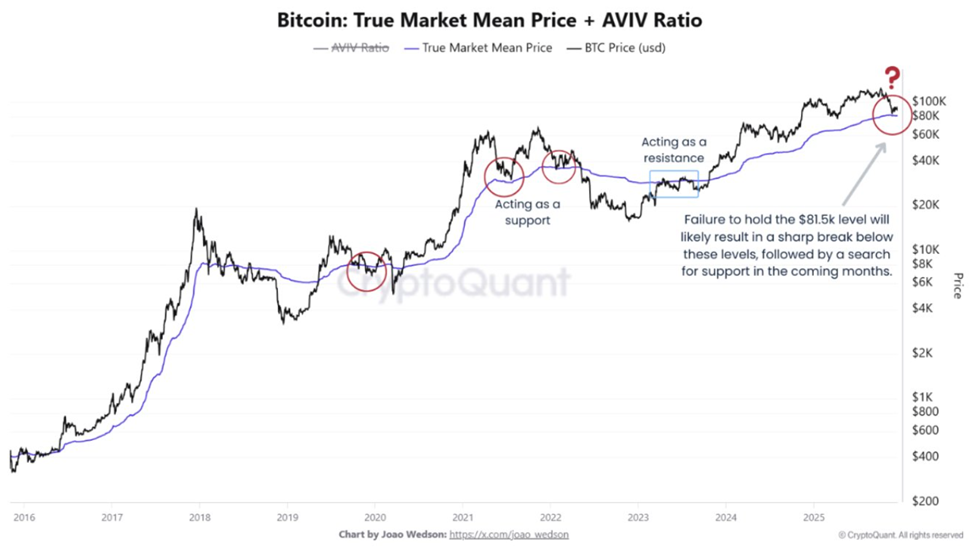

Bitcoin is hovering near a level that matters far more than a headline price. Analysts draw interest to a zone that represents the True Market Mean Price (TMMP), or the average on-chain acquisition price of non-mining investors.

According to CryptoQuant, this level has become a psychological and structural fault line. It tests whether conviction is strong enough to absorb supply or whether belief is beginning to crack.

Bitcoin Trades at the ‘Price of Belief’ as $81,500 Tests Market Conviction

On-chain indicators signal mid-cycle stress, technical resistance continues to cap upside, and analysts are now openly divided. The result is a fragile standoff between:

- Long-term holders defending cost basis and

- Sellers increasingly willing to exit at breakeven.

Against this backdrop, TMMP emerges as Bitcoin’s line in the sand. TMMP is more than a technical indicator. It serves as a collective psychological anchor, marking the average price at which holders initially entered the market.

When Bitcoin trades at this level, investors must choose between holding through uncertainty or selling at a break-even point. This decision point intensifies market pressure and often sets the stage for the next major move.

CryptoQuant analyst Moreno highlights $81,500 as the TMMP, the price at which most real capital entered the market.

Historically, Bitcoin trading above this level has encouraged dip-buying and accumulation. However, losing it often turns the same zone into resistance as investors seek to exit near their average entry. That dynamic is now playing out again.

“When BTC trades above it, investors are generally comfortable…When price loses it, that same level often flips into resistance, as people who bought near the average cost use rallies to exit,” Moreno explained.

The current test near $81,500 places investors at a decision point: hold through uncertainty or sell at break-even.

Previous cycles demonstrate the decisive impact this zone can have. During the 2020–2021 bull market, TMMP repeatedly acted as support. In 2022, it marked resistance as confidence eroded. Which role it plays next may determine Bitcoin’s near-term direction.

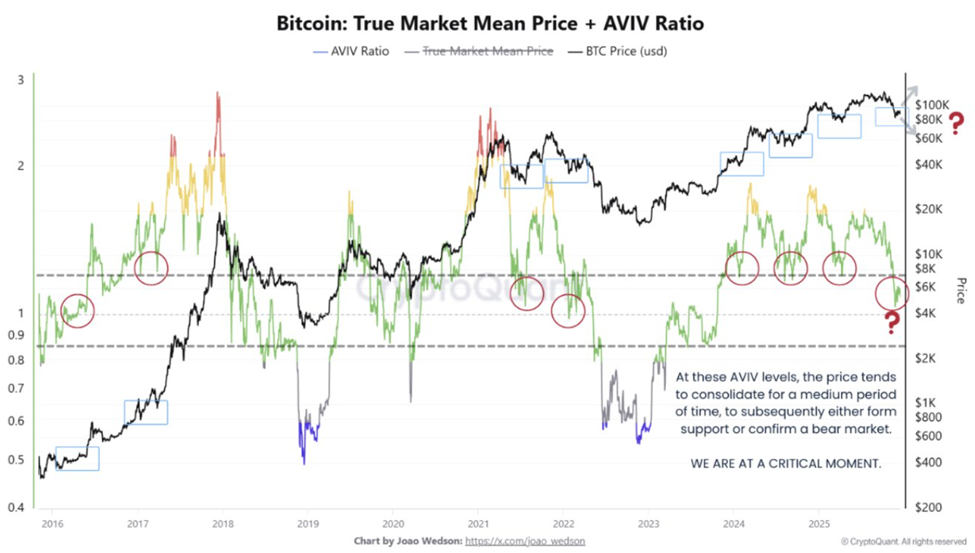

AVIV Ratio Signals Quiet Conviction Stress

Adding a behavioral layer to the picture is the AVIV Ratio, an on-chain metric that compares active market valuation with realized valuation, with a specific focus on investor profitability. Unlike momentum indicators, AVIV reflects sentiment grounded in realized gains.

Currently, AVIV is compressing toward the 0.8–0.9 range, a level historically associated with mid-cycle transitions, periods where markets do not collapse, but also fail to trend decisively.

“If Bitcoin holds above the TMMP ($81,500) while AVIV stabilizes (0.8–0.9), it suggests investors are absorbing supply and defending their cost basis. If price loses TMMP and AVIV continues to compress, it means profitability is fading, and confidence is weakening,” the CryptoQuant analyst added.

Such environments often pressure weaker hands not through sharp drawdowns, but through prolonged stagnation.

As unrealized profits erode, conviction is tested quietly, setting the stage for either renewed accumulation or a deeper search for demand.

Technical Resistance Reinforces Market Paralysis as Macro Fear Deepens the Debate

The Bitcoin price action has so far offered little relief. Bitcoin has repeatedly failed to break above its yearly open, reinforcing hesitation among momentum traders and technical participants.

The inability to reclaim this level has strengthened the perception that upside remains capped for now.

This technical stalemate mirrors a broader ideological split in the market. Veteran holders, many of whom are still shaped by the 2021 peak and subsequent 70% drawdown, appear increasingly sensitive to technical signals and cycle-based models.

“Why is Bitcoin not pumping? Because 50% is selling (OGs traumatized by 2021, technical investors looking at RSI, 4y cycle fans expecting a bear 2y post halving) while the other 50% is buying (fundamental investors, TradFi, banks). Epic battle … until sellers are out of ammo,” wrote analyst PlanB.

Institutional and traditional finance participants, by contrast, appear less concerned with short-term cycles. Their steady accumulation has helped absorb supply, but not yet enough to break the market out of its range.

Adding to the uncertainty, macro analyst Luke Gromen recently revealed that he sold a majority of his Bitcoin position near $95,000. Gromen cited long-term technical breakdowns and systemic concerns.

His decision, shared via Swan Bitcoin’s No Second Best podcast, intensified bearish narratives at a time when investor profitability is already under pressure.

Gromen pointed to weakening long-term momentum, Bitcoin’s failure to make new highs against gold, and concerns around broader market fragility heading into 2026.

While Swan’s hosts pushed back on his conclusions, the sale itself has resonated with investors, who are watching conviction falter near key support.

High-profile exits tend to carry outsized psychological weight, particularly during periods when price is compressing, and on-chain signals suggest fading profitability.

Will Belief Hold the Line?

Bitcoin now sits at a crossroads defined less by hype than by resolve. If price remains above $81,500 while the AVIV ratio stabilizes, it would indicate that investors are still willing to defend their cost basis. This would be a prerequisite for trend continuation.

Failure, however, could be costly. A decisive move below TMMP, accompanied by further AVIV compression, would signal that belief alone is no longer enough. Such an action would force the market to seek demand at lower levels.

The post Bitcoin Trades at the ‘Price of Belief’: Why $81,500 Matters Now appeared first on BeInCrypto.