Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for a peek into the venture capital (VC) arena, and maybe gain insight into where the smart money thinks the next boom lies. A fresh wave of funding is pouring into crypto startups despite market volatility. Investors are betting big on long-term blockchain growth, with the interest stretching from AI-driven DeFi to tokenized assets.

Crypto News of the Day: Crypto Venture Funding Falls to 5-Year Low

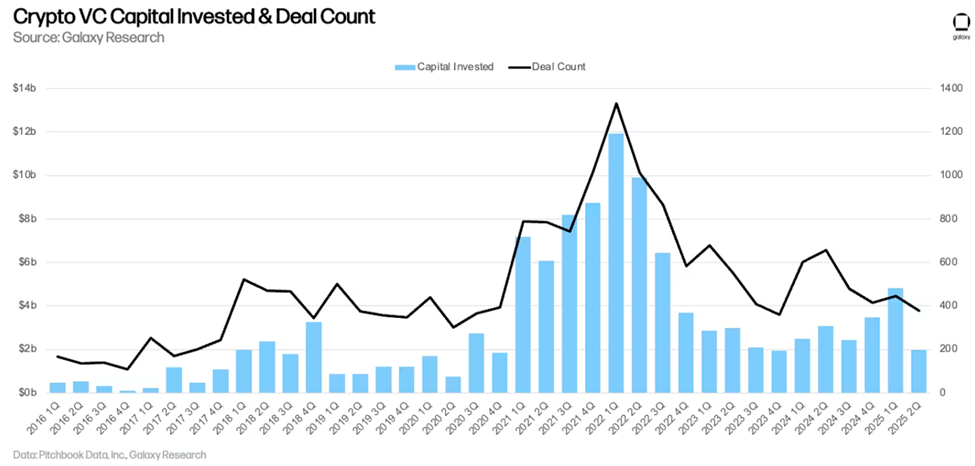

The latest numbers from Galaxy Research show crypto venture capital just had its slowest quarter in five years, with under $2 billion flowing into the sector in Q2 2025. This marks a sharp pullback from earlier in the year, though part of it is due to a statistical quirk.

Q1’s totals were inflated by a single $2 billion mega-investment into the Binance exchange. Even after adjusting for that, the slowdown remains, with data suggesting investors are treading more carefully.

So why the caution? A mix of factors is at play.

- The global economy is still unsettled

- Competition from the booming AI sector is fierce, and

- Some big institutions opt for simpler ways to invest in crypto, like spot Bitcoin and Ethereum ETFs (exchange-traded funds), rather than taking long-term bets on startups.

Interestingly, the biggest share of investment went to more established companies, not early-stage upstarts.

The crypto mining sector unexpectedly stole the spotlight, pulling in over half a billion dollars. The largest chunk came from a $300 million raise by cloud-mining operator XY Miners, backed by Sequoia.

Analysts at Galaxy Research say the growing appetite for computing power, especially from AI, is giving mining a fresh wave of relevance.

Meanwhile, the US regained its lead in funding and deal count, followed by the UK, Japan, and Singapore. Newcomers founded in 2024 grabbed the most deals, while older, battle-tested companies from 2018 pulled in the biggest funding rounds.

This suggests that amidst the cautious market that is characteristic of crypto, track record still matters.

Bitcoin Rally No Longer Driving Crypto Venture Funding

Beyond startups, venture funds also felt the pinch, experiencing a tough quarter. While the amount raised for new crypto-focused funds ticked slightly, the number of new funds remained near multi-year lows.

The ones that did launch tended to be bigger, suggesting that while fewer players are raising money, the ones that do are convincing backers to commit more heavily.

Higher interest rates, memories of the 2022–2023 downturn, and shifting investor priorities continue to weigh on fundraising.

AI is siphoning off attention and cash, while newly launched digital asset treasury products offer institutions easier, yield-bearing crypto exposure without the wait-and-see risk of startups.

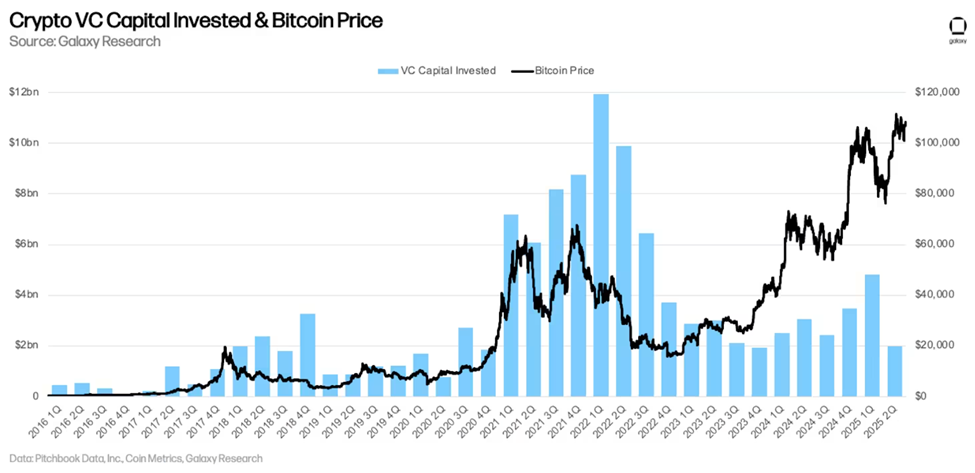

Historically, venture funding in crypto has followed the price of Bitcoin. When BTC boomed in 2017 and 2021, funding boomed alongside it.

However, that link has weakened.

Even though Bitcoin prices have bounced strongly since early 2023, venture activity has not kept pace, hinting that the market’s dynamics are changing.

Notwithstanding, pro-crypto signals from Washington, including stablecoin rules and market reforms, could encourage more traditional finance (TradFi) players to jump in.

If macro conditions settle and regulatory clarity improves, this current lull could set the stage for a new wave of growth.

Charts of the Day

This chart shows quarterly crypto VC capital invested and deal count from 2016–2025, highlighting peaks in 2021–2022 and a sharp decline to near five-year lows by Q2 2025.

This chart compares quarterly crypto VC investment with the Bitcoin price from 2016 to 2025. It shows a strong correlation during past bull runs but a clear divergence since 2023, when Bitcoin rose while VC funding fell.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Ethereum ETFs break $1 billion as Wall Street moves from curiosity to conviction.

- Near Protocol flips Solana: Why NEAR token may be undervalued.

- Solana’s struggles intensify: Why are whales dumping millions in SOL?

- PUMP rallies as Pump.fun bounces back to lead Solana’s meme coin market.

- Crypto’s biggest bull run incoming? Analyst reveals major catalysts.

- Analysts highlight why FARTCOIN under $1 could be a smart buy in August.

- Ethereum exchange reserves sink—Is all-time high imminent?

- Can HYPE Engine push Hyperliquid price to $100 as buybacks top $1.2 billion?

Crypto Equities Pre-Market Overview

| Company | At the Close of August 11 | Pre-Market Overview |

| Strategy (MSTR) | $399.00 | $398.01 (+0.25%) |

| Coinbase Global (COIN) | $320.35 | $319.11 (+0.39%) |

| Galaxy Digital Holdings (GLXY) | $28.59 | $28.56 (+0.11%) |

| MARA Holdings (MARA) | $15.85 | $15.81 (+0.20%) |

| Riot Platforms (RIOT) | $11.41 | $11.37 (+0.26%) |

| Core Scientific (CORZ) | $14.62 | $14.60 (+0.085%) |

The post Bitcoin Price Decouples from VC Investment Trends | US Crypto News appeared first on BeInCrypto.