Bitcoin (BTC) price is poised for its next all-time high (ATH), a show of strength that has prompted Bloomberg Terminal, a staple for institutional investors, to adjust its professional service.

The allure of crypto, particularly Bitcoin, continues to grow, with institutional investors just as interested as retail.

Institutional Optics Shift, But Is Hyper-Bitcoinization Next?

Bloomberg Terminal adjusted its scale, now showing Bitcoin in millions. As of Thursday, one Bitcoin was quoted at 0.112 million, or $112,000.

Bloomberg Terminal is a premium financial software platform that provides professionals with real-time market data, analytical software, and trading capabilities.

The Bloomberg display tweak represents more than a user interface (UI) decision. It reflects a world adjusting to Bitcoin’s role as a high-value macro asset.

It also indicates a subtle but powerful signal of shifting financial optics around the world’s largest digital asset.

Analysts say it could also mark a tipping point in mainstream perception, reinforcing that BTC is no longer “cheap” or speculative. Rather, it is a scarce, high-value digital property.

“Bloomberg terminal showing BTC in millions isn’t just a UI update – it’s a mindset shift. Traditional finance is finally accepting what we’ve known all along. The future of money is digital, and Bitcoin led the way,” one user remarked.

This interface change coincides with Bitcoin’s climb to new all-time highs, from $112,000 to $118,000 within a 24-hour window.

As of this writing, Bitcoin traded for $118,535, up nearly 7% in the last 24 hours. On the Bloomberg terminal, this means almost 0.118 million per BTC.

The move, which triggered up to $1.25 billion in record total liquidations, sparked speculation that the current cycle may enter a hyperbolic phase.

Meanwhile, this price rally comes amid a surge in on-chain activity and renewed institutional interest. It recalls some of the boldest forecasts yet for where the Bitcoin price could be heading next.

Bold Bitcoin Predictions Stack Up for 2025 and Beyond

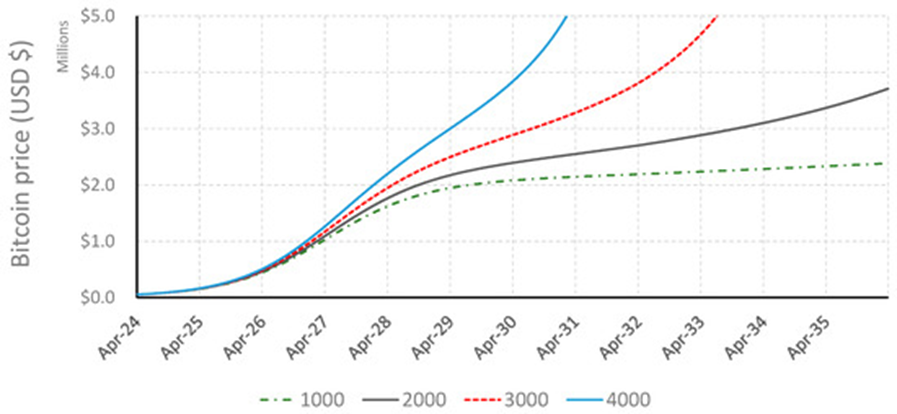

Earlier in the year, academic research published by MDPI suggested that Bitcoin could hit $1 million by early 2027, and potentially $5 million by 2031.

However, this depends on how quickly coins are withdrawn from the liquid supply. The model forecasts a shift from adoption-led growth to supply-driven hyperbolic price action.

“At the highest level of withdrawal… the price could reach USD 2M by late 2027,” read an excerpt in the paper.

The research adds to the pile of market sentiment favoring aggressive upside. Max Keiser has reiterated his long-held call for $220,000 by year-end 2025.

Meanwhile, Standard Chartered expects BTC to hit $135,000 in the third quarter (Q3) and reach $200,000 by Q4.

“My official forecasts for Bitcoin are $120,000 end Q2, $200,000 end 2025 and $500,000 end 2028, all are well in hand,” Standard Chartered Global Head of Digital Assets Research Geoff Kendrick told BeInCrypto recently.

Elsewhere, BitMEX co-founder and former CEO Arthur Hayes is even more bullish, projecting $250,000 by 2025.

However, as BeInCrypto reported, Haye’s target objective is contingent on the Federal Reserve (Fed) pivoting back to quantitative easing (QE)

“If my analysis regarding the interplay of the Fed, Treasury, and banking system is correct, then Bitcoin hit a local low of $76,500 last month, and now we begin the ascent to $250,000 by year-end,” read an excerpt in his blog.

Analysts and economists are increasingly discussing the quantitative easing scenario as US debt levels balloon.

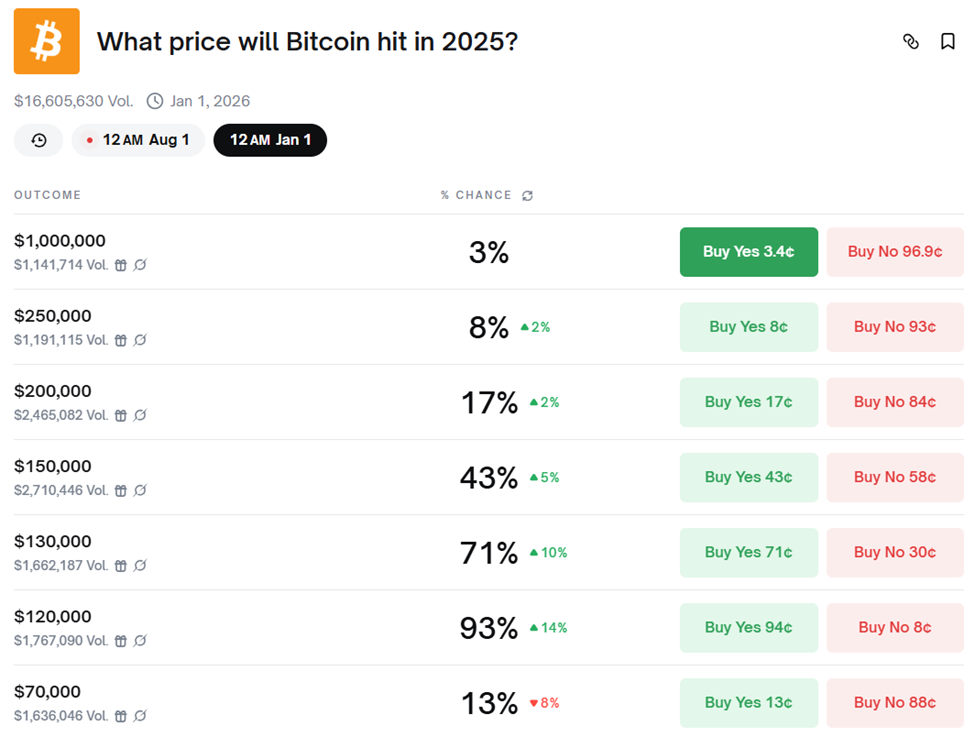

Meanwhile, retail prediction markets are also aligned, with Polymarket bettors currently seeing $120,000 as the most probable 2025 outcome.

This suggests the rally has room to run but may hit resistance near-term.

On-Chain Activity Signals Healthy Growth?

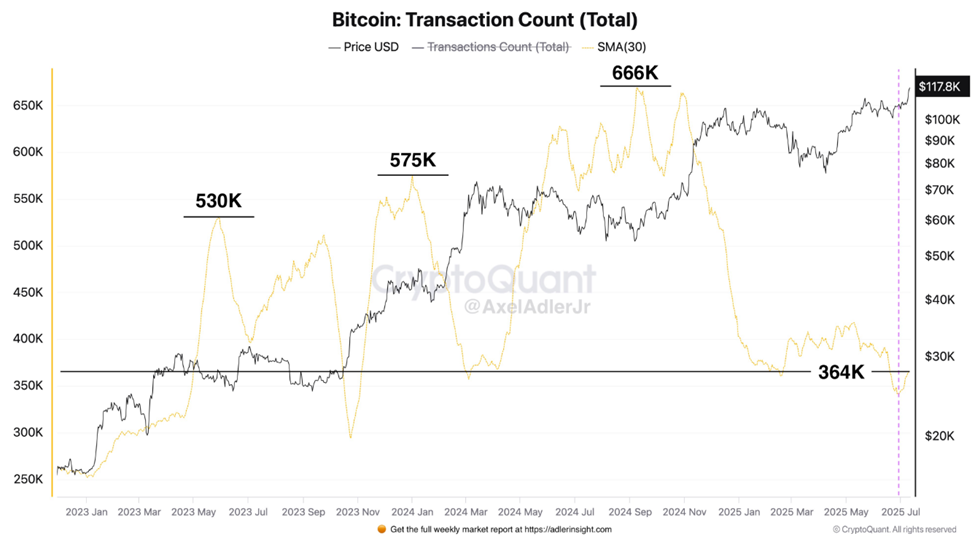

Network activity is also flashing green. Bitcoin’s daily average transactions surged from 340,000 to 364,000 over the past two days, representing a 24,000 or 7% jump.

According to Axel Adler, an on-chain analyst with CryptoQuant, while the rise is still below the 2023–2024 peak range (530,000–666,000), it signals growing engagement.

According to Adler, this points to holders not aggressively selling into the rally to book profits. This, he says, bolsters technical and fundamental support for higher prices.

“Essentially, holders are reacting calmly to the current growth and there are no signs of active coin selling in the market. This strengthens both the fundamental and technical bullish signal,” the on-chain analyst wrote.

While the current price remains shy of $120,000, the conversation is already turning to seven-figure valuations.

The Bloomberg display may feel cosmetic, but in a cycle where narratives move markets and institutional hands are also involved, it could be the psychological bridge needed to normalize what now sounds like hopium.

The post Bloomberg Now Shows Bitcoin in Millions as Price Predictions Top $1M+ appeared first on BeInCrypto.