Bitcoin’s price has faced significant struggles around the $105,000 mark in recent weeks. Despite attempts to push higher, the cryptocurrency has found it difficult to break past this level.

Nevertheless, investors still hold out hope for a recovery, but geopolitical tensions, particularly the rising conflict between Israel and Iran, have created additional uncertainty in the market.

Bitcoin Holders Fear Tariff War Over Actual War

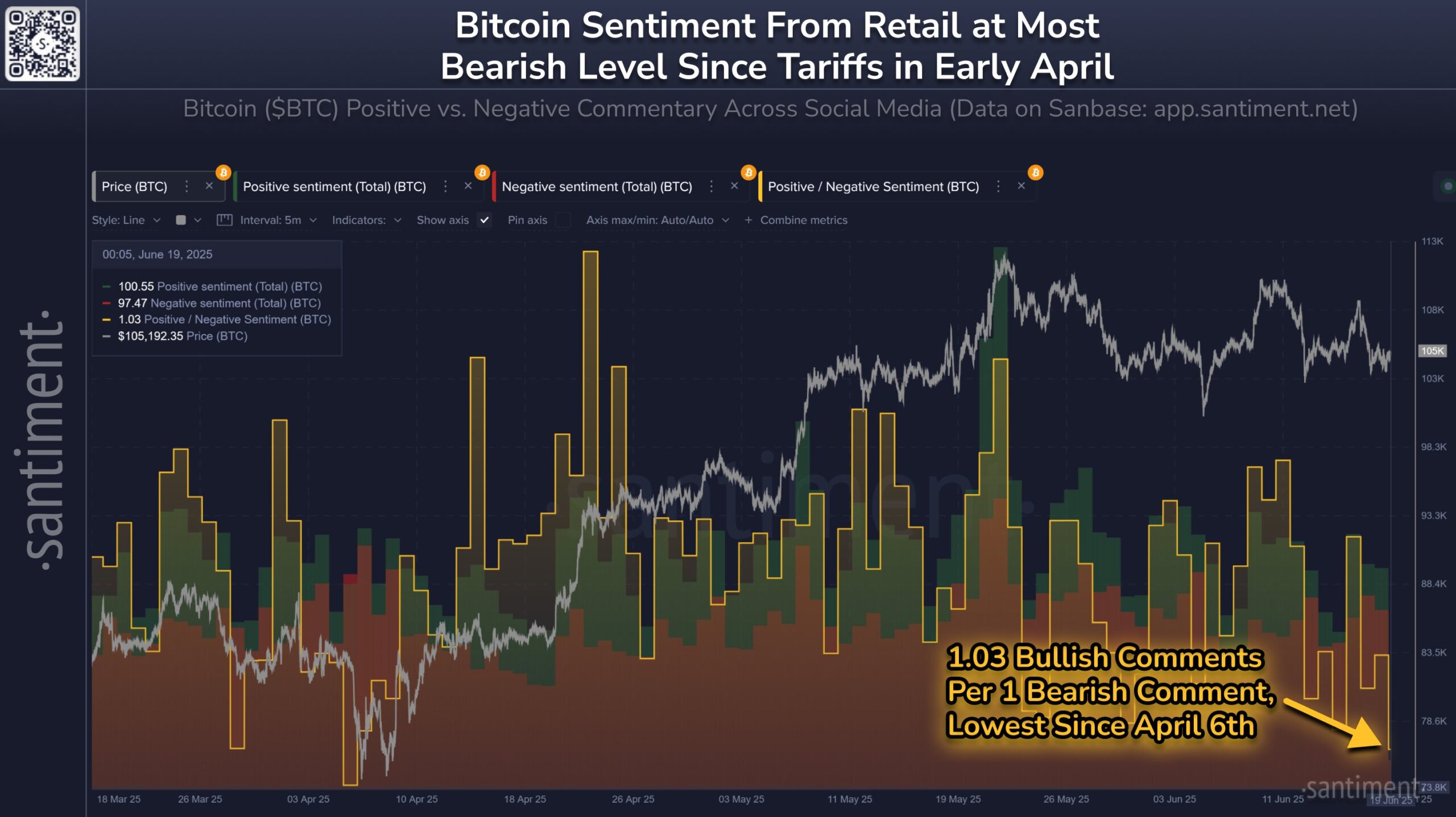

Investor sentiment surrounding Bitcoin has been steadily declining as concerns about the geopolitical climate escalate. While BTC holders are still optimistic about the asset’s long-term prospects, their enthusiasm has waned in recent weeks.

The ongoing tensions between Israel and Iran have contributed to a shift in sentiment, pushing it to its lowest levels in two months. This starkly contrasts the situation in April, when sentiment was also hit hard due to the broader economic effects of the tariff war initiated by former US President Donald Trump.

Despite the drop in sentiment, the current environment is not as dire as it was in April or earlier. During those times, Bitcoin’s price fell below $80,000, driven by broader global uncertainties. The latest geopolitical tensions, while impactful, may not lead to as severe a decline.

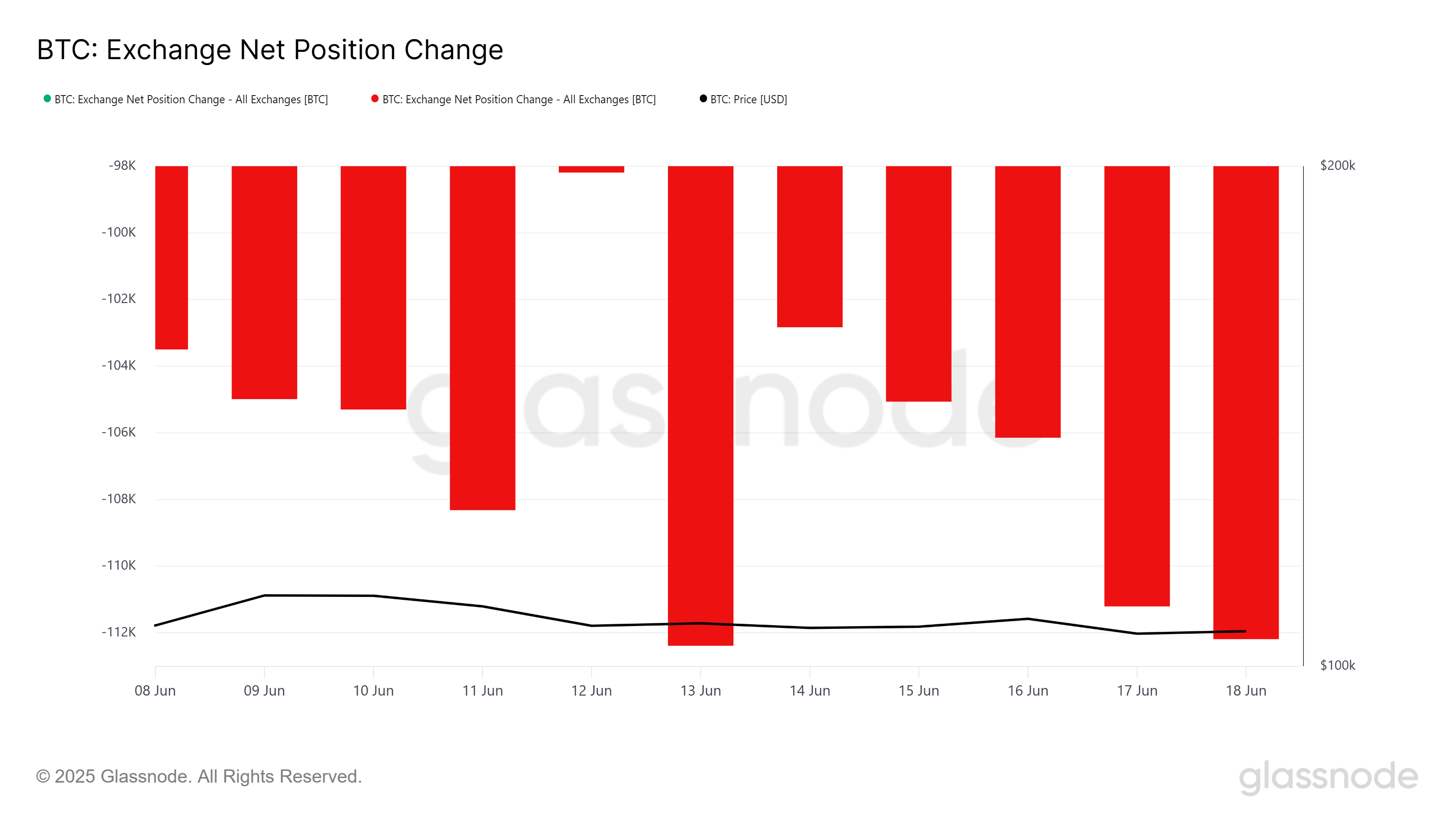

Bitcoin’s recent price action is supported by a slightly bullish trend in its exchange net position. Over the past week, 14,004 BTC, worth over $1.4 billion, were bought by investors.

This demonstrates that, despite the broader market turbulence, there is still strong investor confidence in Bitcoin’s long-term recovery. As long as this accumulation continues, Bitcoin may have a better chance of weathering the storm and recovering once market conditions improve.

BTC Price Is Struggling

Bitcoin’s price currently stands at $105,000, and it is attempting to flip this level into support in order to pave the way for a rise toward $108,000. If BTC successfully holds above $105,000, it could trigger an upward movement toward this next key price point, signaling the possibility of a recovery.

Once Bitcoin breaks through the $108,000 resistance, it will likely aim for the next major level at $110,000. Surpassing the $109,476 resistance will help push the price further, bringing back some optimism among BTC investors. A sustained rise through these levels could bolster investor confidence, reinforcing the bullish outlook for the cryptocurrency.

However, if investor sentiment continues to worsen due to geopolitical tensions, Bitcoin’s price could experience a sharp decline. In such a case, it may fall toward the support level of $102,734 or even lower to $101,503. A drop below these levels would invalidate the current bullish thesis and signal further bearish pressure on Bitcoin.

The post Bitcoin Price Suffered More from Trump’s Tariff War Than Israel-Iran Conflict appeared first on BeInCrypto.