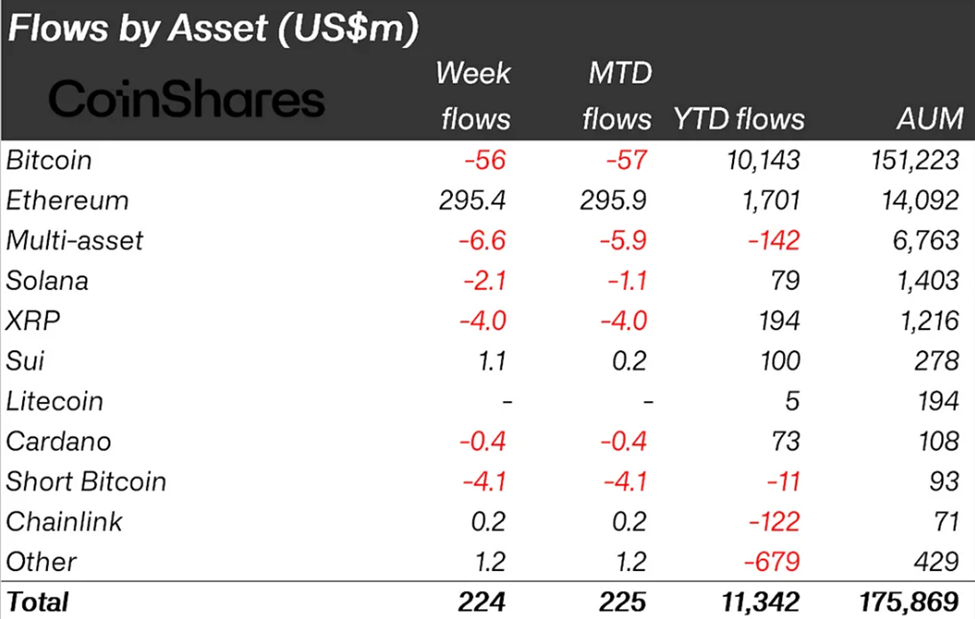

The latest CoinShares report reveals that crypto inflows soared to $224 million last week. Meanwhile, Ethereum (ETH) continues solidifying its position as a frontrunner in institutional sentiment.

The second-largest crypto by market cap continues to record positive returns, with fortunes turning since the Pectra Upgrade hit the mainnet on May 7.

Ethereum Records Strongest Inflow Streak Since US Elections

CoinShares’ latest report indicates that Ethereum posted $296.4 million in inflows last week, marking its strongest run since the November US elections.

The inflows helped push total weekly crypto inflows to $224 million, extending the ongoing seven-week streak to $11 billion despite macroeconomic headwinds.

“Ethereum leads with US$296.4 million in inflows, its strongest run since the US election, now representing 10.5% of total AuM,” read an excerpt in the report.

CoinShares’s James Butterfill noted that the surge in demand for Ethereum comes despite a broader slowdown due to uncertainty around the US Federal Reserve (Fed) policy.

Meanwhile, Ethereum’s rise coincides with the network’s Pectra upgrade on May 7, which enhanced user experience and smart contract efficiency.

Ethereum has repeatedly led crypto inflows in the weeks since, attracting $1.5 billion over seven consecutive weeks. BeInCrypto reported that Ethereum notched inflows of $785 million during the week after the upgrade and $286 million the following week, contributing majorly to its momentum.

Institutional demand is also evident in Ethereum ETF (exchange-traded funds) flows. As BeInCrypto highlighted, Ethereum ETFs recorded a 15-day streak of inflows as of the last trading session on June 6.

This reflects growing confidence in ETH’s long-term potential following the Pectra upgrade and renewed ETF optimism in the US.

“Ethereum 2025 is 2016 on steroids. Same consolidation, same shakeout, same reversal pattern. Back then, ETH rewrote the charts. Now? We’ve got stronger base, more capital, and ETF momentum,” wrote analyst Merlijn the Trader.

Bitcoin Slips Again as Altcoins Remain Subdued Amid Macro Uncertainty

While Ethereum soared, Bitcoin recorded its second week of outflows, shedding $56.5 million as investors remain cautious.

“Bitcoin saw its second straight week of modest outflows totaling $56.5 million, as policy uncertainty kept investors on the sidelines…short-Bitcoin products also experienced a second week of outflows,” the CoinShares report added.

Altcoin activity was largely subdued. Sui (SUI) saw modest inflows of $1.1 million, while XRP recorded its third straight week of outflows totaling $6.6 million. This suggests sentiment remains mixed outside Ethereum.

Despite the broader slowdown, Ethereum’s performance highlights a growing divergence between major digital assets. Its ETF and institutional interest surge signals that investors may be positioning for Ethereum to outperform in a post-rate-hike environment.

With Ethereum now representing 10.5% of total digital asset AuM, the asset appears to be regaining its leadership status in the eyes of institutions. Whether the trend continues may depend on signals from the Fed later on Wednesday.

BeInCrypto data shows Ethereum was trading for $2,528, up 1.28% in the last 24 hours.

The post Ethereum Records Strongest Run Since US Elections, Pushes Crypto Inflows To $224 Million appeared first on BeInCrypto.