Bitcoin traded near $66,400 on February 19, holding steady after days of volatility. However, growing fears of a potential US military strike on Iran are adding fresh uncertainty to global markets, including crypto.

According to confirmed reports from multiple American media, US military officials have told President Donald Trump that strike options against Iran are ready and could be executed as early as this weekend.

US-Iran on the Brink of War as Bitcoin Holds Fragile Support

The Pentagon has already deployed additional aircraft and moved a second carrier strike group toward the Middle East. At the same time, Iran has conducted military exercises and warned it would retaliate if attacked.

These developments follow stalled nuclear talks and rising tensions over Iran’s uranium enrichment and missile programs.

The White House said diplomacy remains the preferred path, but officials also acknowledged that military action is under active consideration. This escalation has increased risk across global markets.

Bitcoin’s recent price action reflects this uncertainty. The asset has fallen sharply from its cycle highs above $100,000 and now trades in the mid-$60,000 range.

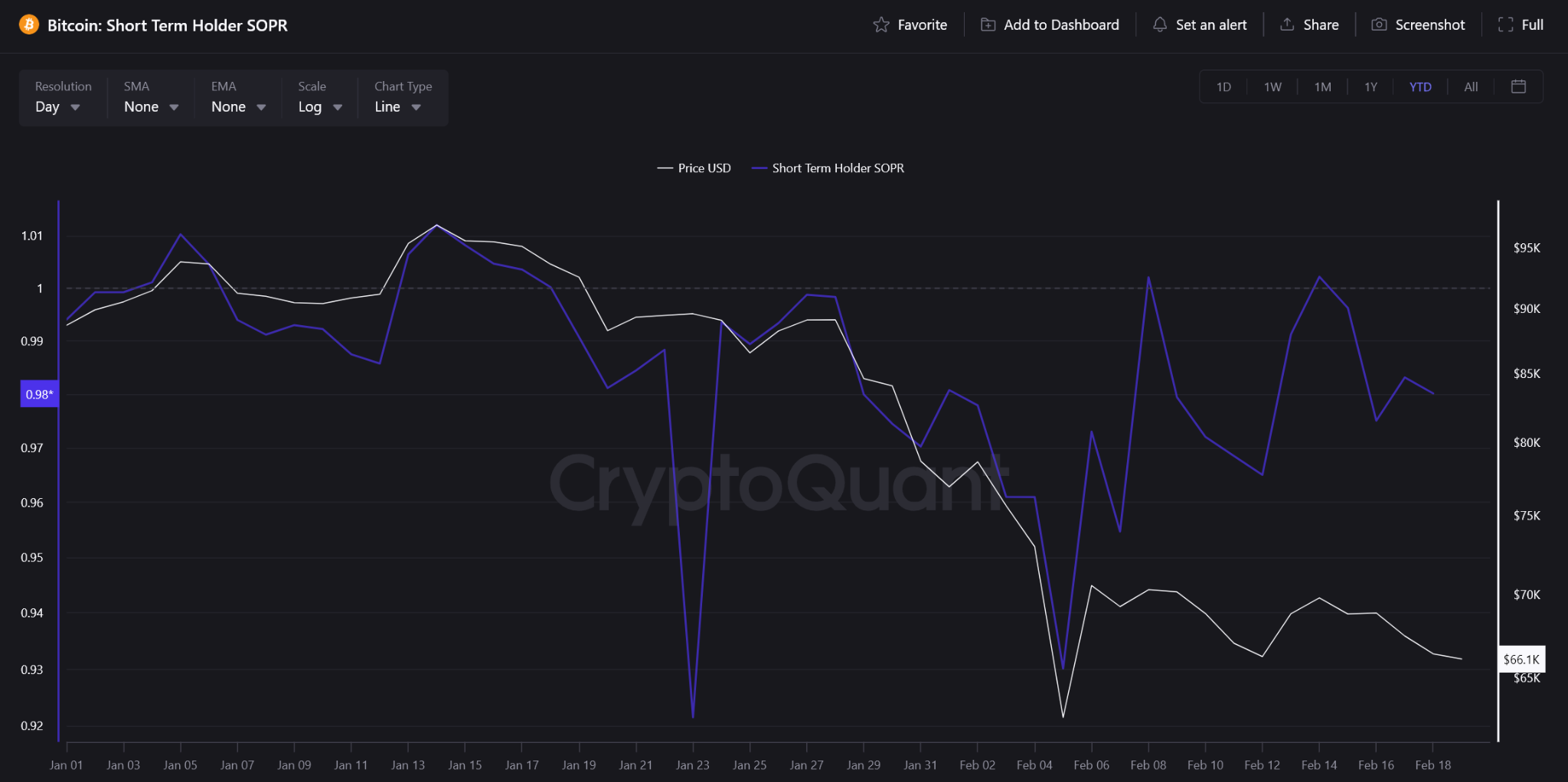

Short-term investors are selling at a loss, according to the Short-Term Holder SOPR indicator, which currently sits below 1. This means many recent buyers are exiting their positions under pressure.

At the same time, Bitcoin’s short-term Sharpe ratio has dropped to extremely negative levels. This shows that recent returns have been poor relative to volatility. Historically, such conditions appear during periods of market stress and fear.

If the US launches a strike this weekend, Bitcoin will likely react in two phases.

Bitcoin’s On-Chain Signals Suggest Panic May Trigger Volatility

First, markets may see an immediate sell-off. During sudden geopolitical shocks, investors often move into cash and safer assets. Bitcoin has historically behaved like a risk asset in the early phase of global crises. The SOPR data confirms that short-term holders are already weak and sensitive to fear.

However, the second phase could look different.

The Sharpe ratio suggests Bitcoin is already deeply oversold in the short term. Many weak hands have exited. This reduces the amount of forced selling that can still occur.

As a result, any sharp drop could be short-lived if buyers step in at lower levels.

In addition, geopolitical uncertainty can eventually strengthen Bitcoin’s appeal. Investors often turn to assets outside traditional financial systems when global tensions rise. This shift does not happen instantly, but it tends to develop over time.

For now, Bitcoin sits at a critical point. Fear remains high, and geopolitical risks are rising. But on-chain data suggests much of the damage from the recent correction has already occurred.

The next move will depend heavily on whether tensions escalate into actual military conflict—or ease through diplomacy.

The post How Will Bitcoin React if the US Military Strikes Iran This Weekend? appeared first on BeInCrypto.