The global crypto market lost nearly $125 billion in value within hours on Friday after US President Donald Trump announced plans for a “massive” increase in tariffs on Chinese imports and canceled his upcoming meeting with President Xi Jinping.

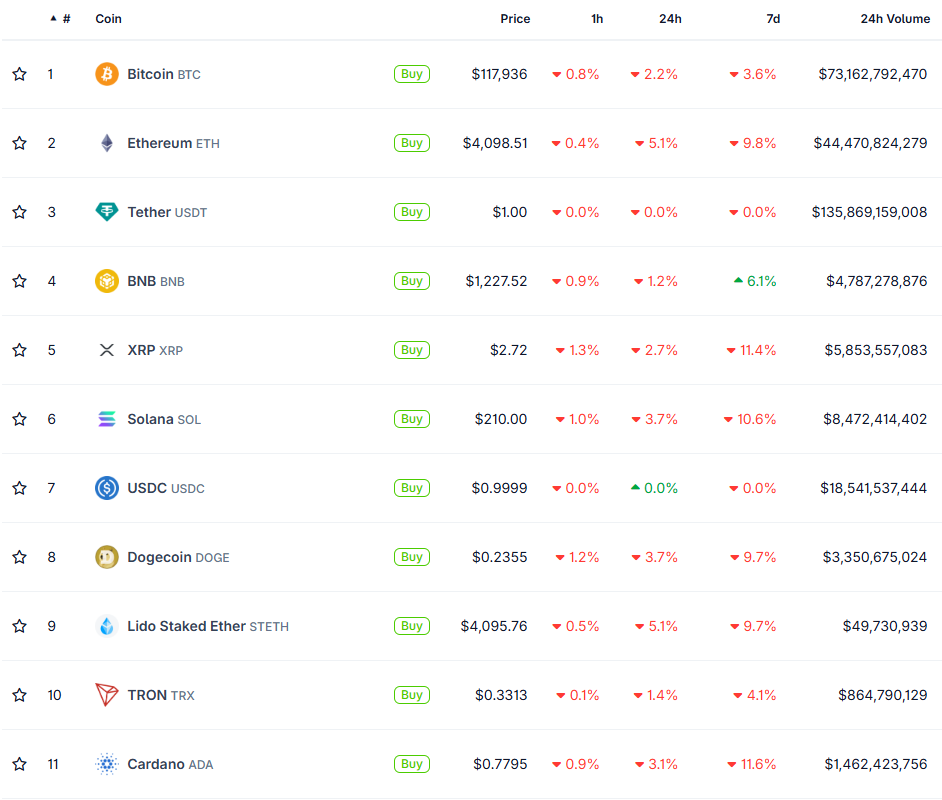

Bitcoin and Ethereum led the decline as risk assets sold off sharply following Trump’s remarks.

Trump’s Trade War Fear Crashes Financial Markets

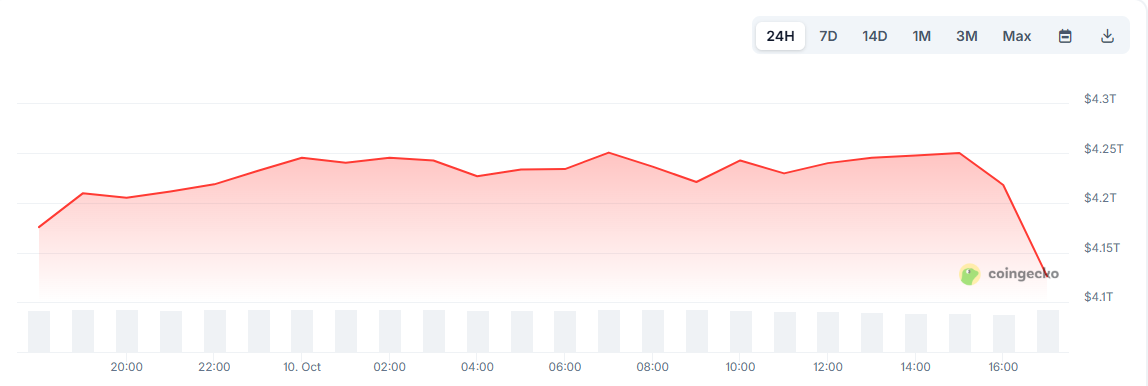

The total crypto market capitalization dropped from around $4.27 trillion to $4.10 trillion, according to CoinGecko. The move mirrored Wall Street’s reaction, where the S&P 500 erased $1.2 trillion in value in 40 minutes.

Bitcoin fell 1.9% to $118,000, while Ethereum slid 4.7% to $4,104. Altcoins faced heavier losses, with Solana and XRP down over 2% respectively.

Liquidation data shows the sell-off triggered a wave of forced unwinding across exchanges. Over $824 million in leveraged positions were liquidated in the past 24 hours, with Bitcoin accounting for the largest liquidations.

Long traders took the biggest hit, losing more than $670 million in liquidations.

Analysts said the shock announcement revived fears of a renewed US–China trade war, adding to volatility already elevated by rate cut uncertainty and slowing global growth.

Crypto markets, which have increasingly tracked equities, reacted as part of a broader “risk-off” shift by institutional traders.

The sell-off highlights crypto’s growing sensitivity to geopolitical and macroeconomic events.

As traditional markets tumbled, digital assets followed closely, reflecting tighter cross-market linkages between tokenized and traditional finance.

Will The Crypto Market Crash Further?

The crypto market should expect immediate volatility to continue through the weekend as traders process the tariff shock and liquidity remains thin.

Short-term sentiment will likely stay fragile for the next 48–72 hours, with Bitcoin hovering near the $115,000–$118,000 range while altcoins remain under pressure.

If no new tariff measures are formally announced, the market could begin to stabilize next week as risk appetite gradually returns.

However, a formal Executive Order or Chinese retaliation could extend the downturn by another one to two weeks. In that case, leveraged unwinding and rotation into stablecoins may intensify.

Longer term, if trade tensions persist into November, the sell-off could evolve into a broader macro correction similar to previous tariff shocks in 2019 or Fed-driven pullbacks in 2022.

Recovery would then depend on how quickly policymakers clarify their positions and whether institutional traders regain confidence in risk assets.

The post Crypto Market Sinks $125 Billion After Trump’s New China Tariff Threat – What’s Next? appeared first on BeInCrypto.