Bitcoin (BTC) rebounded to $105,000 on Wednesday after briefly dipping to $103,000. The recovery comes amid mounting tensions in the Middle East, progressively pushing global markets into risk-off mode.

Meanwhile, traders and investors eye the FOMC (Federal Open Market Committee) interest rate decision later today, a US economic indicator likely to move markets.

Iran’s Strait of Hormuz Blockade Threat Triggers Oil Shock Fears

The price surge came amid growing fears of an oil shock. These fears come after Iran announced it would require prior approval for all oil and LNG tankers transiting the Strait of Hormuz, a narrow chokepoint that handles nearly 20% of the world’s oil trade.

Iran’s move escalates geopolitical risk in an already volatile region. The general perception is that the Strait of Hormuz move is part of a broader strategy.

Defense intelligence, a popular account on X (Twitter) that tracks international affairs, militancy, and politics, says Iran’s most powerful weapon is not missiles but the ability to close the Strait of Hormuz and cripple global trade.

According to political commentator Brian Krassenstein, this move will not do anything to lower gas prices and, by extension, would not encourage the FOMC to cut interest rates.

This perspective stems from the expectation that supplies could still increase. Reuters recently reported that OPEC+ plans to boost oil production by 411,000 barrels daily in July as it looks to unwind production cuts for a fourth straight month.

“Greater oil demand within OPEC+ economies – most notably Saudi Arabia – could offset additional supply from the group over the coming months and support oil prices,” Reuters reported, citing Capital Economics’ analyst Hamad Hussain.

However, others disagree, acknowledging that an oil shock could be on a timer. Analysts warn that oil prices could skyrocket if the Strait of Hormuz were fully closed.

“Any attack on oil production or export facilities in Iran would drive the price of Brent crude oil to $100, and the closure of the Strait of Hormuz would lead to prices in the $120 to $130 range,” CNBC reported, citing Andy Lipow, president of Lipow Oil Associates.

This aligns with JPMorgan’s forecast that any disruption in Iran’s ability to supply global markets could spike oil to $120 and push US CPI inflation to 5%.

Eyes on the Fed With Bitcoin as a Hedge and Gold Volatility Climbing

While traditional markets digested the implications of a global supply chain shock, Bitcoin reclaimed the $105,000 threshold. BeInCrypto data shows BTC was trading for $105,299 as of this writing.

While the pioneer crypto benefits from its perception as a hedge against inflation and geopolitical uncertainty, gold prices are seeing increased volatility as traders rotate into hard assets.

With rising energy costs threatening to ripple through global consumer prices, Bitcoin and gold are seeing renewed safe-haven demand.

According to analyst Daan Crypto Trades, the bounce from $103,000 on Tuesday to above $105,000 keeps Bitcoin price firmly within the $100,000–$110,000 monthly range.

“The total displacement (low to high) of ~10% is the smallest range we’ve seen for a month,” the analyst wrote.

The timing of Iran’s announcement is critical. The US FOMC is set to deliver its next interest rate decision later today, presenting as the most essential US economic indicator this week.

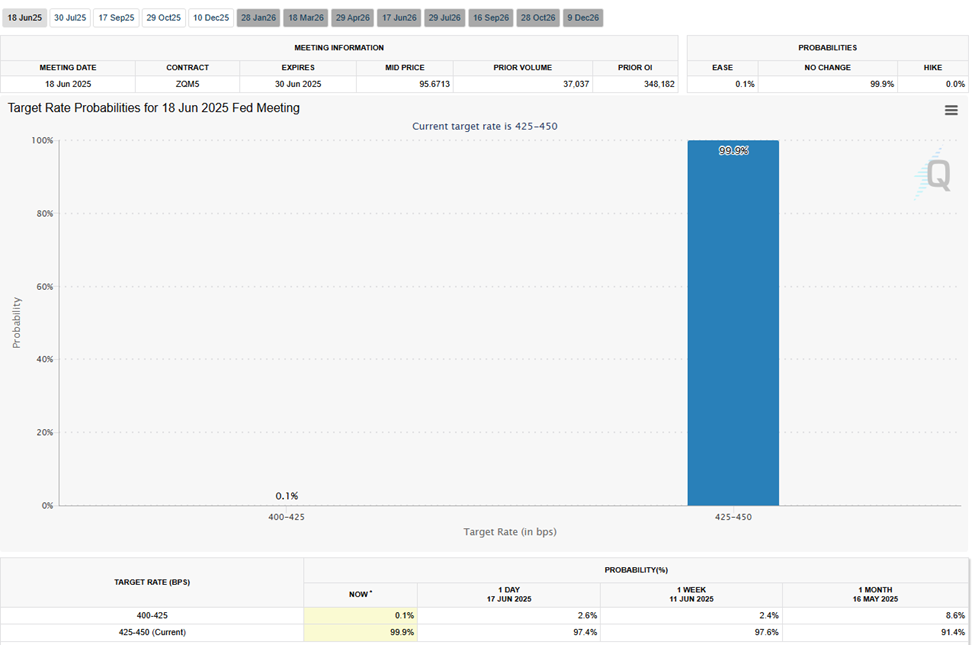

Based on the CME FedWatch Tool, traders do not expect an immediate rate change. Notwithstanding, investors will watch Fed chair Jerome Powell’s speech closely for signs of how the Fed plans to handle persistent inflation amid geopolitical disruptions.

As reported by BeInCrypto, the market remains tense. Crypto investors are bracing for volatility as the Fed struggles between inflation and avoiding market panic.

With oil now weaponized and the crypto market reacting in real time, Bitcoin’s resilience could be tested again, especially if energy markets spiral further or the Fed signals a hawkish tilt.

The post Bitcoin Reclaims $105,000 as Strait of Hormuz Crisis Fuels Oil Shock, Inflation Fears appeared first on BeInCrypto.

Khandouzi, former Minister of Economy: Starting tomorrow for 100 days, no oil tanker or LNG…

Khandouzi, former Minister of Economy: Starting tomorrow for 100 days, no oil tanker or LNG…