Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read about Bitcoin mining wars. A sharp global Hashrate drop, tied to power outages and US strikes in Iran, has ignited fears of a new era: one where hash power becomes a geopolitical battleground.

Crypto News of the Day: Bitcoin’s Hashrate Plunge Sparks Geopolitical Alarm

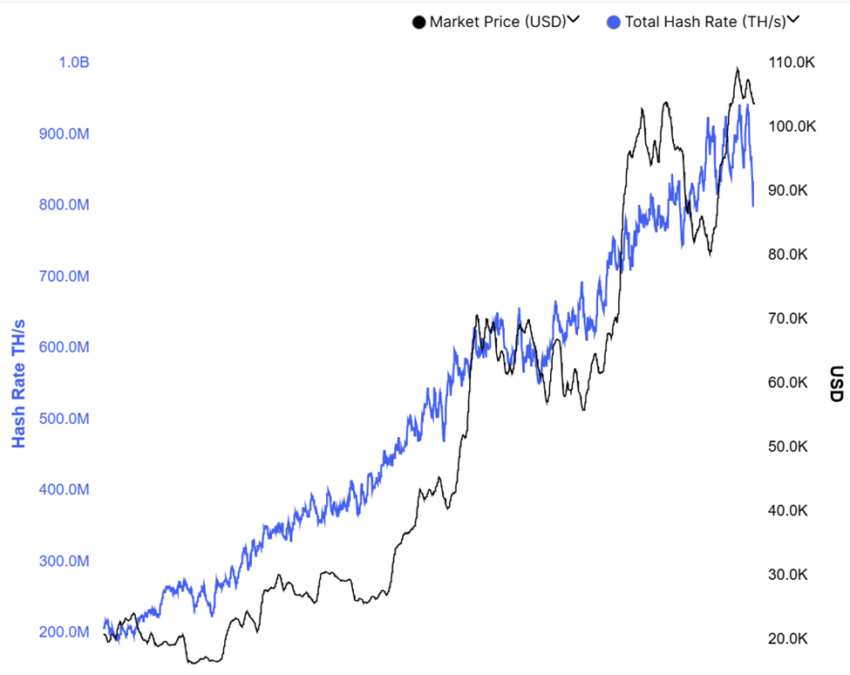

Network data shows the global Bitcoin Hashrate has suffered its steepest decline in three years, falling more than 15% between June 15 and June 22.

BeInCrypto reported the recent dip, which sent Bitcoin’s Hashrate to an eight-month low. This sparked debate over whether the weakness signals a broader risk for miners or an opportunistic entry point for investors.

Just a week earlier, mining costs had surged more than 34% amid record highs in global Hashrate. The trend reversal suggests that miners pushed hardware limits despite narrowing profitability margins.

The sudden drop coincides with reports of US military strikes on Iranian infrastructure and widespread internet outages in the country. This has raised alarms over the rising geopolitical risks tied to Bitcoin mining.

Against this backdrop, BeInCrypto contacted Max Keiser for insights. The Bitcoin pioneer suggested ushering in a new consolidation phase and regional reshuffling.

“We might have entered an era where countries are bombing each other’s Bitcoin mining facilities as part of the global hash war I predicted in 2017,” Max Keiser told BeInCrypto.

Notably, Hashrate volatility is not unusual during seasonal power shifts. This is especially true in North America, where hydroelectric availability changes over the summer.

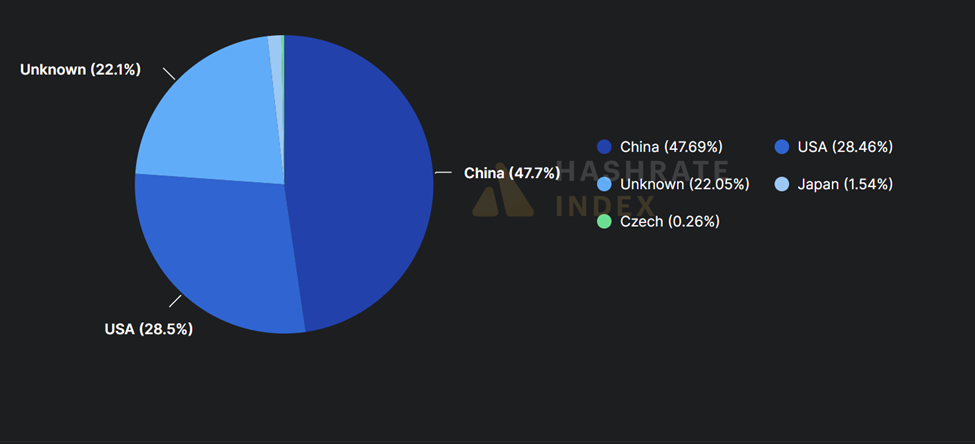

Notwithstanding, the timing of this particular disruption is notable. Iranian mining activity accounts for around 4% of global Bitcoin Hashrate, with analysts speculating that Iran’s energy-rich regions provide a haven for industrial-scale mining despite international sanctions.

Meanwhile, the US accounts for 30%, and 47% for China. Keiser also warned that America’s mining hub in Texas could present “a strategic vulnerability” if hostilities escalate in cyberspace or on the ground.

The comments echo long-standing concerns among Bitcoin maximalists that hashpower would eventually become a matter of national security.

With military tensions rising and decentralized infrastructure increasingly entangled with national interests, Bitcoin mining may no longer be the apolitical industry it once aspired to be.

Meanwhile, it is worth mentioning that President Trump’s trade policies have also caused miner reshuffling. BeInCrypto reported that Chinese Bitcoin mining equipment makers are moving to the US to avoid tariffs. This means the distribution could change, potentially in favor of the US.

This report aligns with recent reports, indicated in a recent US Crypto News publication, that mining hash power has also become a geopolitical battleground, like the stock market.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- SBI CEO lauds Ripple’s permissioned DEX on XRP Ledger, but where’s the demand?

- Analysts predict crypto boom as US dollar index (DXY) drops to multi-year low.

- Kraken receives MiCA license from Ireland’s Central Bank, enabling regulated crypto services across all 30 EEA countries.

- Invesco and Galaxy Digital file to launch a Solana ETF, seeking approval to trade on the Cboe BZX Exchange under the ticker QSOL.

- Bit Digital announces transition from Bitcoin mining to Ethereum-focused strategy.

- On-chain data shows Bitcoin flows to institutions at a record pace while retail exits.

- GameStop raises $450 million in zero-interest bonds, signaling plans to expand its Bitcoin holdings and diversify corporate assets.

- NVDA hits new all-time high, but AI tokens decline — The fading “NVDA Effect” in crypto.

- Paradigm leads a $185 million bet on Kalshi. The prediction-market unicorn hits a $2 billion valuation.

- Chinese brokerage Guotai Junan wins crypto license as Hong Kong unveils LEAP framework.

Crypto Equities Pre-Market Overview

| Company | At the Close of June 25 | Pre-Market Overview |

| Strategy (MSTR) | $388.67 | $386.70 (-0.51%) |

| Coinbase Global (COIN) | $355.37 | $357.26 (-0.53%) |

| Galaxy Digital Holdings (GLXY) | $19.40 | $19.41 (+0.052%) |

| MARA Holdings (MARA) | $14.98 | $15.01 (+0.20%) |

| Riot Platforms (RIOT) | $10.00 | $9.99 (-0.10%) |

| Core Scientific (CORZ) | $12.30 | $12.40 (+0.81%) |

The post Iran’s Bitcoin Mining Disruption Could Trigger a Global Hashrate War | US Crypto News appeared first on BeInCrypto.