With an optimistic outlook for Q3 2025, Coinbase forecasts that the cryptocurrency market will shift into a full-fledged altcoin season.

While current conditions present a promising setup for an upcoming altseason, investors are advised to closely monitor market factors and macroeconomic developments in the months ahead.

Macro Trends Point to Altcoin Season in Q3

A report from Coinbase Institutional indicates that the market is approaching the threshold of a comprehensive altcoin season as September draws near.

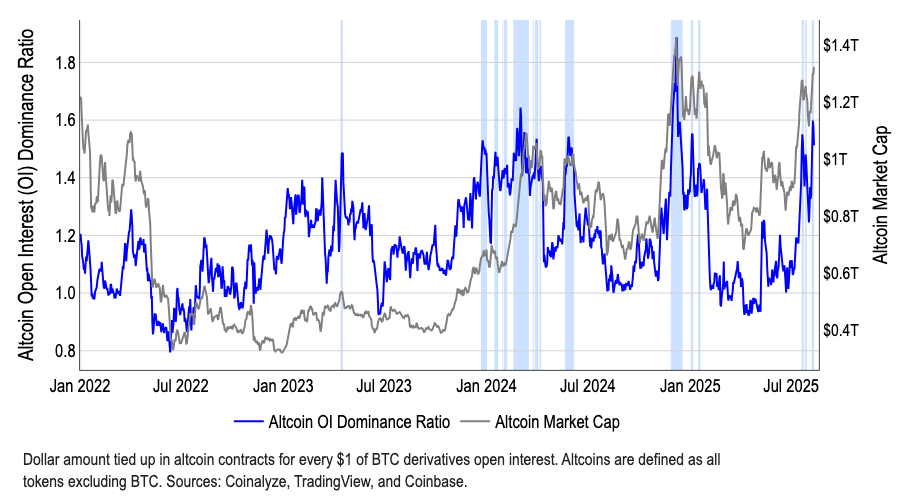

Specifically, Bitcoin’s market dominance reached 65% in May but declined to around 59% in August. This is a clear signal that capital is flowing into altcoins. At the same time, the total market capitalization of all altcoins has surged over 50% since early July, reaching approximately USD 1.4 trillion.

“We think that current market conditions have started to signal a potential rotation into a full-scale altcoin season as we head into September.” The report stated.

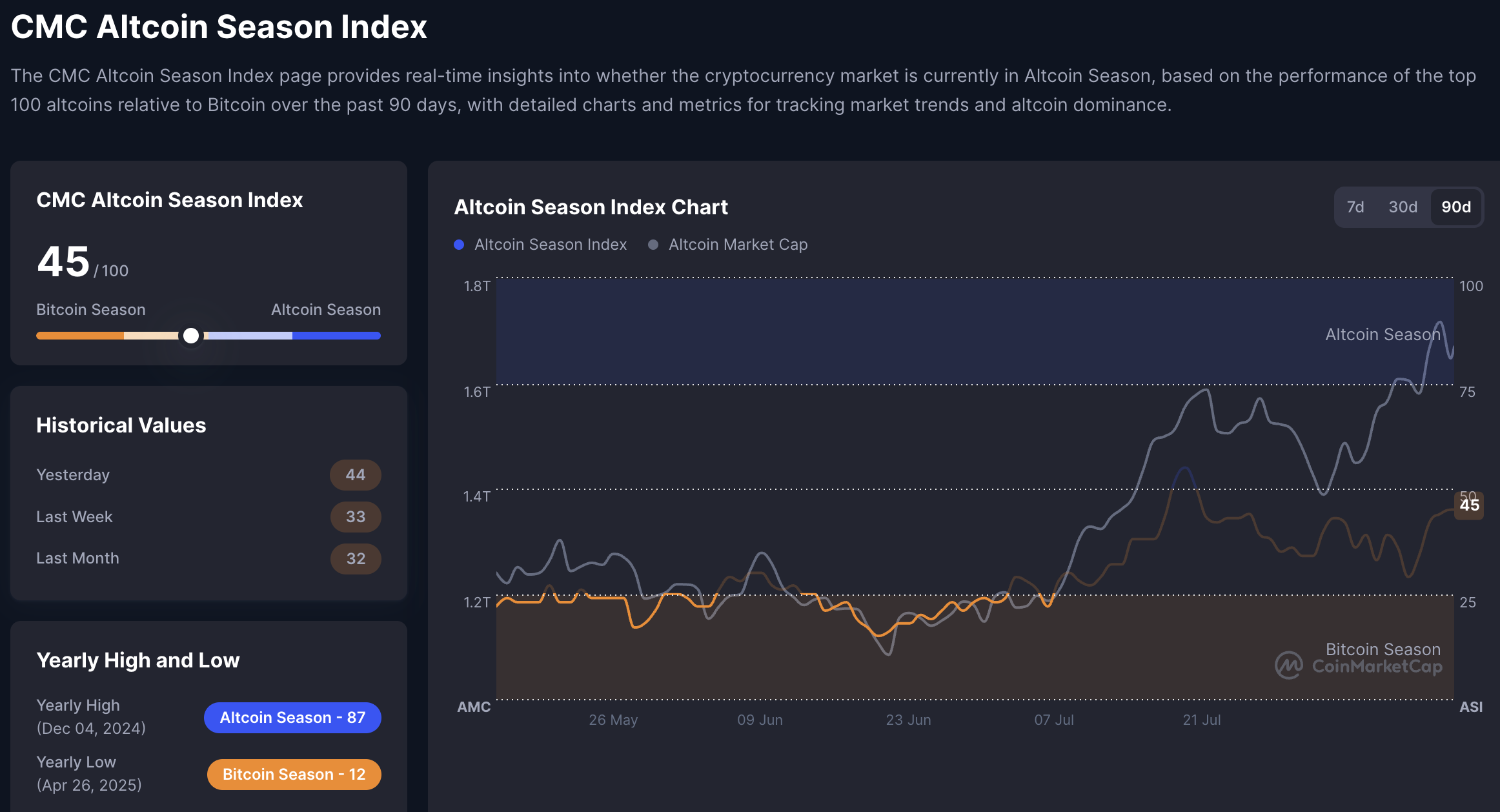

Although the Altcoin Season Index remains relatively low at around 40–45, still below the 75 threshold needed to declare an altcoin season officially, there is cautious optimism. Prevailing macro trends and market signals set the stage for a strong rally in Q3 2025.

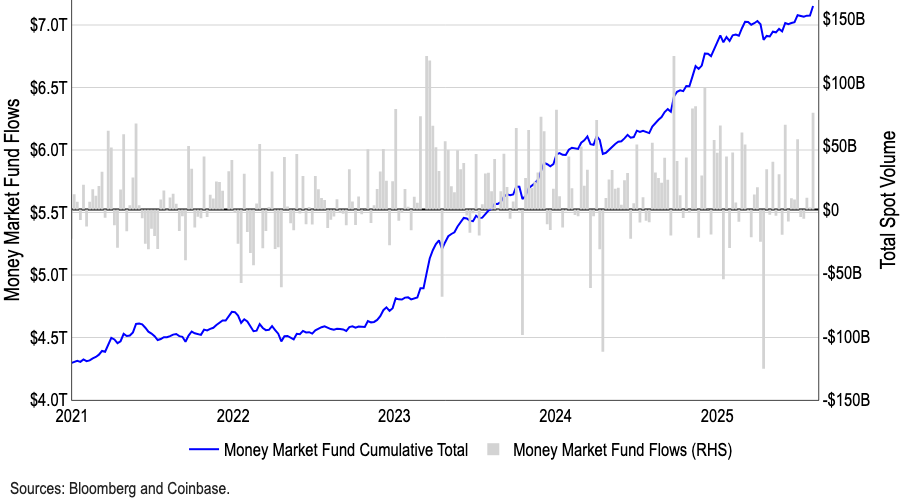

One key factor highlighted by Coinbase is the potential for the Federal Reserve to cut interest rates in September or October. Cash remains “trapped” in money market funds, totaling over USD 7.2 trillion, the highest level on record. Should yields on these funds decline, fund managers could unlock retail capital and redirect it toward riskier assets. Market forces are positioning altcoins to benefit first from this potential shift.

Meanwhile, Ethereum (ETH) is emerging as a focal point for capital rotation. ETH’s market capitalization has risen by about 50% since early July, driven by strong demand from digital asset treasuries. This growth is further fueled by the narrative surrounding stablecoins and real-world assets (RWAs).

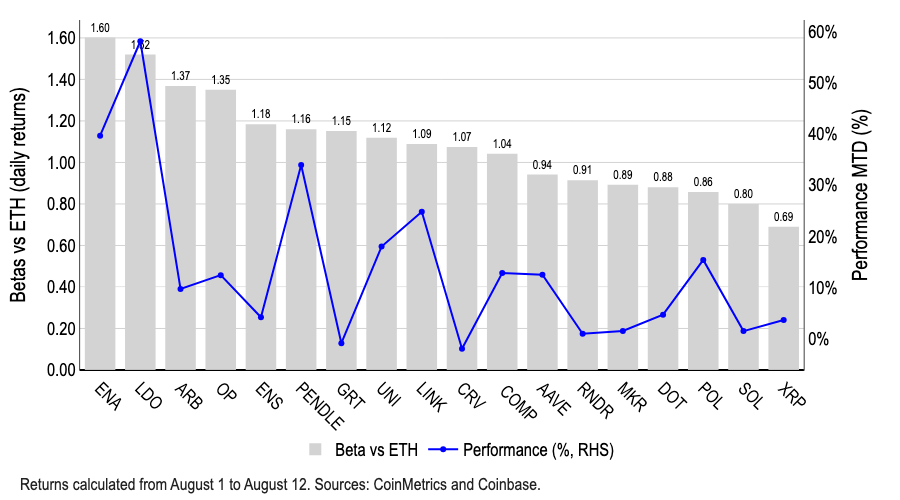

Institutions such as Bitmine Immersion Technologies have purchased up to 1.15 million ETH, while funds collectively hold nearly 3 million ETH, equivalent to more than 2% of the global supply. At the same time, tokens closely tied to Ethereum, including Arbitrum, Ethena, Lido DAO, and Optimism, have seen notable gains. Lido’s 58% monthly gain could come from new legislation recognizing staking tokens as not securities.

Coinbase also notes signs of liquidity recovery, signaling that the market may be ready for its next bullish phase. Indicators such as trading volume, order book depth, and stablecoin issuance are rebounding after six months of decline. This is a crucial signal supporting potential capital inflows into altcoins.

In conclusion, Coinbase maintains an optimistic view for Q3 2025, particularly as macroeconomic, regulatory, and market conditions gradually align. As September approaches, these factors contribute to a solid foundation for a genuine altcoin season. However, to be officially declared, the Altcoin Season Index must surpass 75 — indicating a broad-based and sustained market rally.

The post Coinbase Predicts Altcoin Season as Q3 2025 Approaches appeared first on BeInCrypto.