Bitcoin’s price has declined since late May, currently hovering around $105,000. This level acts as a psychological support, but BTC faces uncertain prospects that could shape its June performance.

BTC is currently weighing bullish optimism against potential selling pressures as the final month of Q2 begins.

Bitcoin Is Yet To Face “Mass Profit Taking”

The MVRV Deviation Pricing Bands indicate Bitcoin is near overheated levels but has not yet crossed the +1σ band. Historically, this threshold triggers mass profit-taking as investors seek to lock in gains. For now, the market appears to have room to grow, delaying a widespread sell-off.

Until Bitcoin crosses this critical MVRV level, bullish momentum may persist, encouraging continued investment.

However, caution is warranted. Monitoring the MVRV band closely is important, as surpassing this point can quickly shift sentiment. This makes June a crucial month, where Bitcoin’s price action could swing sharply depending on investor behavior and macroeconomic influences.

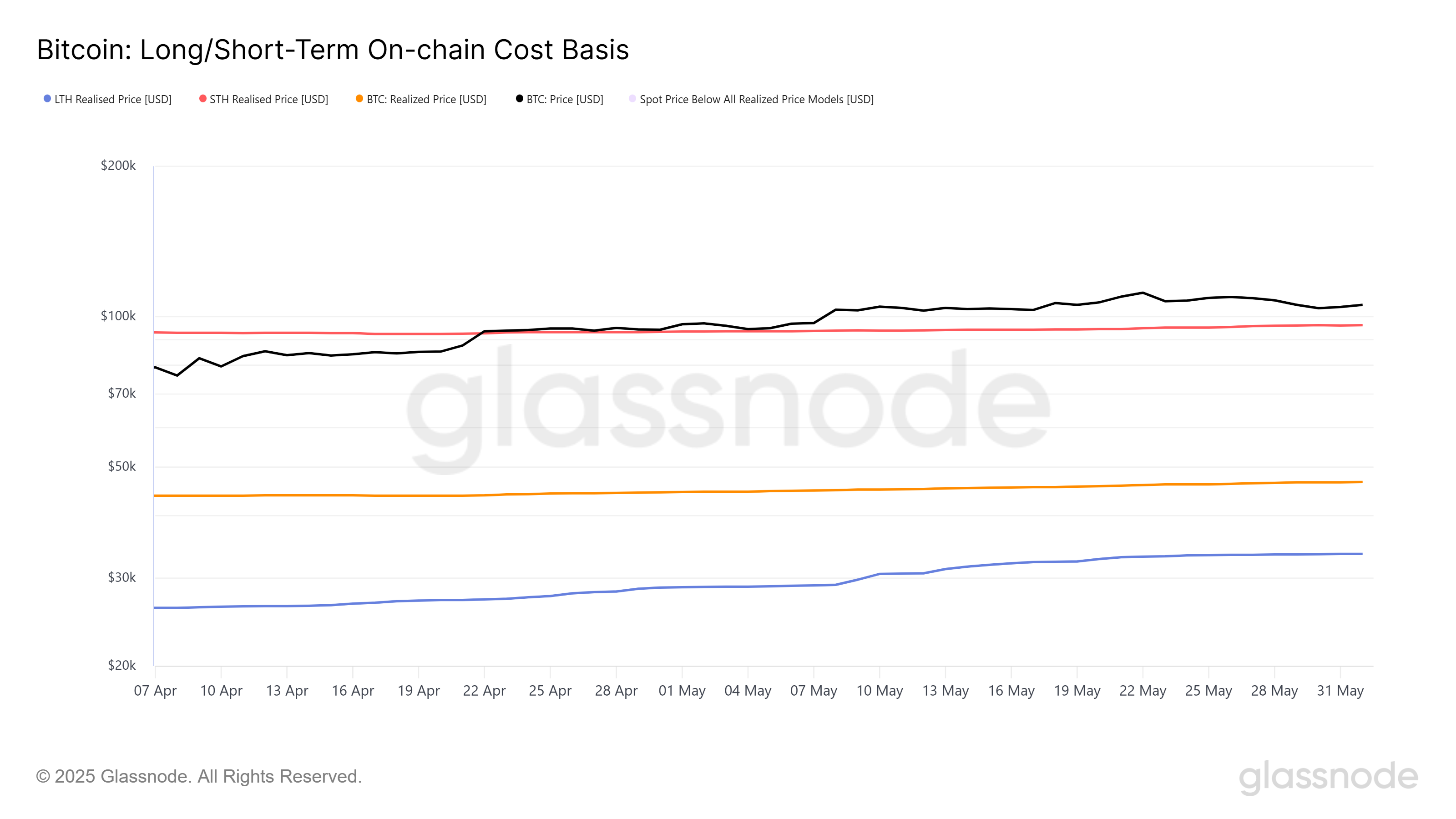

On-chain data reveals the Long-Term Holder (LTH) and Short-Term Holder (STH) cost basis dynamics, shedding light on Bitcoin’s momentum. The STH Realized Price stands at $96,113, below the current market price of $105,238. This gap suggests that short-term holders are in profit, which is typically a bullish sign as these investors are more likely to buy or hold.

Furthermore, the LTHs’ cost basis at $33,555 is well below the market price. However, since these holders tend to refrain from selling most of the time, their rising profits are not an immediate concern for Bitcoin’s price.

Nevertheless, STH profitability raises concerns as they may choose to sell to realize gains, which could exert downward pressure on BTC’s price. This balancing act between holding and selling will be critical in determining Bitcoin’s trajectory through June.

BTC Price Needs Stability

Bitcoin is trading at $105,238, maintaining the crucial psychological support level of $105,000. This stability has restored some investor confidence after recent volatility, setting the stage for potential upward movement.

If bullish momentum continues, Bitcoin is likely to breach the resistance of $106,265 and flip it into support. However, surpassing the $110,000 barrier may prove challenging due to profit-taking pressure and historical resistance at this level.

Conversely, if short-term holders begin to sell and secure profits at current levels, Bitcoin could drop below $105,000. A decline to $102,734 or lower would invalidate the bullish outlook and suggest increased vulnerability, possibly signaling the start of a deeper correction.

The post Bitcoin (BTC) Price Faces Period Of Uncertainty as Q2’s Final Month Begins appeared first on BeInCrypto.