bitcoin hasn’t yet entered the euphoria stage typical of past market tops. Instead, he believes we might be in the early phase of what he calls “the last dance”—a period of strong growth before the final peak.

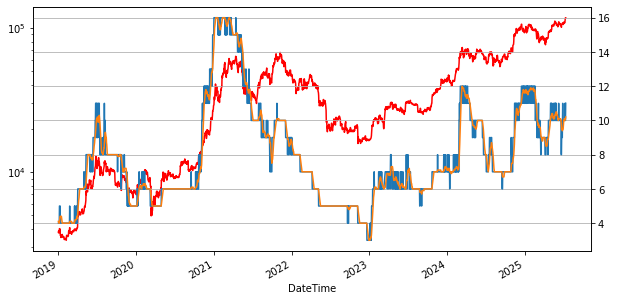

This view is based on the “Greed Indicator,” which is still at moderate levels, far below the peak in 2021. Ryu also points to the rHODL ratio, currently at just 32%.

“A representative example is the rHODL ratio, currently positioned at a modest 32%. This metric, traditionally indicative of long-term holder behavior and the distribution of wealth across different investor cohorts, suggests a continued reluctance among retail participants (often referred to as ‘prawns’ in market vernacular) to fully engage with the market. Historically, periods of true market euphoria have been characterized by substantial inflows from retail investors, a dynamic not yet prominently observed,” Joohyun Ryu explained.

If Ryu is correct, Steve’s decision could be smart—an effort to capitalize before Bitcoin potentially surges to new highs. What remains, however, is the crucial question: When is the right time to exit, before the next bear market sets in?

The post Is Investing $1,000/Month into Bitcoin Now a Smart Move? Analysts Weigh In appeared first on BeInCrypto.