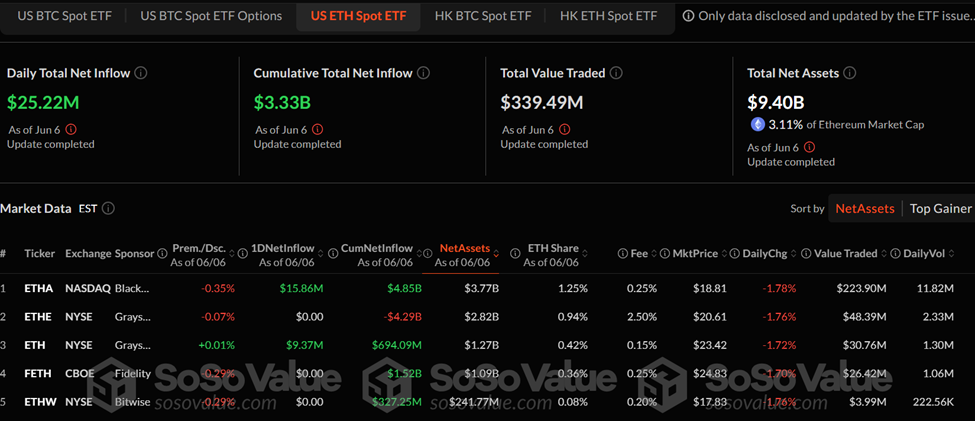

US Spot Ethereum ETFs have logged 15 consecutive trading days of net inflows, amassing $837.5 million since May 16.

The inflow streak started a week after Ethereum’s Pectra Upgrade, which increased EIP-7702 transactions to nearly 1,000 daily and enhanced wallet features without address changes.

Ethereum ETFs Hit $837.5 Million Inflow Streak

These inflows constitute around 25% of all net inflows since the funds launched in May 2024. The streak marks Ether ETFs’ longest uninterrupted inflow period since late 2024.

According to data from SoSoValue, it positions spot Ethereum ETFs at their highest cumulative inflow value to date, now totaling $3.33 billion.

BlackRock’s ETHA fund leads the Ethereum ETF market in individual inflows, contributing nearly $600 million during this surge. While ETHA boasts the highest inflows, Grayscale’s dual offerings, ETHE and ETH, hold a larger asset base, with $4.09 billion in AUM compared to ETHA’s total.

Meanwhile, Fidelity’s offering trails with $1.09 billion, while other funds remain below the $250 million mark. Notably, the surge coincides with a 38% rally in the price of Ether over the past 30 days.

Key drivers include renewed institutional interest, optimism around Ethereum’s long-term fundamentals, and the network’s recent Pectra upgrade. Against these backdrops, analysts are optimistic about the Ethereum price outlook.

Despite this, analysts at JPMorgan noted that while institutional allocations are rising, user activity on the Ethereum network has yet to accelerate post-upgrade meaningfully.

“Neither the number of daily transactions nor the number of active addresses saw a material increase post recent upgrades,” JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in the recent report.

If the current pace continues, the streak could cross the $1 billion mark by next week. Such an outcome would further underline a sharp pivot in sentiment after a relatively muted start for Ether ETFs.

Bitcoin ETFs Retreat After Record Highs

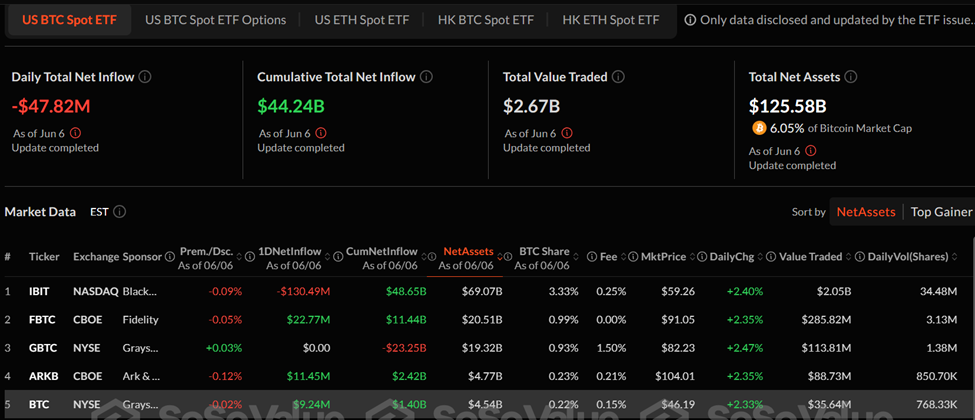

While Ethereum ETFs continue to gather momentum, the same cannot be said for their Bitcoin counterparts. Spot Bitcoin ETFs saw their most recent inflow streak break on May 29, when $346.8 million exited the market in a single day.

Since then, Bitcoin ETF flows have turned volatile, and cumulative inflows have fallen by more than $1 billion. This is from $45.34 billion on May 28 to $44.24 billion as of Friday’s trading session.

BlackRock’s IBIT remains the category leader by a wide margin, managing $69 billion in assets. Fidelity’s FBTC and Grayscale’s GBTC follow with $20.51 billion and $19.32 billion in AUM, respectively.

The market also experienced brief turbulence after a heated online exchange between President Donald Trump and Elon Musk triggered a broader sell-off in crypto markets and equities.

Spotlight on Staking and ETF Innovation

As investor interest in Ether ETFs accelerates, some analysts argue that future inflows will depend on whether staking functionality is introduced. James Seyffart, ETF analyst at Bloomberg, recently highlighted regulatory workarounds being employed to launch staking-enabled ETFs.

ETF provider REX Shares has already filed for Ethereum and Solana staking ETFs, and the first such products may arrive in the US within weeks.

Growing demand is also reflected in broader Ethereum adoption metrics. According to Santiment, Ethereum holders have now surpassed 148 million.

This signals long-term conviction in the asset. Comparatively, Bitcoin has 55.39 million holders, while other popular assets like Dogecoin, XRP, and Cardano report between 4 and 8 million holders.

With Ether ETFs now delivering their strongest performance to date, the spotlight is firmly on whether this momentum can persist.

Perhaps, staking-enabled offerings might drive the next wave of institutional adoption.

The post Ethereum ETFs on a 15-Day Inflow Streak: Is Pectra Bringing Institutional Capital? appeared first on BeInCrypto.

As crypto markets attempt to rally at the end of the work week, crypto networks continue to grow over time. Here are the total amount of holders for select top caps:

As crypto markets attempt to rally at the end of the work week, crypto networks continue to grow over time. Here are the total amount of holders for select top caps: Ethereum

Ethereum